Economics and the 2008 crisis: a Keynesian view

Use 'Print preview' to check the number of pages and printer settings.

Print functionality varies between browsers.

Printable page generated Thursday, 25 April 2024, 10:58 PM

Economics and the 2008 crisis: a Keynesian view

Introduction

Decisions, decisions, decisions. Governments need to make decision about how much to spend, how to finance their debt and how much revenue to collect, in order to ensure their citizens’ welfare is as high as it can be, given that there is a limited amount of resources available or borrowable against future repayments. These decisions become even more pressing and their consequences more acute in times when the economy is not growing; or worse, in moments when it is actually shrinking. As the famous economist Paul Krugman wrote in 2012, 'times of crisis are when economists are most needed. If they cannot get their advice accepted in the clinch – or worse yet, if they have no useful advice to offer – the whole enterprise of economic scholarship has failed in its most essential duty'.

In this OpenLearn course you will work through seven sections in which you will engage with some of the major aspects of economic policy:

- What types of problems are governments concerned with?

- Which policy instruments do they have at their disposal?

- How do they make decisions about the effectiveness of alternative courses of action?

One of the most challenging aspects of economic policy and decision making is the study of how changes in economic variables influence the more immediate and the future economic response. As Charlie Bean, the deputy governor of the Bank of England in the early 2010s, puts it, 'people describe the steering of the economy like driving a car when all you can do is look through the rear view mirror'.

This shows a boy on a ladder, spray painting graffiti on a wall. There is already writing on the wall which says, in large letters, ‘Running the economy’. The boy has sprayed out the first ‘n’ and has replaced it with an ‘i’ – changing it to ‘Ruining the economy’.

So, any claims as to what will happen in the future as a result of current policy are grounded in economic models about how economies, people, firms and industries within them, will respond. In this course you will discover that different economists have different theories about how the economy works, and different theories lead to different results, depending on the state of economies. This creates considerable controversy over which policies are right – you might already have your own views too.

You will also learn about the ways in which John Maynard Keynes’s theories revolutionised the thinking about how economic crises appear and how the government can solve them. In doing so, you will start to build an economic model to explore Keynes’s ideas.

Keynes’s thinking was very influential with economists and policymakers for several decades following the 1930s, but then fell out of favour for a time. The economic downturn that started in 2008 led to a widespread revival of interest as economic conditions seemed to resemble those seen in the 1930s. So a study of Keynes’s ideas is not just of historical interest but highly relevant to modern policymaking too.

This OpenLearn course is an adapted extract from the Open University course DD209 Running the economy.

Learning outcomes

After studying this course, you should be able to:

understand what economists mean by ‘models’ and how they can be used to inform economic policy

define the concept of equilibrium and explain how it can occur at low levels of output

begin to understand the Keynesian model of aggregate demand and how it explains why economies can get stuck in a low output equilibrium

critically evaluate the role of fiscal policy in changing the economy.

1 Keynes in context

Before we start to develop our Keynesian model of the economy, it is helpful to know something about Keynes and the context that compelled him to develop his theories, which are still influential today. Below you will find a timeline of some of the highlights in Keynes' life, and an audio clip in which two Open University economists discuss some key economic ideas, and Keynes' influence in shaping economics and economic policy.

Click on the link below to launch the timeline and then click and drag your mouse to move along the timeline for highlights in the life and career of John Maynard Keynes (1883–1946). Click on each entry to read some details.

Now listen to the following audio. This audio is taken from Block 2 of the Open University course DD209 Running the economy so there are a number of references to the block, as well as a summary of Block 1 of the course, which you should ignore. As you listen to the discussion, you may find it helpful to note down the key points.

Transcript: Open University economists discussing Keynes' ideas and influence

Activity 1

Thinking about the timeline and your notes from the audio clip you have just listended to, suggest one important economic legacy of Keynes.

Discussion

Keynes remains, even today, one of the most influential economists. His legacy includes his General Theory (see the timeline) which set out his thinking that economies do not naturally provide jobs for everyone – governments may need to intervene. Keynes is also recognised as one of the founders of the branch of economics called macroeconomics (mentioned in the audio). You may have made other suggestions.

2 Planned and actual values

Notation in equations

In the sections which follow, you will be introduced to some simple equations. Don’t panic! Wherever they are used, we teach you step by step how to read them. A general point to be aware of is that where one term is multiplied by another we will follow standard maths notation and leave out the multiplication sign. For example, in Section 6, you will see the equation of consumption C = a + bY. We write ‘bY’ instead of writing ‘b × Y’ (with the multiplication sign ‘×’). The general rule is that when two terms are placed side by side, they are to be multiplied.

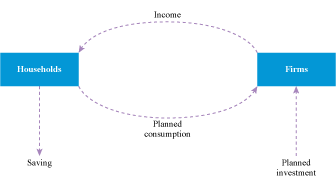

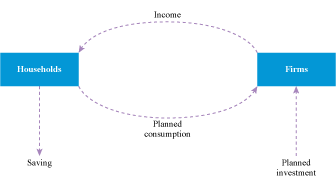

The economy as modelled by the circular flow diagram, below, appears to be a rather peaceful place, where expenditure is always identical to output and saving is always identical to investment. But saving decisions and investment decisions are made by different people, so it seems there is no reason why they should match, and Keynes’s model of change in national income depends precisely on expenditure being too great or too small to match output and hence on saving being too small or too great to match investment.

Flows of money are shown by dashed lines with directional arrowheads.

A flow labelled ‘Income’ runs from Firms to Households.

A flow labelled ‘Planned Consumption’ runs from Households to Firms.

A dashed line pointing vertically down from Households is labelled ‘Saving’.

A dashed line pointing vertically up to Firms is labelled ‘Planned Investment’.

Activity 2

Watch the video below to see how this paradox is resolved. This video is part of the Open University course DD209, Running the economy, so there will be references to Block 1 of the course, which you should ignore.

Transcript: Planned and actual values

3 The consumption function

So far, we have been representing what happens in the economy using the circular flow of income model.

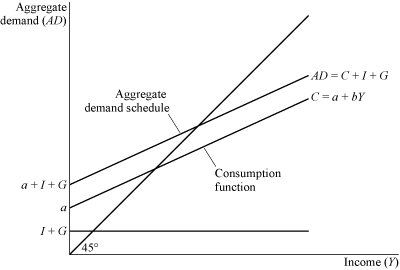

To demonstrate Keynes’s theories about equilibrium in a more quantifiable way, we need to use what is called the aggregate demand model. The two main components of this model are consumption and investment. Section 6 will show you an extended version of this model which includes government expenditure, but for now, Figure 3 represents an economy with no government and no trade and relations with other countries. This section consolidates your understanding of the first element in this model: the consumption function.

