2.2.7 State benefits – inflation and tapers

Now take a look at two important factors that determine the amount of money people receive from state benefits, and discuss their implications.

Activity 3

First, one of the early changes introduced by the Conservative/Liberal Democrat coalition government after coming to power in 2010 was the shift from increasing the benefits (including Income Tax allowances) in line with the RPI measure of inflation to the CPI measure.

Second, an important element of tax credits and of Universal Credit is that they are means tested on household income. In other words, the amount a household receives from them goes down as household income goes up. The rate at which these benefits are withdrawn as income rises is called tapering. For example, for 2018/19 the taper for Working Tax Credit and Child Tax Credit was set at 41 pence for each additional £1 earned by families beyond an annual household income of £6420 (Gov.UK, 2018).

With Universal Credit a ‘work allowance’ is disregarded and then, in 2018/19, a taper of 63 pence in the £ is applied to the rest.

Consider these two questions.

- Bearing in mind what you have learned about the relationship between CPI and RPI, what impact is the move to raising benefits in line with CPI likely to have?

- Why is a ‘taper’ applied to the removal of benefits as income increases? Why not just deduct £1 of benefit for each additional £1 of extra household income?

Answer

CPI inflation has historically been lower than RPI inflation. The changes are likely to reduce the size of annual increases in benefits.

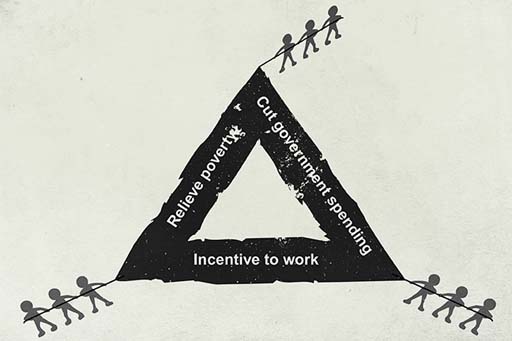

The existence of such a taper demonstrates an important challenge facing policy makers. They wish to make paid employment financially attractive but at some point they also wish to begin to remove benefit payments (in order to contain the cost to government of providing benefits). If they do this too quickly – say, for example, the taper was £1, or even 90 pence or 80 pence in the pound – then many benefit recipients might consider the financial reward for returning to work insufficient. Clearly there are many other positive aspects associated with entering the labour market, such as making a worthwhile contribution to society and improving your skills. But from a purely financial perspective paid employment with a high taper may not appear too appealing. Economists have described such a situation as the ‘poverty trap’, where a high taper represents a disincentive to enter the labour market.