Making decisions

Use 'Print preview' to check the number of pages and printer settings.

Print functionality varies between browsers.

Printable page generated Saturday, 20 April 2024, 5:23 AM

Making decisions

Introduction

This course covers a few key topics that will help you to think in broad ways about how you and others take decisions; we shall also introduce you to some themes in social science which have direct relevance to managerial decision making. The approach of this course is descriptive: rather than prescribing how you should make decisions we look at frameworks that will help you to understand how decisions are actually made. We aim to help you to develop greater insight into both your own decision making processes and those of others.

This OpenLearn course provides a sample of postgraduate study in Business.

Learning outcomes

After studying this course, you should be able to:

have greater insight into decision-making processes

use that insight to make more effective decisions

possess a range of different perspectives on what counts as an ‘effective’ decision

be better equipped to understand and influence the decision-making processes of other individuals and groups

understand better how people perceive and decide about risk.

1 Making decisions

1.1 Introducing decision-making

A vast literature on decision making stretches back over several centuries and encompasses a wide range of academic disciplines – from history and literature through to mathematics. This course is not a comprehensive survey of this field. Rather, we have chosen a few key topics that will help you to think in broader ways about how you and others take decisions; we shall also introduce you to some themes in social science which have direct relevance to managerial decision making. In particular, we have chosen topics that illustrate how attention to the psychology of decision making and the social context in which decisions are made can improve our understanding of decision making in organisations.

Many books on decision making are normative: they tell you how you should make decisions. The approach of this course is different; our approach is mostly descriptive: rather than prescribing how you should make decisions we look at frameworks that will help you to understand how decisions are actually made. So rather than provide recipes for effective decisions, our approach is that your decision making will be enhanced though greater insight into how you and others decide. Since many decisions are strongly influenced by our perceptions of risk, we also take some time to explore different approaches to understanding risk.

How will this enable you to make a difference? First, by developing greater insight into your own decision-making processes you should be more aware of – and able to avoid – some of the traps that face you. Second, by developing greater insight into how others make decisions you should be better equipped to influence their decisions. Third, and finally, we hope that to the extent you find these ideas of practical use, you will be equipped to explore them further beyond the confines of this course.

2 Understanding your own approach

2.1 Exercising judgement

To understand how we make decisions, it is useful to start with the ways in which we make judgements about information we are presented with. Let's start this course with an activity designed to get you exercising judgement. The answers are at the end of the questions but please arrive at your own answers before checking them!

The questions in this activity are adapted from Bazerman (1998).

Activity 1

Question 1

-

In four pages of a novel how many seven-letter words would you expect to find with the form ----ing?

0, 1–2, 3–4, 5–7, 8–10, 11–15, or 16+

-

In four pages of a novel how many words would you expect to find with the form -----n-?

0, 1–2, 3–4, 5–7, 8–10, 11–15, or 16+

Question 2

Which of the following causes more deaths in Western Europe each year?

-

stomach cancer

-

motor vehicle accidents

Question 3 Making estimates

For each of the following questions:

-

Make your best guess as to the answer and write it down.

Do not go and look it up or search online for the right answer – this is about guessing

-

Write down an upper and lower limit that you are 98 per cent certain contains the correct answer.

For example, how far is the earth from the sun?

-

Estimate: 150,000,000 km

-

Upper and lower limit: 200,000,000 km and 100,000,000 km

What was the:

-

value of Swedish exports in 1992 (£ million)?

-

value of UK imports from the USA in 1994 (£ million)?

-

number of people killed by cerebral malaria in India in 1992?

-

total US health and medical expenditure in 1992 ($ million)?

-

total land area of the Japanese mainland (sq km)?

Question 4

A rare disease has swept through a town and has affected 600 inhabitants. Experts have suggested two possible programmes for tackling the disease. Look at the two versions of this problem below. What do you notice about Versions 1 and 2? In each version, which option do you think a doctor presented with this information would tend to choose?

Version 1

-

Programme A will save 200 lives (out of 600).

-

Programme B has a one-third probability of saving 600 lives and a two-thirds probability of saving no one.

Version 2

-

Programme A will result in 400 deaths (out of 600).

-

Programme B has a one-third probability of no one dying and a two-thirds probability of 600 deaths.

You will find the answers to this activity below. Once you have checked the answers make a few notes below about what this tells you about your own judgement and decision making.

Answer

Question 1

Your answer for (a) should be less than your answer for (b) because the group of words of the form ‘ -----n-’ includes all of the words of the form ‘--------ing’. However, most people give a higher answer for (1.) than (2.). This is an example of retrievability bias’. Words ending in ‘ing’ are more easily retrieved from our memory so we tend to give more weight to them. This effect extends to organisations. Organisational structures and systems make some kinds of information more easily retrievable than others and hence give more weight to that information in decision making.

Question 2

Stomach cancer causes more deaths than motor accidents by a ratio of more than two to one. Yet most people believe motor accidents cause more deaths. The news media are more likely to carry vivid accounts of motor accidents. Hence, we tend to overweight the incidence of motor accidents. Similarly, in organisational life we are inclined to give more weight to information that is easily available.

Question 3 Making estimates

-

£56,118 million

-

£19,697.2 million

-

4,000

-

$71,035 million

-

230,448 sq km

How many of the correct answers fell within your upper and lower bounds? The list below sets out the (approximate) odds of answers falling outside your upper and lower bounds if they really were 98 per cent certain.

None outside – 90 per cent

1 outside – 9 per cent

2 outside – 1 chance in 250

3 outside – 1 chance in 2,500

4 outside – 1 chance in 1.3 million

5 outside – 1 chance in 300 million

Typically, most people get more than one wrong; in fact, some people get them all wrong. We tend to be overconfident in our own judgement – even on topics we know nothing about.