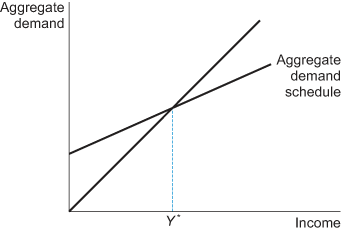

The diagram shows an aggregate demand schedule.

The diagram contains a vertical axis, which is labelled as ‘Aggregate Demand’ and a horizontal axis which is labelled as ‘Income’.

There is a straight line from the origin, sloping upwards at 45 degrees.

The aggregate demand schedule is a straight line, sloping up from left to right, from a point about one quarter of the way up the vertical aggregate demand axis. The slope of the schedule is quite shallow.

The aggregate demand schedule intersects the 45 degree line about half way along the 45 degree line. From this point of intersection, a dashed vertical line is taken down to the horizontal Income axis, to a point on the axis labelled as capital letter Y followed by a star.

3.1 Building a consumption function (1)

According to Keynes, there is a fairly stable relationship between planned consumption and current income. Households plan to spend a fairly constant proportion of each additional pound they earn. He calls this proportion the ‘marginal propensity to consume’. To present this diagrammatically, we start with two axes at right-angles to each other.

Activity 3

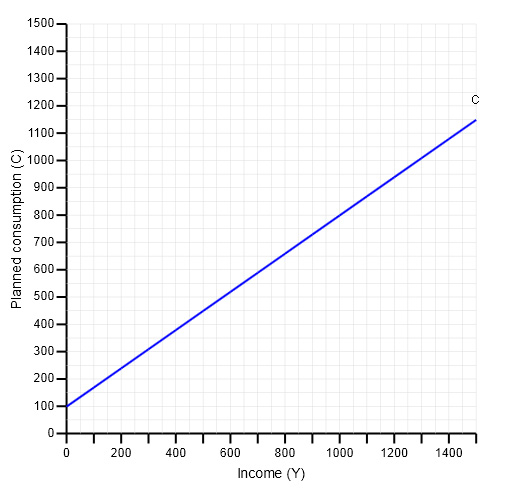

The horizontal axis of Figure 4 shows income (Y) and the vertical axis shows planned consumption (C).

Suppose that consumers plan to spend 70 pence of each additional pound they earn. The marginal propensity to consume is 0.7. The usual symbol for the marginal propensity to consume is b. So, we can say b = 0.7.

Click on three points on Figure 4 which would lie on the consumption function.

3.2 Building a consumption function (2)

We now have a hypothetical consumption function.

Activity 4

Look at Figure 5 and answer the questions that follow.

Question 1

(a) What is the equation of the consumption function we have drawn?

Answer

The equation is: C = 0.7Y

Question 2

(b) In what way is it unrealistic to suggest, as in this example that the consumption function would start from the origin?

Answer

Even with no income, there must be some consumption: households need to consume basic goods so would need to borrow or run down savings balances to finance this consumption. This bare minimum consumption that does not depend on income is known as exogenous consumption. Exogenous consumption is usually symbolised by a.

Question 3

(c) How would the consumption function be affected if exogenous consumption (usually symbolised by a) was £100? Answer by picking up and dragging the consumption line to take account of this level of exogenous consumption.

3.3 Building a consumption function (3)

Activity 5

Look at Figure 6 and answer the following question.

The diagram shows a consumption function, labelled as C.

The vertical axis is labelled as ‘Planned consumption (C))’ and has values from 0 to 1500, at intervals of 100. The horizontal axis is labelled as ‘Income (Y)’ and has values from 0 to 1500, at intervals of 100.

The consumption function is a straight line that slopes upwards, starting from point 100 on the vertical axis. The upward slope is fairly steep but less than 45 degrees. The end point of the function on the diagram is at Y of 1500 and C of 1150. Coordinates of points the consumption function passes through include, for example, (500Y,450C) and (1000Y, 800C).

What is the equation of this revised consumption function?

Answer

The equation is: C = 100 + 0.7Y

4 Modelling equilibrium

We have said that the economy will be in equilibrium when planned saving matches planned investment. So we need to use our diagram to explore this relationship. First, we need to show planned saving. Our diagram already shows planned consumption at each level of income, and of course planned saving is simply the difference between income and planned consumption. Having shown saving, we need to go on to add investment to our model to complete our analysis of equilibrium.

4.1 Modelling planned saving (1)

A good way to make our diagram work for us to show planned saving (the difference between income and planned consumption) is to start by reflecting each value of income plotted on the horizontal axis on to the vertical axis where planned consumption is plotted. This will make it easy to compare visually each level of income with its corresponding level of planned consumption. So let’s start with just the two scaled axes and imagine that each value of income emits a ray of light vertically. A mirror is held diagonally to reflect that ray on to the vertical axis. Click on each circle on the bar underneath the chart, working from left to right to watch this process build up step by step.

The line we have traced out is called, for obvious reasons, the 45-degree line, and it shows us at a glance how far up from the horizontal axis any value of income would appear if we plotted it on the vertical axis. At any point on the line, the variable plotted on the vertical axis – planned consumption – is equal to the variable plotted on the horizontal axis – income.

4.2 Modelling planned saving (2)

If we now show our consumption function on the same diagram, we can visually compare each level of income with its corresponding level of planned consumption.

Activity 6

Recalling that planned saving is the difference between income and planned consumption, click on two points on the diagram which, when joined up, will show the amount of planned saving at an income level of £600.

4.3 Modelling planned investment

At an income level of £600, households are planning to spend £520 on consumption and to save the remaining £80. But firms are not planning to invest at all! Let’s now incorporate planned investment into our diagram. This will mean two slight changes.

- We re-label the vertical axis ‘Aggregate demand’, as we are adding investment demand to consumption demand.

- We reinterpret the 45 degree line accordingly. Recall that at any point on the 45-degree line the variable plotted on the vertical axis is equal to the variable plotted on the horizontal axis. So in this diagram, at any point on the line, aggregate demand is equal to income.

The Keynesian model treats planned investment as an exogenous component of demand, that is, as not dependent on current income. It will therefore appear as a horizontal line on our diagram but, when we add planned investment to planned consumption, the aggregate demand line, which at present shows only planned consumption, will move upwards by the amount of planned investment we introduce.

