7.2.5 Planning ahead for your retirement

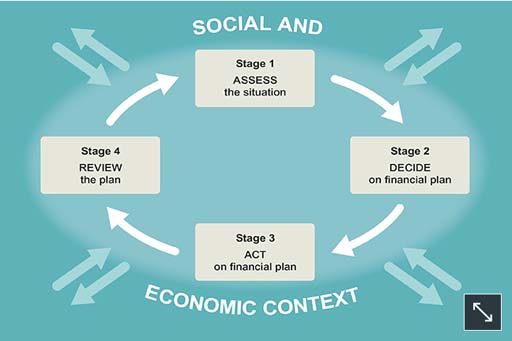

To consider how an individual or household can plan ahead for their retirement years, look once again at the financial planning model. This, or similar planning models, would be used by a financial adviser as the foundation for advice about retirement planning and provides an approach that you can also use for yourself.

Planning for retirement typically means looking many years ahead. Earlier in the course you learned about the need to know whether you’re dealing with figures in real terms – in other words, after taking inflation into account. When planning for retirement, it is important that all planning is done in real terms. This means that forecasts of future values should all be in terms of today’s money so that you’re looking at what a pension might buy after taking into account the possibility of price rises between now and retirement.

Central to the situation is the goal of a comfortable retirement. The need is to have enough income throughout retirement to finance a certain standard of living. The amount required will be determined largely by expectations of spending in retirement.

This raises a question: whose spending needs? Should the financial plan look at the individual or the household? The danger of basing the plan on the household is that many households change over time as, for example, couples split up, family members and friends decide to share a home or leave, or people die.

Traditionally, married couples have adopted the household approach, and the resulting financial plans have often proved inadequate in the face of death or divorce. This is a key reason why women account for such a high proportion of the poorest pensioners today.

The advantage of a retirement plan based on the individual is that each member of the household has their own pension arrangements, which they retain even if the make-up of their household changes.

Spending in retirement can be estimated from the individual’s or household’s current level and pattern of spending. Yet there are some good reasons to think that spending in retirement may be different from spending while working, and that spending needs in early retirement may differ from those later on. You’ll look more closely at this in the next activity.

An alternative might be to base estimated spending needs on the spending patterns of current pensioners, but bear in mind that what today’s pensioners actually spend may reflect the constraints of the income they ended up with rather than the income they wanted to have.