8.1.2 Why do you buy insurance?

A theme throughout this course has been how households can use financial planning to protect themselves from the financial impact of future events, whether planned or unplanned, expected or unexpected.

Insurance is a method whereby individuals or households (or organisations) can protect themselves against the unexpected. To do this, they pay a sum of money called a premium to an insurer in exchange for being indemnified (protected) against the losses that result from specific perils, under conditions specified in a contract. This contract is called an insurance policy. When you take out an insurance policy you’re transferring to the insurer the risk of the financial loss arising from the peril, and so you’re reducing the potential consequences to yourself.

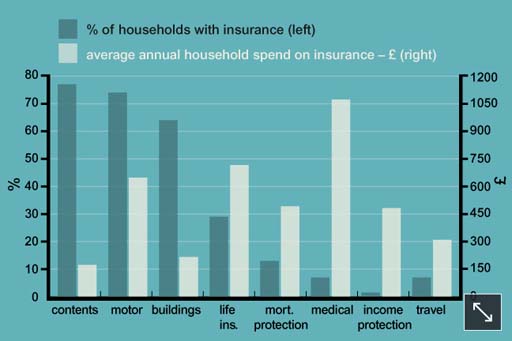

You can see from the chart the actual uptake of various types of insurance in the UK. The chart also shows the average expenditure on each type of insurance policy by those households that buy them, although it doesn’t include insurance cover provided through employers, so it understates total insurance expenditure.

Actuaries provide statistics to insurers to help quantify the risks that insurers are taking on. Insurers need data on the probabilities of the perils for which they offer insurance – death, illness, disease, burglary, accidents and so forth – and data on people of different ages, genders, locations, postcodes and households, so that they can estimate their risks of paying out.

Actuarial data will give an approximation of the future claims that the insurer might face across the range of perils they insure. Insurers will then aim to set premiums so that, on average, total premium income will cover the cost of paying out for claims, building up reserves and making a profit.

Insurers spread their risk by insuring many individuals and households against various risks. By insuring a large number of risks, the average number of times that insurers have to pay out will be more predictable, and so will be the total amount that they have to pay out in any given year. In taking on the risks of many and aggregating them, the insurer faces a more predictable future than individual policy holders would if they had to face their risks themselves.

What are the different strategies for managing risk and uncertainty?

One approach is to ignore the risk. If the peril then materialises, there could be major negative financial ramifications, and so this would be a high-risk strategy.

Another approach is to try to eliminate or reduce risk. Strategies here could include fitting house alarms (to reduce the risk of burglary or fire), eating healthily (to reduce the risk of premature death) or not flying (to eliminate a risk of death in an air crash). These might be beneficial in themselves – although they may have costs attached too – but they cannot eliminate all of life’s risks and uncertainties.

A different strategy is risk assumption. This involves taking on the potential financial impact of the peril materialising. It implies a policy of self-insurance: establishing a fund using savings products to cover the costs of any potential financial loss. This can be a strategy adopted by choice by people who are risk takers or who have enough income or savings to cover possible losses. It can also be adopted by default when other types of insurance are not available or are too expensive. Yet where the financial impact of a peril is large and beyond the financial resources of most individuals, many people who can afford to do so pursue a policy of transferring the financial risk, by using insurance to pass it on.