Activity 7

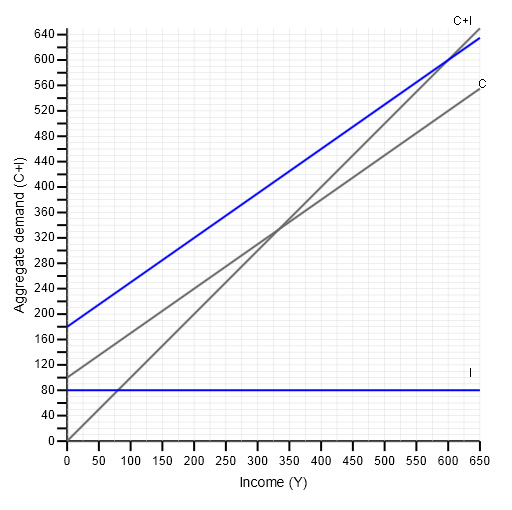

Look at Figure 9 and complete the tasks that follow.

Task 1

(a) At present, the planned investment line is lying along the horizontal axis as we have not yet shown any planned investment. Pick up and drag the line till it shows a level of planned investment equal to the level of planned saving at an income level of £600. (Note that the scales on the axes have been changed to make this task easier - the income level of £600 is now towards the far right of the diagram.

Task 2

(b) What is the equation of the aggregate demand function you have derived?

Answer

The equation is: AD = 180 + 0.7Y, as there are now two constants: exogenous consumption (100) and planned investment (80).

4.4 And so to equilibrium

In our diagram, planned saving is shown by the vertical gap between the consumption function and the 45-degree line. Planned investment is shown by the vertical gap between the consumption function and the aggregate demand function.

Given the assumptions we have made about exogenous consumption, the propensity to consume and the level of exogenously determined investment, these two vertical gaps are equal at an income level of £600, so at this income level planned saving = planned investment. We have therefore illustrated an economy in equilibrium at an income level of £600.

Note that the AD line (C + I) crosses the 45-degree line at an income level of £600. Since at any point on the 45-degree line AD = Y, we can say that at an income level of £600 aggregate demand = income.

The diagram shows an aggregate demand (C+I) function, a consumption function (C), a planned investment function (I) and a 45 degree line.

The vertical axis is labelled as ‘Aggregate Demand (C+I)’ and is marked from 0 to 640, at intervals of 40. The horizontal axis is labelled as ‘Income (Y)’ and is marked from 0 to 650, at intervals of 50.

The 45 degree line slopes up from the origin.

The planned investment line (I) is horizontal, drawn across from the point 80 point on the vertical aggregate demand (C+I) axis.

The consumption function (C) slopes upward more shallowly than the 45 degree line, from the point 100 on the vertical axis.

The Aggregate Demand function (C+I) is in shown in blue and lies above and is parallel to the consumption function (C). It slopes upward from the 180 point on the vertical axis. The vertical gap between the C+I and the C function is equal to the value of planned investment (I).

The Aggregate Demand (C+I) function intersects the 45 degree line at an income level of 600. At this point, Aggregate Demand also equals 600.

So we have two ways of looking at equilibrium in this simple economy.

When the economy is in equilibrium:

- Planned saving = Planned investment

- Aggregate demand = Income

5 When equilibrium is not enough

Keynes believed that an economy may settle into equilibrium at a level of income too low to support full employment.

We can use our model to illustrate this possibility and to illustrate how policy intervention to stimulate aggregate demand may bring about full employment.

5.1 Underemployment equilibrium

Equilibrium occurs when aggregate demand equals income, so, in the previous activity, when AD is equal to income at £600. But it may be that AD of £800 equal to Yf is needed to support full employment, so equilibrium would need to occur at an income level of £800. Given current consumption and investment habits, however, if income stood at £800, AD would be less than £800, as we can see from the fact that the C + I line lies beneath the 45-degree line at an income of £800. To achieve full employment, a policy intervention would be needed to stimulate demand sufficiently to bring about equilibrium at an income level of £800.

You will now use an Aggregate Demand tool to explore how we could move the economy to a full employment equilibrium.

Activity 8

Select the link below to access the tool.

Place yourself in the tab 'Closed economy without government'. This means the economy has no government, and demand comprises only consumption and investment. Complete the following tasks.

Task A

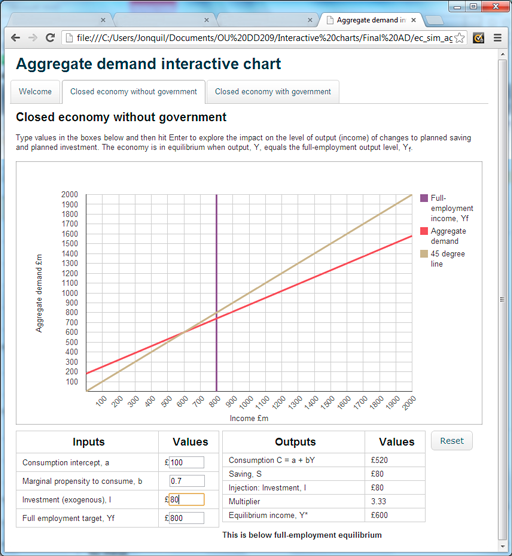

(a) Set the inputs to the following values: exogenous consumption (labelled 'Consumption intercept' equals 100, the marginal propensity to consume is 0.7, investment is set at 80 and full-employment income is 800.

Answer

The outputs and chart in the tool should look like this. You can see that this economy is currently in equilibrium at an income of 600 but we want to reach the full-employment equilibrium of 800.

The figure is a screenshot of the Aggregate Demand Interactive chart.

It shows the answer to Activity 8 question (a) which asks you to input specified values for exogenous consumption, the marginal propensity to consume, investment and the full employment equilibrium.

The diagram shows what the Aggregate demand chart should look like with these values inputted. Above the chart, it says that this is for a closed economy without government.

Aggregate Demand in millions of £ (£m) is shown on the vertical axis, starting at 0 and rising to 2000, at intervals of 100. Income in £m is on the horizontal axis, starting at 0 and rising to 2000 at intervals of 100.

The 45 degree line is shown in brown. The Aggregate Demand function is shown in red. The full employment equilibrium level is shown at a level of income of £800m. A vertical full employment income line is drawn in purple from this point to intersect the 45 degree line.

Just on the right of the chart is a legend showing the colour coding for the three lines. This legend tells us that the full employment income is denoted as Yf.

The AD line intersects the 45 degree line at an income level Y of £600m, below the full employment level of income Yf.

Task B

(b) State by how much AD falls short of the level required to produce the full-employment income of £800.

Answer

In this example, aggregate demand at any level of income is calculated using the equation:

AD = 180 + 0.7Y

So, if equilibrium income (Y) were to be £800:

AD = 180 + 0.7 x 800 = 180 + 560 = 740

which would fall short of income by £800 – £740 = £60.

Policy intervention will be needed to give a stimulus that initially raises aggregate demand by £60.

