4.1 Income and expenditure, and debt

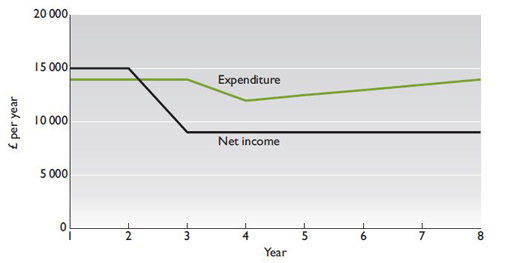

An important reason why people take on debt is because of a continued excess level of expenditure over net income: a situation which could be caused by a number of factors. Let’s use the example scenario of the Syme family: a household consisting of a lone parent and two children. We can use the Syme household to look at how flows of expenditure and income relate to debt. In this case, shown in Figure 8, the main income earner in the household loses her full-time job in year 2, and so household income falls below expenditure. This is a realistic scenario: according to Citizens Advice, job loss is one of the three main reasons for problems with debt, along with living long term on low income and overcommitment to high levels of spending (Citizens Advice, 2003). In the case of the Symes, from year 3 onwards net income, made up of benefits and earnings from part-time work, totals £9000 per year. Expenditure remains constant at £14,000 in year 3, and then the household manages to cut expenditure down to £12,000 in year 4. However, the shortfall between expenditure and income must be financed. This can be done by either using up any savings, or taking on debt, or a mixture of the two. For simplicity, in this example we’ll assume that the Symes have no savings and that they take out debt to finance the expenditure over and above net income. This debt leads to expenditure increasing from year 5 onwards as interest and other charges are added to existing household expenditure. This, in turn, would require more debt. Such a situation is not sustainable in the long term and, eventually, the Symes would either have to make other cuts in expenditure or find a way to increase income.

The Syme scenario highlights how certain life events, such as job loss, relationship breakdown or illness might lead to households having to take on debt. Other more predictable life events, such as full-time study, are easier to build into financial plans. A household, for instance, with one member who intends to go to university, might plan to finance current levels of expenditure through taking out debts and then use the benefit of the graduate earnings premium to pay these debts off after graduation.

One reason why individuals and households take on debt is to finance expenditure which is above income. Another reason is to spread the cost of expensive purchases, such as a car or house, over a number of years. In these cases, a household takes out a relatively large debt which is repaid over time. This cannot be taken to imply that taking out a debt to pay for such items means that the debt can be considered part of income – it might sometimes appear that credit can be used like income, to pay for items, but of course, unlike income, it forms a liability which is then owed. Debt problems often arise when a household already has debt, but then faces unexpected life events like those mentioned above.