1.4 Try the bad habits test

As you heard earlier from Mark Fenton-O’Creevy, there are good reasons why we sometimes make bad financial decisions, even if we’re pretty smart about most other things in life.

Find out if you’re suffering from some of the factors that make personal financial choices particularly difficult – perhaps we should call them the ‘perils of personal finance’.

Download this video clip.Video player: ou_futurelearn_money_vid_1018.mp4

Transcript

Martin Upton

There are reasons why we sometimes make bad financial decisions. Find out if you're suffering from some of the factors that make personal financial choices particularly difficult - perhaps we should call them the 'perils of personal finance'! Try this Bad Habit Test!

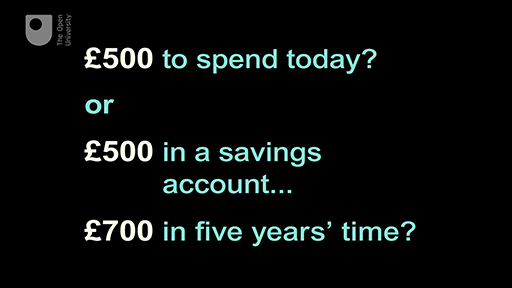

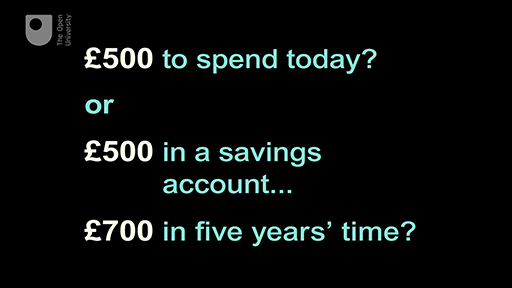

Which would you rather have: £500 to spend today? Or £500 in a savings account... and then have £700 to spend in five years' time, when interest is added?

If you chose to have £500 today, you're in good company; despite the 7% per annum return on the savings account. Most people don't like delayed rewards. If our choice means putting money aside, there's an immediate pain of having less to spend in exchange for a very distant and uncertain gain. So, not surprisingly, making the right choices for the long-term future can be very hard. Prioritising the present over the future can even be due to capitulation, which means that some personal financial challenges seem so daunting you may be tempted to assign them to the category of 'things I could never afford to do'. For example, many young people today may give up on the aspiration of buying their own home when they look at the deposit required and the bills that go with home ownership.

Here are two groups of loans - Group A and Group B. If you needed to borrow £100 for one year which group of loans contains the best deal?

In Group A we have two loans -

Loan 1: pay back £120 at the end of the year.

Loan 2: pay back £115 at the end of year.

In Group B,

Loan 3: pay a £10 arrangement fee and then equal monthly repayments; the interest rate is 5% per annum.

Loan 4: you pay a £5 arrangement fee and equal monthly repayments; the interest rate is 8% per annum.

Loan 5: you pay off the loan in equal monthly instalments at an interest rate of 7% per annum, plus a final charge of £3.

And finally loan 6: there are no repayments for the first 6 months, then

there are equal monthly repayments with a 3% per month interest charge.

Did you choose Group A? You may be surprised to discover the cheapest loans are Loans 5 and 6 in Group B. But we human beings do not like complexity. As options become more complex, the reliability of our decision making quickly deteriorates and we become more inclined to go for the simplest options or make no choice at all, just letting things carry on as they are. Moreover infrequency doesn't help. Many of our really big financial choices like changing jobs, taking a training course, buying a house besides being very complex, aren't taken very often. So there's not much opportunity to practise, but there is much scope to forget what we have learned from one time to the next.

Each year, you are 80% sure your boiler will not break down. How likely are you to take out a service contract for boiler repairs costing £15 a month?

a) Very or fairly likely

b) Not likely

We're very good at not expecting 'the unexpected'. In fact, we really don't like unpredictability at all. Financial planning involves projecting ourselves into situations we don't want to think about. So we may be tempted not to make financial provisions for unexpected events. Like major repairs to our cars or having to replace our boilers or finding that the roof needs retiling. But unexpected events not only happen, they are surprisingly likely. Take that boiler. Over a period of say four years, the chance of it not breaking down is 80% x 80% x 80% x 80% and this equals 41%. So viewed over a four year period there is a 59% chance that you would have to pay for boiler repairs. The unexpected event should now be expected within four years!

Imagine you inherit £20,000. The inheritance comes to you in the form of £5,000 in cash and £15,000 in shares. Would you:

a) Increase the amount invested in shares.

b) Make no changes.

c) Reduce the amount invested in shares.

Chances are you said 'make no changes'! That's because we all have a tendency towards inertia. That means we tend to feel uncomfortable making changes and so often stick with existing arrangements even when they might not be the best option. To help people deal with these problems, policy makers have become very interested in the idea of giving the rest of us a 'nudge'. This is a way of structuring financial choices so that, while people are still free to choose, the design of the choice steers them in a direction that's likely to be best for them.

For example, in the UK, the Government has argued that it's good for people to save for retirement, so it decided to enrol all employees into workplace pensions, unless they actively choose to opt out. Think about how you make choices, about what bad financial habits you might have. Have they ever created problems, or proved costly? Over to you - identify your bad habits and change them.

Interactive feature not available in single page view (see it in standard view).

You’re almost at the end of the first week. When you’ve explored your bad habits, see what you’ve learned so far in the first test.