3.5 Accounting for closing stock

The bookkeeping for stock transactions can be done in a number of different ways.

In an ideal world, the bookkeeping entries would follow the physical flow of the goods:

- accumulate purchased supplies in a stock account – an asset account in the nominal ledger

- when an item is sold, transfer it to a cost of sales account – an expense account in the nominal ledger

- at the end of the period, transfer the balance in the cost of sales account to the P&L account in order to work out the gross profit.

This is how we did it in the example above of Peter ’s Photographic Enterprises’ sale of a camera. In practice, however, this method is inefficient in a context where there are many transactions and they each have a low unit value. For example, if you were running a grocery store, you would not want to carry out a bookkeeping transaction to transfer each item sold from stock to expense.

From here on we will therefore use a simplified procedure that assumes that as the business buys goods for resale, they are immediately treated as an expense, called purchases, in the ledger. Then, at the end of the accounting period, the value of the closing stock (i.e. stock remaining at the end of the period) is deducted from purchases to show as cost of sales only the value of stock or goods sold in the period.

Information point

This section deals only with closing stock, the stock that is normally determined at the stocktake on the last day of the accounting period.

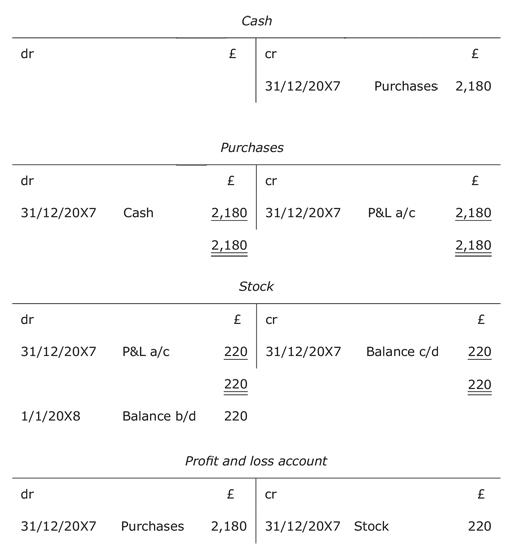

What would be the T-account entries for a business which, in the course of the financial year ended 31/12/20X7, bought goods for cash to the value of £2,180 and had a closing stock of £220 on the last day of the financial year?

Information point

Unlike the stock account, the cash account has not been ‘balanced off’. This is because cash purchases (i.e. £2,180) were not all of the cash transactions for the business during the year. In the real world, cash and stock are both assets of a business and they need to be ‘balanced off’ at the end of the period.

The P&L account now shows cost of sales, the value of stock used up in the period, i.e. £2,180 (Purchases) – £220 (Closing stock) = £1,960.

All accounts are ruled off at the period end to show the end-of-period balances that are transferred to the trial balance. Liability and asset accounts (like the stock account above) are said to be ‘balanced off ’. This involves bringing the balance forward to the next accounting period. On the other hand, income and expense accounts (like the purchases account above) are ‘closed off ’ because no balance is brought forward to the next accounting period. The balance in every income and expense account is brought to zero at the period end by a double entry to the P&L account.

In the example above, what was the double entry to ‘close off’ the purchases account?

The purchases account was ‘closed off ’ for the year by crediting the purchases account by £2,180 and debiting the profit and loss account by the same amount.

Information point

You should have noticed from the example above that the P&L account is not only a financial statement like the balance sheet, but is also the name of a nominal ledger account. In general, when we refer to a P&L account we are referring to its meaning as a financial statement and not as an account in the nominal ledger.

The following activity shows how we complete the P&L account, in its conventional form as a financial statement, from closing balances in income and expense accounts.

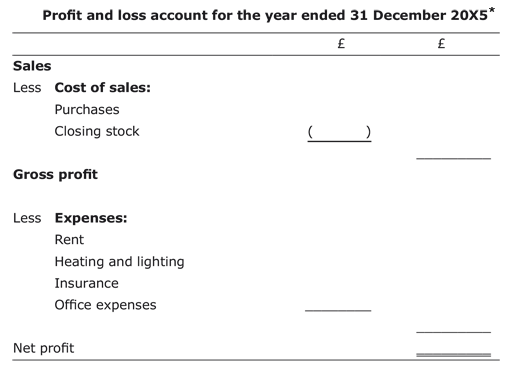

Activity 20

A small business, with no opening stock, has the following closing balances in its income and expense accounts for the financial year just ended on 31 December 20X5:

- Sales £21,568

- Purchases £10,261

- Rent £4,568

- Heating and lighting £756

- Insurance £329

- Office expenses £287

At the last day of the year a stocktake was carried out and the stock figure for the year was £987.

Using the template for the P&L account given below, ‘close off’ or transfer the balances above to the P&L account and work out the net profit for the year.

*In the format of the P&L account as a financial statement, the two columns do not represent debits and credits. The purpose of the first column is to give sub-totals, when required, for the totals that make up the second column.

Answer

*The cost of sales in the profit and loss account above is £987 less than the purchases for the year because it excludes the closing stock of £987, which is included in the purchases figure.

Income and expense accounts, like asset and liability accounts, reflect the accounting equation and the rules of double-entry bookkeeping, as will be shown in the next section.