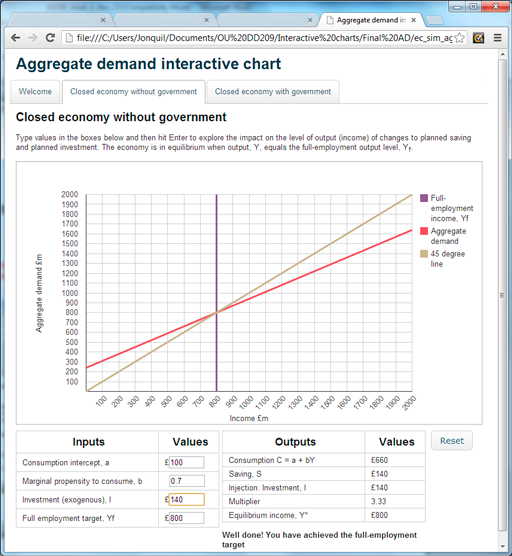

Task C

(c) Assume that the required stimulus is going to take the form of policy to increase investment. Use the tool to change investment by the amount you calculated in (b).

Answer

If you increased investment by 60, the new amount of investment should be 140. The outputs and chart from the tool should now look like this:

The figure is a screenshot of the Aggregate Demand Interactive chart.

It shows the answer to Activity 8 question (c). Above the chart, it says that this is for a closed economy without government.

Aggregate Demand in millions of £ (£m) is shown on the vertical axis, starting at 0 up to 2000, at intervals of 100. Income in £m is on the horizontal axis, starting at 0 and rising to 2000 at intervals of 100.

The 45 degree line is shown in brown. The Aggregate Demand function is shown in red. The full employment equilibrium level is shown at a level of income of £800m. A vertical full employment income line in purple is drawn from this point to intersect the 45 degree line. The legend on the right of the chart shows the colour coding for the lines and tells us that full employment income is denoted as Yf.

The AD line intersects the 45 degree line at an income level Y of £800m, which equals the full employment level of income Yf.

Task D

(d) Describe what has happened to the equilibrium level of income as a result of the change you made in (c).

Answer

The economy is now in equilibrium at an income of £800 which is the full-employment level of income.

6 The aggregate demand model with government and fiscal policy

The previous sections introduced some of the arguments made by Keynes as to why capitalist economies can become stuck in positions of high unemployment. Though there may be a quite stable relationship between income and consumption, private investment can languish at levels that are insufficient for full employment. The government may choose to fill the gap: an active state sector for Keynes can iron out the vagaries of volatile private investment spending. For the macroeconomy, the key problem is the failure to reach full employment owing to a shortfall in aggregate demand, and the component of aggregate demand that is most frequently insufficient is investment demand.

This section introduces some of the policy tools that are available to a government department responsible for coordinating public finance – in the UK called Her Majesty’s (HM) Treasury. The Treasury is the coordinating body that allocates government spending (for transport, health, education, defence, and so on) and oversees the collection of taxes (such as Income Tax, Value Added Tax (VAT) and excise duty on petrol). When the government uses these spending and revenue raising activities to stabilise the economy, this comes under the purview of fiscal policy, which is the main focus of this section.

It should be emphasised that the role of fiscal policy is highly contested by economists and policymakers. From a Keynesian perspective, the government has a vital role in stabilising the macroeconomy, because there is no automatic mechanism through which the economy can recover from a recession. For critics of the Keynesian approach, however, the government should leave the private sector alone: it is government intervention that prevents the private sector from bringing about full employment equilibrium. The purpose of this section is to introduce and explore the Keynesian point of view. Some critiques of the Keynesian approach are also explored.

Section 6 introduces government expenditure and shows its full potential Keynesian impact. Not only can government spending generate demand for goods and services that may encourage firms to employ more people, but also its effect on income can be much greater than the initial stimulus. The section then focuses on the more tricky issue of how government spending is financed through taxation. It also considers how the cutting of taxes can help to stimulate aggregate demand. These two dimensions of fiscal policy are brought together in a consideration of fiscal stabilisers. The government can use fiscal policy in a discretionary way to actively intervene in times of crisis; it can also allow what are known as automatic stabilisers to smooth out economic fluctuations. Finally, the section examines a big policy issue that has dominated public policy-making in recent years – the issue of budget deficits.

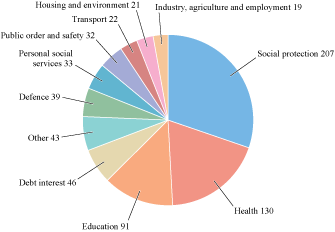

6.1 Government expenditure (1)

In modern capitalist economies, the public sector plays a key role. In the UK, total government expenditure was forecast to be £683 billion in the financial year 2012–13, which is 43.4% of Gross Domestic Product (GDP) (HM Treasury, 2012). Government activities range across all spheres of the economy, from the provision of social protection (such as benefits and pensions) to health, transport and defence. A breakdown of government spending is provided in Figure 13. Social protection is clearly the largest category, with health and education the next largest categories.

This diagram is a pie chart, divided into eleven sections showing the breakdown of government spending. The data source is HM Treasury, 2012, page 1, chart 1.

The largest category is Social protection, at £207bn.

Then, moving clockwise the pie chart presents the other categories of spending in descending order:

Health 130; Education 91; Debt interest 46; Other 43; Defence 39; Personal social services 33; Public order and safety 32; Transport 22; Housing and environment 21; Industry, agriculture and employment 19.

Social protection includes the provision of transfer payments, where there is a transfer from the government to individuals that is not made in return for any services. Old-age pensions and unemployment benefit are examples of transfer payments. If, for example, a refuse collector becomes unemployed and receives unemployment benefit, this benefit is a transfer payment, since he is providing no direct service. By contrast, if the refuse collector is in work and paid a wage by the government, that is government spending on the service of emptying bins.

As you will see in the analysis that follows, some economists and policymakers may regard government expenditure as unproductive and wasteful, a drain on the wealth-creating private sector, even when it takes the form of expenditure on goods and services. For Keynes, however, government expenditure represents a powerful lever for intervention when the private sector fails to generate sufficient demand.

Keynes formulated his ideas during the 1920s, making a number of attempts to persuade the UK government to increase its expenditure in order to boost aggregate demand. Although the wartime British Prime Minister, David Lloyd George, had promised that there would be ‘jobs for the boys’ when soldiers came home after the First World War, this did not materialise. High unemployment in the 1920s led to the decline of the Liberal Party, of which Lloyd George was the leader, and its replacement by James Ramsay MacDonald’s Labour Party as the main alternative to the Conservatives – a position from which the Liberal Party (calling itself the Liberal Democrats at the time of writing) has never recovered.