Question 4

Versions 1 and 2 are in fact both the same: they are just ‘framed’ differently. Version 1 is framed in terms of lives saved, whereas version 2 is framed in terms of lives lost. However, how the problem is framed does affect decision making, even for medical experts. We tend towards ‘risk aversion’ for problems framed as gains, while we tend to be ‘risk-taking’ to avoid losses where problems are framed in terms of losses. Consequently, most people choose Programme A when presented with version 1 but Programme B when presented with Version 2.

How did you do on these problems? It is likely that they have confronted you with some evidence that you (like many others) are prone to a range of biases in the way you form judgements and make decisions. We will return later in this course to a more detailed examination of the kinds of biases and decision traps we are all prone to.

2.2 Different approaches to decision making

Activity 2

Think of a major decision you have recently been involved in making at work. For each of the following statements about your decision-making process make a note of the number which shows your level of agreement with the statement.

| Strongly disagree | Disagree | Neither agree nor disagree | Agree | Strongly agree | ||

|---|---|---|---|---|---|---|

| 1 | I/We gathered all relevant information. | 1 | 2 | 3 | 4 | 5 |

| 2 | I/We carried out a detailed analysis of all the financial costs, opportunity costs, and benefits of each option and likely outcome. | 1 | 2 | 3 | 4 | 5 |

| 3 | I/We made the decision on the basis of detailed analysis and objective criteria. | 1 | 2 | 3 | 4 | 5 |

| 4 | Discussion of the decision focused mostly on the accuracy and quality of the information and analysis on which it was based. | 1 | 2 | 3 | 4 | 5 |

| 5 | Personal opinions and experience were very important to the making of this decision. | 1 | 2 | 3 | 4 | 5 |

| 6 | Important elements of the decision-making process were based on ‘hunches’ or intuition. | 1 | 2 | 3 | 4 | 5 |

| 7 | Discussion and analysis focused on the information that was most easily available. | 1 | 2 | 3 | 4 | 5 |

| 8 | The decision process was quite emotional. | 1 | 2 | 3 | 4 | 5 |

| 9 | It was important that the final decision was a good fit with how we normally do things in my organisation. | 1 | 2 | 3 | 4 | 5 |

| 10 | I/We needed to be seen to be doing the right thing. | 1 | 2 | 3 | 4 | 5 |

| 11 | I/We needed to be sure that influential individuals or groups were happy with the outcome. | 1 | 2 | 3 | 4 | 5 |

| 12 | Decision makers were concerned with the effect of the decision on their reputation. | 1 | 2 | 3 | 4 | 5 |

Add the scores for Questions 1–4, Questions 5–8, and Questions 9–12. Make a note of the three totals and the category they to which they correspond in the bar chart below.

The questions in Activity 2 divide into three areas. Questions 1–4 focus on the formal rational decision-making process. Questions 5–8 take a psychological perspective and focus on the tendency to rely on ‘heuristics’ (mental shortcuts or rules of thumb) when making decisions. Questions 9–12 focus on the role of social influences on judgement and decision making.

What does the bar chart you have constructed tell you about the decision-making process you described? Which was most important in this case? In many decisions all three play a part.

The three different approaches to making decisions reflected in this activity form the core of our discussion of decision making.

Philip Tetlock (1991) identifies three competing metaphors employed for understanding human decision making:

-

people as naïve economists (rational perspective)

-

people as naïve psychologists (psychological perspective) and

-

people as naïve politicians (social perspective).

Financial economics, for example, rests on the first approach. People are seen as making rational judgements in pursuit of maximum expected utility. In some variants people are modelled as making such judgements effectively; more pessimistic versions assume limited capabilities. While the rational-economic perspective on decision making has met with great success, not least because it is easy to model mathematically, there is abundant evidence that it is a poor description of individual behaviour.

The second, psychological perspective, approach sees people as driven to achieve cognitive mastery of their environment. Again, there are more optimistic and more pessimistic versions. The more optimistic describe people who make effective use of lay versions of formal logical and statistical procedures to arrive at conclusions about the physical world and the behaviour of others (Kelley, 1967).

Heuristics are mental shortcuts or ‘rules of thumb’. For example, the British Army saying ‘If it moves salute it, if it doesn't paint it white’ is an example of a heuristic. We use heuristics and take shortcuts to reduce the complexity, cost and time taken to make decisions. While the more pessimistic depict us as cognitive misers, prone to a wide range of systematic failings of judgement and biases (Nisbett and Ross, 1980), there is increasing evidence that we move between both extremes – switching from simple heuristics to more complex cognitive strategies in response to the importance of the situation and desired outcomes (Fiske and Taylor, 1991).

What both the economic and psychological perspectives have in common is the notion of people as limited-capacity information processors and the concept of ‘bounded rationality’ (Simon, 1957): that is, there are limits to the cognitive and information-processing capacity we can devote to any judgement. Both perspectives also focus on individual behaviour rather than social processes. This is the starting point for the third sociological perspective identified by Tetlock: people as naïve politicians. In this approach people are seen as acting to manage the social world they inhabit. An important goal in decision making is satisfying the constituencies to which the individual feels accountable. The key question from this perspective is ‘What strategies do people use in managing accountability to social groups and norms?’ This is the domain of sociology and of institutional theory in particular.

In the following sections we examine each of the three perspectives in more detail.

3 The rational-economic perspective and its problems

3.1 Introduction

Much of economics and finance theory rests on the notion of people as formally rational decision makers. First, people are understood to have ordered preferences. That is, if someone prefers A to B and prefers B to C then they should prefer A to C. Second, decision makers are assumed to engage in a formally rational decision-making process on the basis of those preferences.

