3.3 More on interest

Let’s look at interest payments in more detail. We can return to the car loan I mentioned in Section 3.1. If £10,000 is borrowed and no repayments of this principal sum are made during the year, and the interest rate is 7 per cent p.a. with interest being paid once a year at the end of the year, the interest charge for that year is £700. Thus, provided that the principal sum owed to the lender remains at £10,000 and interest rates are 7 per cent p.a., the borrower will have to pay £700 each year to the lender.

Activity 4

How much would you pay in interest per annum if you make no repayments on a principal sum of £50,000 and the rate of interest is as follows?

- 5 per cent p.a.

- 35 per cent p.a.

- 7.5 per cent p.a.

- 6.7 per cent p.a.

Answer

As you completed the calculations in Activity 4, you may have started to think of some factors that could complicate the calculation of the interest charge. For example, what would be the interest charge if some of the principal sum is repaid during the course of the year In many cases, the answer is that the interest rate calculation will be based on the average balance of the principal sum during the year. For instance, if £10,000 is owed at the start of the year and £100 is repaid halfway through each month, then the outstanding balance at the end of the year would be £8800. The average balance of principal outstanding during the year would be the average (mean) of the balance at the start and at the end of the year, or £9400.

Based on this average balance, the interest for the year at 7 per cent p.a. would be £658 – rather less than the £700 if no repayment of the principal sum had been made.

The precise practice for computing the interest charge varies among different lenders – and interest can be calculated by different lenders at different time intervals. One of the pieces of financial small print it is always vital to read is the basis on which interest is charged – that is, how often and by reference to what terms. For instance, if someone was repaying some of the principal sum of their loan regularly, the interest charged would be lower if the interest charge was calculated on a daily basis, rather than a monthly, or an annual, basis (an annual basis would be the least favourable if repayments of the principal sum were being made).

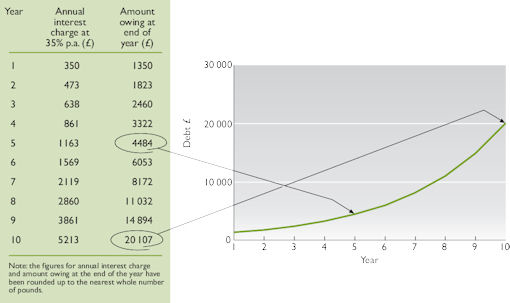

Another question may be what happens if the borrower does not repay the interest due to the lender? Again, this will depend on the details of the contract with the lender and their attitude to borrowers who fall into arrears. Normally, the lender will add the interest charge left unpaid to the principal sum. This means that the following period’s interest charge is going to be higher since the borrower will be paying interest not only on the original principal sum but also on the unpaid interest. This is known as compounding, and can quickly enlarge debts. Figure 6 provides an example of compounding, illustrating what happens if someone borrows £1000 at an interest rate of 35 per cent and makes no repayments over ten years. Over this period of time, the debt would rise from £1000 to £20,107.

The dangers of compounding were demonstrated vividly in a famous case which came to court in 2004. This is reported fully in Box 4. A debt of £5750 grew to the staggering sum of £384,000 in fifteen years. In the event, the debt was (unusually) cancelled for being ‘extortionate’. Yet it showed the risks of compounding very clearly!

Box 4 Landmark ruling as judge erases couple’s debt

A judge today wiped out a couple’s debt of £384,000 which had spiralled out of control from an original loan of £5,750 due to ‘extortionate’ interest rates. Tony and Michelle Meadows, from Southport, Merseyside, faced losing their home after they were taken to court by London North Securities for failing to keep up with repayments on their loan.

The couple, who have two children, took out the loan in 1989. Mr Meadows, 45, a car windscreen salesman, claimed he had taken out the loan, designed for people with poor credit ratings, to install central heating and convert a bathroom into a third bedroom. The small print of the loan agreement revealed that the couple would be charged a ‘compounded’ interest rate if they ever fell into arrears.

Essentially this meant that the money lenders were charging 34.9 per cent interest on the arrears as well as on the repayments, which soon resulted in the debt growing to an enormous amount.

Judge Howarth said: ‘Where the rate concerned is as high as 34.9 per cent it seems to me that the combination of factors is so potentially exorbitant that it is grossly so and does grossly contravene the ordinary principles of fair dealing.’ He added: ‘This is one of the few credit bargains which is extortionate.’

When the couple failed to keep up with repayments, their debt soared and London North Securities attempted to take possession of the couple’s £200,000 family home to pay off the loan.

Speaking outside court, Mr Meadows said ‘It wasn’t a wanton spending spree we went on back then, it was just something we had to do at the time. I would advise people thinking of taking a loan to read the small print very carefully.’

The court heard the couple ended up with a loan for £5,750 to pay for £2,000 home improvements, around £3,000 to pay off their mortgage and £750 for an insurance policy they did not want …

[Subsequently the Court of Appeal] dismissed a challenge by the lender, London North Securities, to a County Court judgment that wiped out the debt run up by the Meadows. They said the loan agreement was unenforceable under the Consumer Credit Act after the original loan company had wrapped insurance payments into the debt and then added interest and penalty payments to the total.

(adapted from The Guardian, 2004 and 2005)

Interest rates can also be set in a number of different ways. These are:

- A variable rate which can move upwards or downwards during the life of the loan. In the UK, these usually move in tandem with movements in the official rate of interest (see Box 3). Some products (called ‘trackers’) are specifically linked to official Bank of England rates.

- A fixed rate where the rate is determined at the start of the loan and remains unaltered throughout the fixed rate term. The rate will be based on what the lender has to pay for fixed rate funds of the same term.

- A capped rate where the rate cannot rise above a defined maximum (the ‘cap’), but below this ‘cap’ it can move in tandem with movements of official interest rates. A variation to a capped rate loan is a ‘collared’ rate loan where rates can move in line with official rates but cannot either go above a defined maximum (the ‘cap’) or below a defined minimum (the ‘floor’). Such products usually require the payment of a fee to the lender at the start of the loan.

Most commonly, personal loans are set at a fixed rate, credit card debt and overdrafts at a variable rate, while mortgage lending is split between the three interest rate forms defined above. However, between 2008 and 2011 the volume of ‘capped-rate’ mortgage business was very small. In mid 2010, new mortgage lending in the UK was divided almost equally between fixed rate and variable rate (CML, 2010). Households with variable rate mortgages are, along with most of those with credit cards and overdrafts, at risk to increases in the official rate of interest made by the Bank of England. As mortgages account for a large proportion of personal debt, it is easy to see why the UK economy can be easily affected by even relatively small movements in interest rates.

Activity 5

Under what circumstances do you think it might be attractive to borrow at the following types of interest rate?

- Fixed rate of interest.

- Variable rate of interest.

Comment

Assuming that borrowers have a choice and want to pay as little interest as possible, choosing a variable rate may be preferred if interest rates are expected to fall, and fixed rates may be preferred if rates are expected to rise. However, to assess which would be cheaper requires a forecast of how rates will move during the life of the loan, and making such forecasts is difficult because it is difficult to predict future rates of inflation and interest rates. In addition, the choice may reflect the borrower’s household budget. For example, households on a tight budget may choose a fixed rate because this would provide certainty of monthly expenditure.