In one final push, in the 1929 General Election, Lloyd George tried to regain his supremacy over the ‘spectre’ of socialism. Under his auspices, the Liberal Party published a pamphlet entitled ‘We can conquer unemployment’. He also marshalled the support of Keynes to develop his party’s manifesto. In his address to Liberal candidates on 1 March 1929, Lloyd George pledged: ‘If the nation entrusts the Liberal Party at the next General Election with the responsibilities of government, we are ready with schemes of work which we can put immediately into operation, work of a kind which is not merely useful in itself but essential to the well-being of the nation’ (Keynes, 1972, p. 88).

The Conservative-dominated press rubbished these claims as the fantasies of a Welsh windbag, being far too optimistic and not based on common sense. Keynes piled in, in a pamphlet entitled ‘Can Lloyd George do it?’, written with a politician, Hubert Henderson. This aimed to supplement and to answer criticisms of the Liberal Party pamphlet mentioned above. Keynes wrote:

The Liberal Policy is one of plain common sense. The Conservative belief that there is some law of nature which prevents men from being employed, that it is ‘rash’ to employ men, and that it is financially ‘sound’ to maintain a tenth of the population in idleness for an indefinite period, is crazily improbable – the sort of thing which no man could believe who had not had his head fuddled with nonsense for years and years.

In answer to the objections raised by the then Conservative Prime Minister Stanley Baldwin, Keynes observed: ‘Mr Baldwin and his colleagues are not more capable of expounding the true economic science of the matter than they would be of explaining to you the latest propositions of Einstein’ (Keynes, 1972, p. 91).

6.2 Government expenditure (2)

Lloyd George’s £300 million programme had three main planks:

- Transport: To modernise the rail and transport system, including electrification of railways and particular emphasis on roads, since they were under the direct control of the government sector. A capital sum of £145 million for road replacement and extension over two years was proposed.

- Housing: To build 200 000 houses a year: a million houses over a ten-year period would provide for slum clearance and reduction of overcrowding. Unemployed building workers would be set to work on these road- and house-building programmes.

- Small projects: A host of other small developments, such as telephone development and land drainage. All this required was a Treasury green light for ‘innumerable schemes pigeonholed in government offices’ (Keynes, 1972, p. 99).

Similar public spending programmes were announced throughout the world in response to the economic crisis of 2008. In the USA, President Obama introduced the American Recovery and Reinvestment Act of 2009, which resulted in US$831 billion of government spending on items such as infrastructure, health and education. In the same year, Australia launched a ‘Nation Building and Jobs Plan’, costing AUS$42 billion, on items such as building local community infrastructure and refurbishing schools – estimated to create 90 000 jobs and to boost annual GDP by 1% after two years (Vu and Tanton, 2010, p. 129).

The official UK government position in 1929, however, as summarised by the Balfour Committee on Industry and Trade, was that a programme of this kind ‘could not provide employment in their own trades for any considerable number of unemployed persons’ (quoted in Keynes, 1972, p. 100). Against this pessimistic assessment, Keynes stated the Liberal position that ‘each million pounds spent annually on road improvements would employ, directly or indirectly, 5,000 workpeople’ (Keynes, 1972, p. 103). Keynes pointed out that this is four times higher than the assessment given by the Balfour Committee. The committee had failed to take into account the indirect employment effects of the road-building programme.

This error was eventually admitted, after questioning in the House of Commons, by the Conservative Minister of Transport, Colonel Ashley. After noting that for each £1 million of road-building expenditure employment ‘might be increased to as much as 2,500’, Colonel Ashley conceded that for each of these direct jobs ‘another man would be indirectly employed in producing and transporting materials in other ways, and this assumption may not be unreasonable’ (quoted in Keynes, 1972, p. 104). There would be additional indirect employment created in the production and transport of the tarmac and other materials that are required for road-building, leading to a further possible 2500 jobs.

Activity 9

As reported above, the official estimate was that 5000 jobs were created by each £1 million of expenditure. Directly and indirectly, how many jobs could have been created by the £72.5 million earmarked for the first year of the Lloyd George road-building programme?

Answer

The total impact would have been 362 500 jobs (72.5 × 5000) in the first year – a substantial hole in the more than one million unemployed in 1929, created just by road-building. For Keynes, this was not a Lloyd George fantasy; it was confirmed by the government itself after intensive pressure and analysis.

In Keynes’s view the Balfour Committee had failed to take account of something much more significant than the indirect employment to which the Liberal Party’s pamphlet and statements had drawn attention. By putting unemployed people into work both directly and indirectly, an initiative such as the road-building programme would increase what he called ‘effective purchasing power’. Newly employed workers in the road-building industry would spend part of their wages on a wide range of goods and services, providing increased income and creating further new jobs in other parts of the economy. This in its turn would lead to further spending, more income and more new jobs. In this way there would develop a considerable ripple in the form of successive rounds of spending: ‘the forces of prosperity [would] work with a cumulative effect’ (Keynes, 1972, p. 106).

This notion of cumulative increases in demand and hence in income and output is so central to Keynes’s system that it is worth quoting at some length from the pamphlet that he wrote with Henderson:

It is not possible to measure effects of this character with any sort of precision, and little or no account of them is, therefore, taken in ‘We Can Conquer Unemployment’. But, in our opinion, these effects are of immense importance. For this reason we believe that the effects on employment of a given capital expenditure would be far larger than the Liberal pamphlet assumes.

By the time Keynes published The General Theory of Employment, Interest and Money in 1936, he had refined his thinking about these cumulative effects and showed how they might be estimated using the marginal propensity to consume.

The analysis that follows in the next section shows how the impact of government expenditure on output and employment can be modelled, using the aggregate demand framework.

6.3 Government expenditure (3)

To model the impact of government expenditure, the first step is to introduce a new term G to represent planned government spending. Whereas earlier it was assumed that the economy consisted only of private agents (households and firms), the government sector (also called the public sector) is now included in the model. Like private investment, government spending is treated in this model as exogenous.

It is important to note that the portion of government spending that takes the form of transfer payments is not included in G since it adds nothing directly to the demand for goods and services. However, as you will see, transfer payments do affect the household consumption component of aggregate demand and income.

Aggregate demand (AD) in the extended model consists of planned consumption (C ) and planned investment (I ), as before, with an additional term (G ) representing planned government spending:

AD = C + I + G

Some elements of spending may form part of I at one time in history and part of G at another. For example, investment in railways in the 1920s would be categorised as part of private investment (I ), whereas after railway nationalisation in the 1940s such investment would be categorised as part of government spending (G ). Keynes made the point that expenditure by the government on roads was equivalent to private investment in the railways. In fact, since in times of stagnation, the private sector might be reluctant to invest, government spending can be required to fill the gap – not just to boost aggregate demand, but also to provide vitally needed infrastructure investment.