3.2 Utility theory

Utility theory is based on this assumption of rationality and describes all decision outcomes (financial and otherwise) in terms of the utility (or value) placed on them by individuals. Within this framework, decisions can be understood in terms of rationally ordered levels of utility attached to different outcomes.

Bazerman (2001, pp.3–4), for example, describes a formally rational decision process for arriving at a decision with the greatest expected utility in the following terms:

-

define the problem

-

identify the decision criteria

-

weight the criteria

-

generate alternatives

-

rate each alternative on each criterion

-

compute the optimal decision.

More sophisticated versions of such decision processes allow for the calculation of probabilities for different possible outcomes associated with each alternative and the weighting of the utility of those outcomes by their probability. Indeed, the discipline of decision sciences is devoted to the study and development of such analytical and model-building methods to support formally rational decision making. We could not possibly do justice to a field as broad as decision sciences within the scope of this course. However, for a good introduction see Wisniewski (2000).

3.3 Limitations of the rational-economic perspective

As an approach to understanding economic life, the assumption of formal rationality has been very successful. For example, there is great deal of evidence that, on average, prices in financial markets behave as if investors were formally rational. However, there is also a great deal of evidence that individuals do not behave in this way (e.g. de Bondt, 1998). Even within the field of financial economics, there is increasing interest in developing theories of market behaviour which take better account of how people really make decisions (e.g. see Fenton-O'Creevy et al., 2004).

One of the leading exponents of this emerging field of behavioural finance, Werner de Bondt, suggests that:

For at least forty years psychologists have amassed evidence that economic man is very unlike a real man and that reason – for now, defined by the principles that underlie expected utility theory, Bayesian learning and rational expectations – is not an adequate basis for a descriptive theory of decision making.

(de Bondt, 1998, p.831)

Having considered some of the limitations of the rational-economic perspective on decision making, we turn to the psychological and social perspectives.

4 A psychological perspective

4.1 Introduction

A psychological perspective does not start from the assumption that people are fundamentally irrational. Rather, it emphasises a different logic: a logic that meets the challenges we have evolved to face (Calne, 1999). For much of our evolution we have faced an environment with major differences from the modern business world. We have developed a range of cognitive mechanisms to cope with adverse environments in which resources are scarce. These include a range of simplifying and confidence-sustaining mental short cuts (heuristics) that help us to make quick decisions when pausing to undertake a full analysis would be unwise (Gigerenzer et al., 1999). While these ways of thinking do not accord with rigorous logic or formally rational reasoning, they are well suited to fast-paced intuitive judgements and actions (Nicholson, 2000). However, these evolved modes of thinking also create some major traps.

4.2 Bounded rationality and the use of heuristics

As decision makers, none of us has infinite resources or time to devote to gathering and analysing information. In addition, we all have significant limitations to the amount of complexity we can cope with. Thus, even where we make conscious efforts to make decisions according to a formally rational process, we often need to make simplifying assumptions and accept limits on the availability of information and the thoroughness of our analysis.

As noted above, we constantly use heuristics as a way of reducing the complexity of decision making: for example, associating a particular brand with quality rather than engaging in a detailed evaluation of the merits of different breakfast cereals or clothing stores. Many of these are entirely unconscious. They are often useful, but also lead to some significant biases in our decision making. You encountered some of these in Activity 1 (in Section 1). We are going to look at some of the most important in more detail below:

-

framing the problem

-

using information

-

problems of judgement

-

post-decision evaluation.

4.3 Framing the problem

As you saw in Activity 1, how a problem is framed can have a significant effect on how you make decisions. Medical decisions can be affected by whether outcomes are framed as likelihood of deaths or of saving patients. Financial decisions can be affected by whether you see yourself in a position of loss or gain. In a position of gain we tend to become risk averse; in a position of loss we will tend to take risks to avoid or recover losses. You may know people who are good at using this to their advantage; they exert influence by framing choices so that others will choose the option they prefer. Box 1 gives an example of how framing can affect our recall of relevant ‘facts’.

Box 1: The effect of question framing on recall

Framing effects can be quite subtle and even affect our recall of events. For example, in one study, groups of students were shown a film of a car accident. Each group of students was shown the same film clip and then asked ‘How fast were the cars going when they xxxx each other?’ ‘xxxx’ was different for each group, variously ‘smashed into’, ‘collided into’, ‘bumped into’, ‘hit’ and ‘contacted’. The table below shows the average speed estimated by each group.

| Verb | Mean Estimate of Speed (mph) |

|---|---|

| Smashed | 40.8 |

| Collided | 39.3 |

| Bumped | 38.1 |

| Hit | 34.0 |

| Contacted | 31.8 |

Those who were asked the ‘smashed’ question were also more likely to believe they had seen broken glass in the film clip than those who were asked the ‘hit’ question. There was no broken glass.

4.4 Using information

Our use of information is often biased in important regards. First, we pay more attention to information that is easily available (the availability heuristic). Second, we overweight memories which are more easily retrievable – usually because they are emotionally vivid or have personal relevance (the retrievability heuristic).

We pay selective attention to information, often in a self-serving way. We will often give greater weight to information which shows us in a favourable light (self-serving bias), or information that supports an already established point of view (the confirmation bias). For example, in some research that colleagues and I carried out into the decision making of traders in investment banks, one trader told us:

I spend time talking to a lot of people; consultants, other traders on the desk, in the markets, finding out what people are doing. I am always absorbing information. … I like to find people who have the same thought processes as me.

This trader may have been suffering from the confirmation bias: unconsciously avoiding people who might offer views too different from his own.

4.5 Deciding: problems of judgement

We are constantly bombarded by information. Simply walking though a room risks flooding us with more sensory information that we can possibly process. Stop for a moment and consider all the different things you can see, hear, smell, or feel.

