5.4.2 How investments are taxed

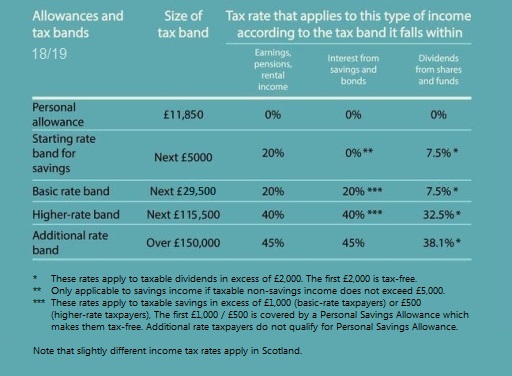

Start by looking at the table to see the details of the allowance and tax bands for different forms of investment in 2018/19.

The taxation of interest from bonds, also known as fixed interest investments (and unit trusts and OEICs that invest mainly in bonds) is very straightforward because it is taxed in the same way as interest from a savings account. However, unlike savings accounts, interest from most bonds is paid out gross (without any tax already deducted).

Gains from investments are subject to Capital Gains Tax, but every person has a yearly tax-free allowance (£11,700 in 2018/19). Only gains in excess of that amount are taxable and, in 2018/19, the rate which then applies is either 10% or 20%. To work out which of these rates applies, the taxable gain is added to the investor’s taxable income for the year. Any part of the gain that falls within the higher or additional rate band is taxed at 20%, otherwise the 10% rate applies.

As explained earlier, most of the tax on savings and investments can legally be avoided by investing through ISAs.

So, in summary, there are two main types of tax for UK investors: Income Tax and Capital Gains Tax. Interest from savings and bonds, and dividends from shares, are taxed as income; the profit from selling something for more than it originally cost is typically taxed as a capital gain. Income and gains from some savings and investments are tax-free and, even when they are taxable, the investor may have tax-free allowances to use so that in practice no tax is due.

Tax-efficient investment means choosing tax-free products, using allowances and taking advantage of the difference in tax rates between different types of income and between income and gains – for example, choosing an investment that pays gains rather than income when gain