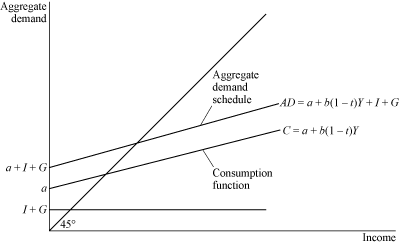

This new role for government spending can now be shown in the aggregate demand diagram (Figure 14). In this diagram, government spending (G ) and investment (I ) are shown as exogenous elements of aggregate demand, unaffected by changes in income. The combined total of government spending and private investment (I + G ) is represented by a horizontal line. Also exogenous is the intercept of the consumption function (a). You may recall from earlier sections that the slope of the consumption function is represented by the coefficient b.

This diagram has Aggregate Demand (AD) on the vertical axis and Income (Y) on the horizontal axis.

A solid line at a 45 degree angle is drawn upwards from the origin.

From a short way up the vertical axis, a horizontal line is drawn. This is labelled I+G.

A little above this horizontal line, from point ‘a’ on the vertical axis, a straight line is drawn upwards, with a shallower slope than the 45 degree line. This is labelled ‘Consumption function, C=a+bY.’

Somewhat above the consumption function, and parallel to it, is a line drawn from a point on the vertical axis a+I+G. This line is labelled ‘Aggregate Demand schedule, AD=C+I+G.’

To derive the new aggregate demand schedule, the horizontal line for combined investment and government spending can be added to the consumption function. The new aggregate demand schedule AD = C + I + G has an intercept a + I + G and the same slope (b) as the consumption function.

6.4 Government expenditure (4)

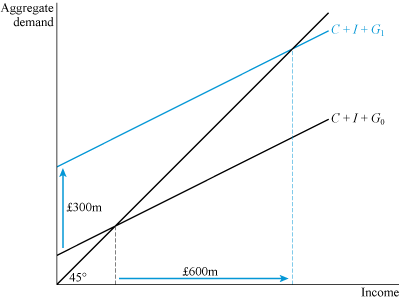

The aggregate demand model can also be used to illustrate what might happen under an increase in government spending, as shown in Figure 15. Let government spending increase by £300 million – money that could be spent along the lines of the 2009 Obama Recovery Act or the 1929 Lloyd George three-point plan. This is shown by an upward shift of the intercept of the aggregate demand schedule by £300 million due to an increase in government spending from G0 to G1. It is referred to in modern economics as a fiscal stimulus. Using one of its key fiscal powers – the ability to carry out expenditure – the government is able to boost aggregate demand.

This diagram has Aggregate Demand (AD) on the vertical axis and Income (Y) on the horizontal axis.

A solid line at a 45 degree angle is drawn upwards from the origin.

From a short way up the vertical axis, a straight line is drawn, sloping upwards at an angle shallower than 45 degrees. This line is labelled as C+I+G zero and it intersects the 45 degree line quite low down. A dashed line is drawn from this intersection point down to the horizontal Income axis.

From a point about half way up the vertical axis, a second straight line is drawn. This is parallel to the first one and is labelled as C+I+G1. This intersects the 45 degree line much further along. A dashed line is drawn from this intersection point down to the horizontal Income axis. This point is much further along the axis than the point from the first aggregate demand schedule.

There are two arrows in blue showing the direction of change. One arrow points upward along the vertical axis, from the lower to the higher aggregate demand schedule. This has £300m written beside it.

Another arrow runs to the right along the horizontal axis, from the lower point on the axis to the higher point. This has £600m written beside it.

Activity 10

By how much does income increase in Figure 15 under a £300 million fiscal stimulus?

Answer

Figure 15 shows, for this particular example, that the increase in income is £600 million – which is double the fiscal stimulus. In this example an extra £1 million of income is created for each £1 million of fiscal stimulus – an extra £1 million of output that could lead to double the number of jobs initially created directly and indirectly by the stimulus.

This ‘double your money’ insight can now be explained by breaking down the effect of the stimulus into a series of rounds, as shown in Table 1. In Round 1, the change in income is equal to the fiscal stimulus of £300 million. Round 2 then depends on how much of this income is spent.

| Round | Change in income (£ m) | Cumulative change in income (£ m) |

|---|---|---|

| 1 | 300.00 | 300.00 |

| 2 | 150.00 | 450.00 |

| 3 | 75.00 | 525.00 |

| 4 | 37.50 | 562.50 |

| 5 | 18.75 | 581.25 |

| 6 | 9.38 | 590.63 |

| 7 | 4.69 | 595.32 |

| 8 | 2.35 | 597.67 |

| 9 | 1.18 | 598.85 |

| 10 | 0.59 | 599.44 |

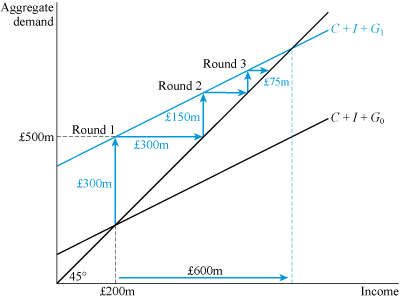

It is modestly assumed in Figure 15 that the marginal propensity to consume – the slope (b) of the consumption function – is equal to 1/2. This means that in Round 2, half of the initial increase in income from the fiscal stimulus will be spent on consumption, as shown by the £150 million change in income. By Round 2 it therefore follows that there is a cumulative increase in income of (i) the initial direct increase in income of £300 million, and (ii) the additional indirect impact of £150 million. These two items add up to a cumulative income of £450 million in Round 2.

This process continues in Round 3, with half of the previous round’s change in income (£150 million) spent as consumption: a new change in income of £75 million. In each round, half of the previous round’s change in income is spent; these rounds continue indefinitely. By Round 10, however, the change in income has fallen to just over half a million pounds, and the cumulative change approaches its final value of £600 million – the doubling of income that is illustrated in Figure 15. Even by Round 3, 87.5% of the eventual cumulative change in income has occurred, so although in theory the expansionary effect may take many rounds and a great deal of time to work itself out, the main impact is felt quite quickly.

Figure 16 shows the first three rounds. In Round 1, the injection of government demand leads to an upward shift of the aggregate demand schedule by £300 million. Initially, this planned aggregate demand exceeds current output. At the outset, in Round 1, only £200 million worth of output (income) is being produced, yet now the total aggregate demand is £500 million. If the key assumption is now made that there is sufficient spare capacity – idle factories or machinery, and a pool of unemployed workers – then in response to the additional demand, output can be increased by £300 million, as depicted by the first horizontal arrow.

This diagram has Aggregate Demand (AD) on the vertical axis and Income (Y) on the horizontal axis.

A solid line at a 45 degree angle is drawn upwards from the origin.