4.5.1 Filtering

Which of these senses do you usually tune out? From birth we start learning to filter information out and to prioritise, label and classify the phenomena we observe. This is a vital process. Without it we literally could not function in our day-to-day lives. In our work lives, if we did not filter information and discard options we would suffer from analysis paralysis: the inability to make any decision in the face of the complexity and the ambiguity of the real world.

However, this filtering comes at a cost and introduces some significant biases into the judgements we make. One, which you came across in Activity 1, is overconfidence: we tend to be unduly optimistic about estimates and judgements that we make and filter out of our awareness many of the sources of uncertainty. Another problem we have already discussed is our tendency to be swayed by how a problem is framed.

4.5.2 Anchoring adjustment

Many decisions need revisiting and updating as new information comes available. However, most of us make insufficient anchoring adjustment: this is the tendency to fail to update one's targets as the environment changes (Rutledge, 1993). Once a manager has made an initial decision or judgement then this provides a mental anchor which acts as a source of resistance to reaching a significantly different conclusion as new information becomes available. It is what happens when one has made a snap judgement and then disregards feedback that is inconsistent with this position. This bias can affect judgements about people as well as technical judgements. Making early judgements about someone, for example in a job interview, may put you in an anchored position, and later information may come too late to shift your opinion (Anderson, 1992).

4.6 Post-decision evaluation

For most normally functioning people, maintaining self-esteem is an important internal goal. This can cause us to filter out or discount information that might show us in an unfavourable light. This is what lies behind the fundamental attribution bias. This is the tendency to attribute good outcomes to our own actions and bad outcomes to factors outside our control. While such defences against loss of self-esteem can be helpful to the extent that they help us persist in the face of adversity, they can reduce learning and reduce opportunities to take corrective action.

Another important internal goal is to maintain a sense of control over events and our environment. In consequence, a common way in which we distort our understanding of events is to assume we have greater control of events than we really do. When we suffer from this illusion of control, we are likely to underestimate the risks of our actions and decisions and have problems in learning from experience as we discount information that suggest we are not in control (Fenton-O'Creevy et al, 2003).

5 A sociological perspective

5.1 Introduction

As we noted earlier, both the rational-economic and psychological perspectives on decision making tend to ignore the social context in which we live and work. We turn now to consider this social context.

5.2 The social construction of reality

What do we mean when we say reality is socially constructed? We inhabit a social world. Many of the ‘facts’ of our lives which we take for granted are ‘facts’ only in so far as we hold common mental models about them: for example, common understandings of money, contracts, marriage, the rules of the road, democracy, to name just a few. To understand the nature of social influences on decision making we need to start from this idea that the environment within which we exist and the meanings which we attribute to that environment – even to a large extent the categories available to us to think about that environment – are socially constructed. When you enter a shop and buy a magazine the whole transaction relies on you and the seller having shared beliefs about the meaning of money and the nature of an exchange relationship. When you enter into a contract you have a set of expectations about the meaning of mutual contractual obligations and penalties for non-compliance. Finding those expectations are not shared can cause significant problems, as many Western businesses have found in China where different expectations prevail.

5.3 Social institutions

Of course, the extent of agreement about meaning can be highly variable: from the ephemeral (a certain style of clothing may come to stand for a shared attitude among a small group of teenagers for a short period) to the more profound (such as the idea of ‘a market’ or ‘marriage’). Sociologists refer to these more profound shared meanings as institutions. In this sense, an institution is a persistently reproduced social pattern that is relatively self-sustaining. However, to say that institutions are self-sustaining is not to say they cannot change. In recent decades, to take one example, the shared understanding of the meaning and rules of the institution of marriage have changed considerably.

These shared social meanings powerfully influence and constrain the way in which we reason and decide. They provide categories within which we think. To return to the example of marriage, the socially shared categories of fidelity, housework, childcare, separation, divorce and so on provide a framework within which we think about such relationships. These shared social meanings are tacit, implicit, and taken for granted. We understand them as ‘facts’ and they quite literally shape how we see the world. Social institutions powerfully affect how we perceive the world and exercise judgement. Box 2 gives an example.

Box 2: Social influences on what we see

In an experiment conducted by Lynne Zucker (1991) participants were placed in a darkened room where a small light was shone. They were asked to judge how far the light moved while they were in the room (the light was in fact stationary). Typically, individual participants judged the light to move to some extent. In Zucker's version of the experiment participants joined another participant who they were told was ‘experienced’. The experienced participant was in fact one of the research team. When the two participants were asked for their judgement of how far the light had moved, the ‘experienced’ participant was asked first. After 30 repetitions, the ‘experienced’ participant left the room and another naïve participant joined and the process was repeated. Zucker found that the judgement of the planted ‘experienced’ participant not only affected the judgement of the first naïve participant, but also the judgement of the second, who they never met. The perception of light movement was passing through the generations.

Zucker then varied the experiment and carried out two further versions. In the first she told participants that they should consider themselves to be part of the same organisation as other participants; in the second that they were part of an organisation and that there was an official role of ‘light operator’ – the person responsible for pressing the button to start the experiment. The light operator was first the ‘experienced’ participant (a member of the research team), and then the role passed to the first naïve participant.

Zucker found the strength of transmission of perceptions was greater when participants considered themselves part of the same organisation, and even greater when the formal role of light operator was bestowed. In other words, the more the participants were encouraged to see themselves as part of a defined social structure within which others had a legitimate role, the more their perceptions were influenced by those others. This experiment is just one example of the ways in which social institutions can powerfully affect how we perceive the world and exercise judgement.

As we consider how decisions are made in organisations, we need to understand the role of social institutions both within the organisation and in its environment. There is an important link to the psychological perspective: much of our mental capacity has evolved to understand not the physical world we inhabit, but the social world. As a social species, individual survival has depended crucially on our ability as individuals to understand and work within our social milieu. A significant proportion of our cognitive capacity is devoted to understanding and working within social rules. If we are to negotiate our social environments and to collaborate with others, our success depends on our understanding and mastery of social institutions; so too in the world of business. Economists have typically explained firm behaviour in terms of the search for economic advantage. Many sociologists (while not denying the role of economic forces) have looked to the importance to organisation survival of establishing legitimacy in terms of relevant social institutions.

5.4 The pursuit of legitimacy

Social institutions affect which actions are seen as legitimate. As we make decisions in organisations it is common to be concerned not just with economic outcomes but also with ‘legitimacy ’: ‘How will this decision be seen by X ’?; ‘Does this fit the way things are done around here?’; ‘What would happen if the press got hold of this?’; and so on.

Some of this can be quite unconscious; the conceptual frameworks and notions of cause and effect that are available to decision-makers to reason with are largely socially determined. This can operate at different levels – national, industry, firm, team, and so on. For example, at the industry level some researchers have looked at the way in which cognitive communities develop. These are networks of firms whose managers share cognitive schema: core ideas about how the industry works, cause-and-effect relationships, and what constitutes reasonable conduct. These ideas simplify and constrain the ways in which managers within a group identify competitors and customers, and reason about competitive strategy. Box 3 describes some of this research.

Box 3: Cognitive communities in the knitwear industry

Porac et al. (1989) studied the shared mental models of managers in the Scottish knitwear industry. They found that managers in this industry shared core assumptions about customers and competitors and informal ‘rules’ about legitimate behaviour. These shared assumptions were reinforced by the informal networks and ties that existed between managers. For example, competition on price was frowned upon and firms competed mainly on the basis of design, service and quality. There was also a high level of consensus that their products were aimed at the top income group (although this seemed based on little actual market research).

While senior managers often like to think that they are driven by the rational pursuit of economic success, there is evidence that some of the drivers for their behaviour have more to do with social legitimacy: Box 4 illustrates this.

Box 4: Legitimacy and popular management techniques

Barry Staw and Lisa Epstein (2000) carried out a study of the adoption of popular management techniques, such as quality and team-based initiatives in top US firms. They found that adoption of such techniques was not associated with increased economic performance. However, the techniques were associated with more positive firm reputation among top executives in other firms (Fortune's ‘Most admired company’ survey) and higher remuneration for the firm's chief executive officer (CEO). They concluded that CEOs are motivated to adopt such practices not because they are economically optimal for the firm, but because they are seen as highly legitimate management practices, which reassure company stakeholders and offer signals about the CEO's competence to compensation decision makers.

5.5 Social pressures which affect our decision making

Broadly, there are three kinds of social pressure which affect how we make decisions:

-

coercive

-

mimetic

-

normative.

We look at these in more detail below.

5.5.1 Coercive pressures

Coercive pressures come from the social sanctions that can be applied if we do not act in socially legitimate ways. The law is one source of coercive pressure, but so too is the knowledge that you will get promoted only if you act in ways which fit accepted ways of doing things in your organisation.

5.5.2 Mimetic pressures

Mimetic pressures come from the pressure to imitate what others do. The world is complicated and finding the optimal solution often difficult. One way of dealing with this complexity is to copy others. For example, in my own consulting work I carried out an assignment for British Petroleum (BP). Subsequently, other (smaller) clients would often ask me ‘So how does BP do this?’, usually with little regard for the different circumstances they faced. It is this mimetic pressure that lies behind the tendency to follow management fashions. Of course, imitation can be a successful strategy, but it can often occur with little regard for the different contexts and challenges faced by different organisations.

5.5.3 Normative pressures

Normative pressures concern what we think we ‘should’ do. They concern our values and the broader social values to which we subscribe. Some organisations make explicit attempts to foster particular kinds of value (for example, in relation to customer service), but normative pressures also come from outside the organisation, such as from a particular professional or religious affiliation.

Institutional pressures are important for both private and public-sector organisations. However, they have especial relevance in the public sector, as noted by Lozeau et al.

Although all organizations are susceptible to institutional influences these pressures seem to take on greater importance in certain organizational fields, such as in domains where professional associations play a major role (e.g. accounting, medicine and law) and in governmental sectors where market pressures are dampened. In the public sector where there may be limited capability to assess simple bottom-line outcomes such as profitability, it becomes tempting for those who evaluate these organizations (governments, regulatory bodies, the public) to judge them on the basis of their processes. In such circumstances, the adoption of techniques that are viewed as rational, modern and progressive can enhance an organization's legitimacy.

(Lozeau et al., 2002, p.538)

An important aspect of institutional theory is the emphasis given to the different demands of the different contexts faced by decision makers. First, not all institutional pressures push in the same direction. For example, in a hospital setting there may be conflict between normative pressures arising out of the role of professional medical groups such as consultants and nurses, and coercive pressures from government bodies (e.g. see Lozeau et al., 2002). Secondly, there can be a conflict between institutional pressures and economic pressures arising out of the competitive environment.

5.6 A way of dealing with social pressures: decoupling

Organisations often deal with these social pressures by decoupling responses to these different pressures. The need to appear legitimate in the eyes of important constituencies is met by actions and practices which have a purely ceremonial character: they are done for the sake of appearances and not with any real engagement. The example in Box 5 shows how the Taiwanese subsidiary of a Western multinational uses decoupling to resolve the tension between parent-company coercive pressures to adopt a particular approach to performance management, and the mimetic and normative pressures resulting from the cultural setting in which the subsidiary operates.