From a short way up the vertical axis, a straight line aggregate demand schedule is drawn, sloping upwards. This is labelled as C+I+G zero. This has a shallower slope than the 45 degree line and intersects the 45 degree line quite low down. A dashed line is drawn from this intersection point vertically down to the £200m point on horizontal Income axis.

From about half way up the vertical axis, a second aggregate demand schedule is drawn. This is parallel to the first one. This is labelled as C+I+G1. This intersects the 45 degree line much further along the line. A dashed line is drawn from this intersection point down to the horizontal Income axis. This point is much further along the axis than the point from the first aggregate demand schedule.

The diagram shows three rounds of the fiscal stimulus process, via a series of vertical and horizontal arrows that form three steps. The arrows decrease in length as we move from left to right.

The first vertical arrow runs from the point of intersection between the lower aggregate demand schedule and the 45 degree line directly up to the higher aggregate demand schedule. This has ‘£300m’ written beside it. . Above the point where the arrow hits the higher aggregate demand schedule is written ‘Round 1’.

From the point where the vertical arrow hits the higher aggregate demand schedule, an arrow runs horizontally right to hit the 45 degree line. This arrow has ‘£300m’ written beside it. Another arrow runs vertically up from this point on the 45 degree line up to the higher aggregate demand schedule, with ‘£150m’ written beside it. Above this point is written ‘Round 2’.

From this point on the higher aggregate demand schedule an arrow runs horizontally right to the 45 degree line, and then vertically up to the higher aggregate demand schedule. This has ‘£75m’ written beside it and above is written ‘Round 3’. A final short arrow is drawn horizontally to the 45 degree line. This is just short of the equilibrium position, where the higher aggregate demand schedule intersects the 45 degree line.

There is one further line on the diagram. From the point where the first vertical arrow hits the higher aggregate demand schedule, a dashed line is taken horizontally left to the vertical axis, to a point labelled ‘£500m’

In Round 2, the new stimulus of £150 million, as shown in Table 1, comes into play. Once again aggregate demand exceeds current output, this time by £150 million, and a new horizontal line indicates the increase in output to match this demand. Similarly, in Round 3 the impact of the £75 million boost in aggregate demand is matched by a £75 million boost in output. These rounds eventually peter out, as in Table 1, when both aggregate demand and aggregate output have increased by £600 million.

The process, illustrated in Table 1 and in Figure 16 is referred to by Keynes as the multiplier process, since the impact of the fiscal stimulus is multiplied throughout the economy. The multiplier captures the cumulative effect of a change in spending on income. The change represented here is a change in government spending, but the model could also be used to show the effect of a change in another exogenous factor such as investment.

Let Δ denote the amount by which a variable might change. The multiplier can be expressed in mathematical terms as the ratio of the eventual change in income (ΔY ) to the initial change in spending that caused it (ΔG ):

Activity 11

Calculate the size of the multiplier when a £300 million fiscal stimulus increases income by £900 million.

Answer

In this example, ΔY = 900 and ΔG = 300; hence the multiplier is equal to 900/300 = 3. Since the multiplier is 3, the fiscal stimulus increases income by a threefold amount.

The size of the multiplier depends on the marginal propensity to consume, as explored in the box below. It has a simple formula:

where b is the marginal propensity to consume. In the example in Table 1, the propensity to consume is equal to 1/2. Hence

The eventual doubling of income in the multiplier process is captured in total by this formula for the multiplier.

Since the concept of the multiplier emerged in the 1930s, economists have used statistical methods to estimate its empirical size. There is, however, considerable uncertainty as to the multiplier’s precise value. At the top end of estimates of the size of the multiplier, Eggertsson (2006) finds the multiplier to be as high as 3.8. In a more recent survey, Ramey (2011) pronounces that the ‘range of plausible estimates for the multiplier … is probably 0.8 to 1.5’. Due to the uncertainty involved, however: ‘Reasonable people could argue that the multiplier is 0.5 or 2.0’. A multiplier of 0.5 would mean, for example, that £1 billion of spending leads to only half that increase in income; whereas a multiplier of 2.0, as you have seen, would mean a doubling of income.

One problem is that estimates tend to be based on observations made during periods of economic growth, yet multipliers are most relevant in times of contraction. Larry Summers, a leading US economist who has advised Presidents Clinton and Obama, has been very cautious about the impact of fiscal stimuli but argues that the specific circumstances of the economic crisis of 2008 would point to a multiplier nearer to the top end of Ramey’s range of estimates (DeLong and Summers, 2012).

Deriving the formula for the multiplier

To derive the formula for the multiplier, consider two equations.

First, consider an income equation showing points of equilibrium between income and aggregate demand (points where the aggregate demand schedule intersects the 45-degree line):

Second, consider the consumption function, showing the relationship between planned consumption and income:

Substituting the consumption function into the income equation gives a new expression:

Now notice that on the right-hand side there is an expression that relates consumption to income. I can now subtract this term from both sides of the expression:

Collecting 1 and b in a bracket:

Dividing both sides of this equation by (1 − b), this term cancels out on the left-hand side, to leave:

This gives a multiplier relationship between income and exogenous spending

The expression is the multiplier below:

6.5 Government revenue and taxation

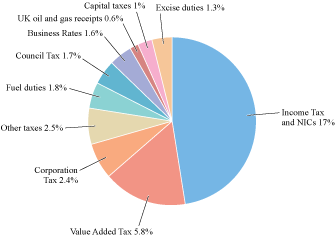

This section examines the income side of the public sector accounts. The main source of income for the government is the collection of taxes, which in the tax year 2012–13 was estimated to make up 36.1% of GDP in the UK (Office for Budget Responsibility, 2012, p. 100).

Taxation and the circular flow of income

Figure 17, below, gives a breakdown of tax receipts, showing the percentages of GDP allocated to the main types of taxation levied by the UK government. The largest part of the tax take (17% of GDP) is contributed by Income Tax and National Insurance Contributions (NICs). These are direct taxes, payable by the individuals who receive income and by their employers. People who work for an employer have Income Tax deducted directly from their pay each month; for the self-employed, two advance payments are usually made each financial year. Corporation Tax, which makes up 2.4% of GDP, is a direct tax paid by companies directly out of their income, as are Capital taxes (1% of GDP) paid by individuals and companies, charged on increases in the value of financial or physical assets.

The second major source of income is VAT, making up 5.8% of GDP. This is charged on purchases of goods and services. When you buy a car, for example, 20% of the cost will be contributed as VAT. In this case it will be the company that sells you the car that pays this tax over to the government, not you personally. The tax is paid via an intermediary, and can hence be categorised as an indirect tax, as can fuel excise duties, paid via your garage when you buy petrol.