Box 5: Decoupling appraisal practices in a multinational firm

While running an executive education programme for a large multinational, I touched on approaches to appraisal and performance management. I knew the firm had just rolled out a performance management system worldwide. The system embodied a USA-style, individually focused approach, with rewards and career advancement tied to outcomes of annual appraisals which were conducted according to a predefined template of competencies and performance criteria. I also knew that such systems had a poor record in cultures with a strong Chinese influence, where there is considerable emphasis on the role of relational ties and strength of personal networks in determining career advancement.

I asked how this new system had been received in Taiwan. At first, in class, the answer was that it was working fine. However, after lunch two Taiwanese managers approached me and asked if I would like to know the real story. ‘In truth,’ they said, ‘each year we meet, as we always have, to decide on who we want to promote and give bonuses to. Then a couple of us go into another room and write the appraisals to ensure we get those outcomes.’

So in this section we have seen that our decision-making behaviour is affected by more than just our own individual psychological make-up. Our decisions are significantly affected by the social milieu in which we live and work. We are all driven to varying extents by the need for social legitimacy and the demands of groups of which we are members. Paying attention to these social contexts and pressures can enrich our understanding of how decisions are really taken and alert us to some of the invisible strings which tug at us.

6 Risk and decision making

6.1 Introduction

An important aspect of decision making which crosses all three perspectives is making decisions about risks. Risk is all-pervasive in organisational life and many decisions require us to weigh up and choose between different kinds of risk. Thus any account of decision making would be incomplete without examining how our perceptions of risk affect our decisions. In this section we will examine risk from the three different perspectives we have identified: rational-economic, psychological and social.

6.2 A rational-economic perspective on risk

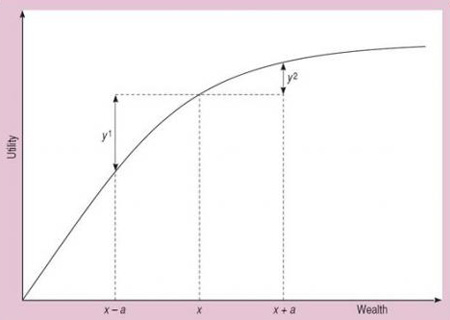

A rational-economic perspective generally represents risk as a combination of the expected magnitude of a gain or loss, combined with some probability distribution of anticipated outcomes. Economic ideas of risk behaviour are founded largely on expected utility theory. Expected utility theory predicts that investors will always be risk averse. The shape of the utility curve (utility plotted against increasing wealth) is such that utility increases with wealth, but at a declining rate. This is founded on the common-sense notion that I will value £100 less if I am very wealthy than if I am poor.

Figure 1

Figure 1 illustrates that (at any point x) the utility of an increase (+a) in wealth is less than the disutility of a decrease (−a) in wealth. This is used to explain why investors can be assumed to be risk averse. In a 50/50 gamble the disutility of the possible loss is greater than the utility of the potential win, so they will require a premium to engage in the gamble.

Thus, in economic accounts of market behaviour people are generally assumed to be risk averse and to require a ‘risk premium’ to accept a less certain outcome rather than a more certain outcome. Across a market, individual risk preferences aggregate to create a market price for risk.

Other simplifying assumptions, such as the idea of efficient markets, which instantaneously bring about market prices based on all available information, provide a basis for the construction of mathematically sophisticated approaches to understanding financial risks.

If you have studied financial strategy, you will know that there are a range of financial tools and technologies for managing financial risks, including portfolio management, options and the use of risk-adjusted discount factors and sensitivity analysis in discounted cash-flow calculations. The range and sophistication of such tools is increasing rapidly and there is no doubt that they have value. However, these tools are used by people (with all their biases and cognitive limitations) and assume a model of human behaviour (rational-economic) which is a significant oversimplification of how people really behave. For a brief review of decision science approaches to accounting for financial risk in decision making see Vlahos (2000).

6.3 The psychology of risk

Within the psychological paradigm there is a different starting point for understanding risk. In financial economic accounts, risk is generally regarded as a combination of the expected magnitude of loss or gain and the variability of that expected outcome. Human perception of risk works rather differently. There are two other important components of risk that influence our perceptions: the fear factor – how much we dread the potential outcome – and the control factor – the extent to which we are in control of events. When risks combine both dread and lack of control, for example in a nuclear accident, they are perceived as very great. It is, for instance, common to fear an accident more as a car passenger than as a driver, even when we acknowledge the other driver to be the more competent.

While expected utility theory suggests people to be consistently risk averse, available evidence on human risk preferences suggests that we are risk averse when considering potential gains, but will often take significant risks to avoid losses. We are ‘loss averse’. Further, whether we see ourselves as operating in the domain of gains or losses depends crucially on how a decision is framed and the reference point we are using to judge losses and gains. For example, a manager considering ways of reducing an expected loss may have already mentally accepted the loss and hence may frame the problem as improving on the existing situation and hence incline to risk aversion. Or she may still, in her own mind, be striving to avoid the loss and hence inclined to take risks to avoid it.

6.4 Prospect theory

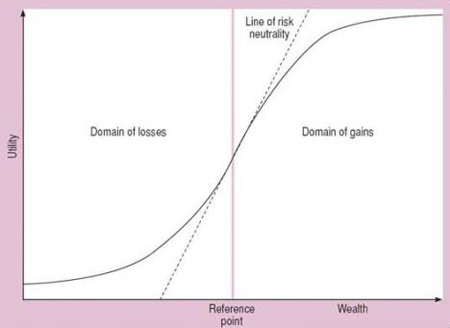

Kahneman and Tversky (1979) developed ‘prospect theory’ to describe this combination of risk and loss aversion. This suggests that whether an individual is risk seeking or risk averse will depend on where they are in relation to a personal reference point. The reference point divides the area where they feel as if they are in loss from the area where they feel they are in gain. This point is not usually zero, and will change over time. For example, a professional financial trader who is paid a bonus of £100,000 may experience this as a gain if he had been expecting a lower bonus. But say he had expected £200,000 and had committed to a house purchase on that assumption. In these circumstances he will experience the bonus as taking him into the domain of losses. In the first instance the reference point was somewhere between current wealth and current wealth plus £100,000. In the second case the reference point is at current wealth plus £200,000. Prospect theory suggests that because people are loss averse, they are risk averse above the reference point and risk seeking below. Figure 2 illustrates this.

The shape of the curve above the reference point displays risk aversion for the same reasons we set out in our discussion of expected utility theory. An extension of the same arguments shows the line below the reference point to represent risk-seeking behaviour. If you are having trouble seeing this, try drawing in lines to show a loss and gain of ‘a ’ at points x1 and x2 above and then below the reference point in the same way we did on the previous figure.

6.4.1 Implications

What does this all imply for decision making? First, the importance of control perceptions to decision makers' perceptions of risk suggests an important source of bias. In a study of managers' risk taking, Zur Shapira (1995) found that managers would often discount risks on the basis that they felt they could control them. In my own research on traders' decision making, I found traders to suffer from control illusions and their risk judgement and performance to suffer in consequence: illusory control beliefs lead to underestimation of risks (Fenton-O'Creevy et al., 2003). Second, individual decision makers may behave in risk-averse or risk-seeking ways, depending both on how potential outcomes are framed and on their personal reference points.

6.5 The social construction of quantifiable risk

Earlier in this course we referred to the way in which social groups can develop shared cognitive schema. One important role for shared cognitive schema is to define the risks that we pay attention to, the dread in which we hold them and the perceived likelihood of their occurrence. Because these perceptions affect behaviour, they also play a role in selecting the risks that we face. In the last half century, some sociologists suggest (e.g. Beck, 1992; Giddens, 1990) that our concerns with risk have shifted largely from what nature does to us to what we do to nature. Rather than being concerned with natural risks we are increasingly concerned with manufactured risks. Unlike natural risks, the risks that we manufacture are affected by how we perceive them. For example, consider the following apparent paradox. Road traffic in the UK increased twenty-fivefold between 1922 and 1986, and common perceptions of the dangers of roads changed from roads as relatively safe places to roads as dangerous places. Yet over the same period the number of children killed in road traffic accidents fell from 736 per annum to 358. The child road-death figure per motor vehicle fell by about 98 per cent (Adams, 1995, p.11). The ‘objective’ measure of road safety is in contrast to perceptions of roads as unsafe. Why might this be? As social perceptions of road risk have changed, so too has our behaviour. Parents no longer allow their children to play in the road and they teach them to exercise greater vigilance when crossing the road. The risks we construct as a society are changed by our beliefs about them.

To take another example, a series of railway accidents in the UK led to great public concern about the risk of rail travel. One consequence has been a shift in the industry of resources and effort from ensuring a reliable and timely service to ensuring an accident-free service. As a result, there has been a shift among previous rail passengers to greater car use, with implications for greater risk of road accidents. One way of understanding this at a social level is not as a process of risk avoidance but as process of risk selection: as a society we select the risks we face.

This reflexive nature of risk is also apparent in the field of finance: for instance, the risks of investing in particular markets are significantly affected by aggregate investor perceptions of the risks of such investment. Market panics can lead to very rapid price swings multiplying the risks faced by investors. To give another finance example, an important element in the downfall of the Long Term Capital Management (LTCM) hedge fund was the change in the perceptions of risks associated with assets held by LTCM as a consequence of changes in other investors' interpretations of LTCM's behaviour. LTCM held a large highly diversified portfolio of assets and had made very significant returns from arbitrage activities related to those assets. (Arbitrage is the process of buying and selling assets and securities to benefit from pricing anomalies and thus make a profit.)

An important part of their risk-management strategy was to invest in assets with uncorrelated returns so that a fall in value of one asset would not be matched by changes in value of others. However, the success of LTCM had created a fan club. Fans of LTCM tried to emulate their success by building up matching portfolios of assets. When a market crisis was triggered by the Russian default on their sovereign debt, LTCM needed to offload assets. However, the values of different assets in their diverse portfolio had become linked by virtue of the same assets being held by many investors. As they tried to sell assets, prices plummeted as their fan club also started to sell. The subsequent collapse of this fund came close to destabilising financial markets and triggering a series of bank failures around the world.

6.6 The social construction of unknown risk

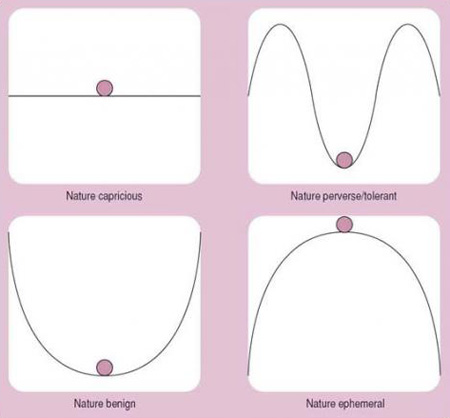

While some risks can be quantified, many are unknown. In the face of such uncertainty our approach to risk depends on fundamental assumptions about the way the world works which cannot be readily subject to empirical test. Different social groups have different approaches to uncertainty. Schwarz and Thompson (1990) characterise these in terms of what they describe as four myths of nature. Adams (1995) has conceptualised these in terms of a ball on a surface (see Figure 3). Imagine a ball on a surface. A small push on the ball has different effects depending on the shape of the surface.

Figure 3

Those subscribing to the myth of nature as capricious see the world as essentially unpredictable. A small action could have entirely unpredictable consequences of unknown scale. Those who see nature as benign believe strongly in equilibrium. However strong the disturbance to the world, the status quo tends to be restored. Those who subscribe to the perverse/ tolerant myth believe that, within limits, the world is predictable and tolerant of shocks to the system. However, pushing beyond those limits risks catastrophe. Those who see nature as ephemeral take a profoundly pessimistic view. Even small disturbances can lead to profound and potentially catastrophic changes. The world is fragile, precarious and equilibrium can be overturned by even small actions. For example, the different stances taken by different groups over climate change can be understood in these terms.

Each myth has consequences for how we deal with the world. While this framework has most often been applied to understanding reactions to environmental risk, and in the business world to understanding the reactions of different stakeholder groups, it is also clearly applicable to reactions to economic risk. For example, one can imagine quite different approaches to brand changes among firms subscribing to nature-benign and nature-ephemeral world views.

7 Making a difference to decision making

7.1 Introduction

We have taken a brief excursion through three different perspectives on decision making (the rational-economic, the psychological and the social) and we have considered how we think about risk from these different perspectives. How can you use these ideas to improve your own and others' decision making? The first way is to use them to develop greater insight into the pressures and influences that may be affecting how you process information, think, and decide. By becoming more aware of these influences you will be able to exercise greater choice about the short cuts you take and the influences you succumb to. You should also be able to be more aware of the limitations of your information and analysis. Second, by consciously trying to understand the way in which individual and social factors are affecting how others make decisions, you should be more effective in influencing them.

7.2 Understanding the limits of rationality

An important first step in making more effective decisions is to understand the limits of human rationality. Because of these limits we have developed formal processes for reasoning: statistics; probability theory; modelling methods; and so on. We have also developed technologies such as computers to support us in processing information. These are certainly useful, but it is always important to remember they are used by humans and can be easily subverted. For example:

-

The assumptions on which models are based are often changed to provide the ‘right’ answer.

-

The conclusions reached through a modelling process often ignore the tentative and uncertain nature of the information on which they are based. For example, it is common to see planning figures or outturn estimates expressed to second-decimal precision when the figures on which they are based are accurate only to the nearest thousand.

-

Many options are filtered out long before any formal analysis takes place.

-

The way in which the outputs of formal analysis are framed often affects the final decision.

-

The same data can lead to very different conclusions if decision makers have different assumptions about the way the world works.

7.3 What is an effective decision?

To improve decision making it is first important to have a clear idea of how we should judge an effective decision. While in this course we have suggested that decisions often stray from formal rationality, this does not always mean those decisions are less effective. Sometimes it is smart to take mental shortcuts: drawing on hunches and intuition can allow us to tap our tacit knowledge and experience and can reduce the costs of decision making. It can be smart to ask what is ‘legitimate’ when making decisions. Individuals and organisations that breach social norms can find themselves subject to sanctions or shut out of access to resources and influence. Nonetheless, there are dangers for the unwary and while short cuts and the pursuit of legitimacy do not necessarily make for bad decisions, they are more likely to if you lack awareness of the influences and biases that affect you.

7.4 Avoiding decision traps

While it is not possible to change our human natures, it is possible to immunise ourselves to some extent against common decision traps. Useful strategies include:

-

Get in the habit of reframing problems. For example, if you are considering strategies for avoiding a loss of €10,000 try asking yourself if you would feel differently if you consider them as strategies for making a gain of €10,000.

-

Think about the information you have relied on – to what extent have you been biased towards information which is easily retrievable or available? How may this have affected your thinking?

-

Ask yourself whether your understanding of the problem or the decision outcome became anchored at an early stage. Try and imagine radically different approaches.

-

Consider if it is possible that your own or others' concern to be cast in a good light is preventing an honest appraisal of failures.

7.5 Becoming an institutional entrepreneur

While acting in ways that are seen to be legitimate is important for both individuals and organisations, social institutions are not immutable. Some people and organisations seem to have a talent for changing the rules of the game.

Some writers have referred to this as being an institutional entrepreneur. At the organisational level an example might include Microsoft working actively to establish industry standards which favour them. At the individual level, managers who actively engage in building networks and alliances and influencing others are sometimes able to change perceptions of what is legitimate.

Conclusion

We hope this course has set you thinking about how you and others make decisions. It has been a very brief and to some extent shallow introduction to some quite complex ideas. The reference list should give you some pointers to further resources which will help you explore this topic in greater depth.

Before you move on take some time for a final activity.

Activity 3

In Activity 2 you answered a series of questions about a major decision you have been involved in at work. Take some time to make a few notes about how you might apply what you have learned in this course to that decision.

Keep on learning

Study another free course

There are more than 800 courses on OpenLearn for you to choose from on a range of subjects.

Find out more about all our free courses.

Take your studies further

Find out more about studying with The Open University by visiting our online prospectus.

If you are new to university study, you may be interested in our Access Courses or Certificates.

For reference, full URLs to pages listed above:

OpenLearn – www.open.edu/ openlearn/ free-courses

Visiting our online prospectus – www.open.ac.uk/ courses

Access Courses – www.open.ac.uk/ courses/ do-it/ access

Certificates – www.open.ac.uk/ courses/ certificates-he

Newsletter – www.open.edu/ openlearn/ about-openlearn/ subscribe-the-openlearn-newsletter

References

Acknowledgements

Except for third party materials and otherwise stated (see terms and conditions), this content is made available under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 Licence

Course image: Wonderlane in Flickr made available under Creative Commons Attribution 2.0 Licence.

All materials included in this course are derived from content originated at the Open University.

Don't miss out:

If reading this text has inspired you to learn more, you may be interested in joining the millions of people who discover our free learning resources and qualifications by visiting The Open University - www.open.edu/ openlearn/ free-courses

Copyright © 2016 The Open University