This diagram is a pie chart, divided into ten sections. The data source is the Office for Budget Responsibility, 2012, page 100, Table 4.6.

The largest category of tax is Income Tax and National Insurance Contributions, at 17% of GDP.

Then, moving clockwise the pie chart presents the other categories of tax: Value Added Tax 5.8%; Onshore corporation tax 2.4%; Other taxes 2.5%; Fuel duties 1.8%; Council tax 1.7%; Business rates 1.6%; UK oil and gas receipts 0.6%; Capital taxes 1%; Excise duties 1.3%.

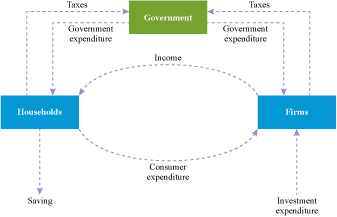

Taxation is a key component of fiscal policy, alongside government spending decisions, which were considered in the previous section. In a period of economic recession, the government can choose to stimulate aggregate demand by either boosting government spending or cutting taxes. This can be illustrated using the circular flow diagram (Figure 18).

Activity 12

Compare Figure 18 with the circular flow diagram represented in Figure 19.

The diagram shows three sectors of the economy, with various money flows shown as moving between them. The money flows are shown as dashed arrows, indicating the direction of flow.

The Household sector is in a blue rectangular box on the left of the diagram; the Firms sector is also in a blue rectangular box is on the right of the diagram; and the Government sector is in a green rectangular box which lies above the other two and in the centre.

From households, consumer expenditure flows to firms and taxes flow to government. There is also a flow of savings from households and this is shown by an arrow pointing out of the circuit of flows – indicating a leakage out of the circular flow.

From firms, income flows to households and taxes flow to government. There is also a flow of investment expenditure to firms. This flows in from outside the circuit of flows – indicating an injection into the circular flow.

From government, government expenditure is shown flowing to both households and to firms.

Flows of money are shown by dashed lines with directional arrowheads.

A flow labelled ‘Income’ runs from Firms to Households.

A flow labelled ‘Planned Consumption’ runs from Households to Firms.

A dashed line pointing vertically down from Households is labelled ‘Saving’.

A dashed line pointing vertically up to Firms is labelled ‘Planned Investment’.

Discussion

You will see that in Figure 18 a new box has been added to show the government sector. As you have seen, government expenditure provides an injection to the circular flow of income, as indicated by the arrows in Figure 18. For example, if the government-run National Health Service hires more doctors, there is a flow of money to the household sector.

Tax receipts are a leakage from the circular flow of income. For example, out of incomes received by households, a part of these are paid in Income Tax, which leaks out of the household sector into the government sector. A reduction in Income Tax would put money into the pockets of households, which could stimulate aggregate demand. Similarly, Corporation Tax is represented here by a flow of money from the firms to the government. A reduction in Corporation Tax could stimulate the expenditure plans of firms.

The leakage of taxes means that there is another important difference between the two models. In the model without government expenditure (Figure 19), planned consumption is the proportion of income left after saving had been deducted; in Figure 18, consumer expenditure is the proportion of income left after saving and also taxes have been deducted.

A tax-modified multiplier

To explore how taxation works as a fiscal policy tool, a modification can be made to the aggregate demand model and multiplier. To keep things simple, we will assume a tax rate for the whole economy, capturing the proportion of income raised from tax. The coefficient t can be defined as the rate of tax – i.e. the proportion of national income levied by tax. Hence the total revenue received by the government from tax (T) is

T = tY

With a national income (Y ) of £1200 billion, for example, and a tax rate of 1/3, the total tax revenue will be £400 billion.

The amount of income available for consumption (often referred to as disposable income) is now equal to income (Y ) minus taxation (tY ):

Y − tY = (1 − t )Y

It therefore follows that the tax-modified consumption function is

C = a + b(1 − t )Y

This tax-modified consumption function, shown in Figure 20, has a shallower slope than the consumption function shown in Figure 14. This new slope is represented by a new (tax-modified) marginal propensity to consume b(1 − t ).

This diagram has Aggregate Demand on the vertical axis and Income on the horizontal axis.

A solid line slopes upwards from the origin at an angle of 44 degrees.

From a point a short way up the vertical axis, a horizontal line is drawn. This is labelled ‘I+G’.

From a point a little higher up the vertical axis, labelled ‘a’, a solid straight line slopes upwards diagonally to the right. This line is labelled ‘Consumption function’ and has the equation C=a+b(1-t)Y. It has quite a shallow slope.

Higher up the vertical axis, from a point labelled ‘a+I+G’, there is another upward sloping line, parallel to the consumption function. This line is labelled ‘Aggregate Demand schedule’ and has the equation AD= a+b(1-t)Y+I+G

We can now consider the effect of modelling tax on the structure of the multiplier, which was shown earlier in this section to take the form 1/(1 − b). It intuitively follows that instead of having a denominator 1 − b, the tax-modified multiplier has a denominator 1 − b(1 − t ). The marginal propensity to consume (b) is no longer the only determinant of the value of the multiplier. We now also need to take account of the leakage of tax, as shown in Figure 20, and the new multiplier is

Activity 13

Suppose that the marginal propensity to consume (b) is equal to 0.75 and the tax rate (t) is 0.2. Calculate the size of the tax-modified multiplier.

Answer

This calculation involves carrying out a number of steps.

Step 1: Calculate 1 − t = 1 − 0.2 = 0.8

Step 2: Calculate b(1 − t) = 0.75 × 0.8 = 0.6

Step 3: Calculate 1 − b(1 − t) = 1 − 0.6 = 0.4

Step 4: Calculate 1/(1 − b(1 − t)) = 1/0.4 = 2.5

The tax-modified multiplier has a value of 2.5. Without the leakage of taxation, using the calculation 1/(1 − b) = 1/(1 − 0.75), the multiplier would be equal to 4. So instead of a fourfold increase in income, in response to a fiscal stimulus, only a 2.5-fold increase is generated once the leakage of tax is taken into account.

A tax-cutting fiscal stimulus

It is now possible to explore the impact of cutting the tax rate from t0 to t1. Since a higher proportion of income is now available for consumption (a reduced leakage of taxes in the circular flow of income), this provides a boost to aggregate demand. This tax reduction will be modelled in order to illustrate a key fiscal policy arm available to policymakers: the manipulation of taxation in order to stimulate aggregate demand.

In response to a tax cut, the initial reduction in tax payments ΔT is equal to

ΔT = (t0 − t1)Y0

where Y0 is the level of income before the tax change. The change to tax receipts depends on the difference (t0 − t1) between tax rates before and after the change.

Now let the initial level of income (Y0) be £600 million, and let the initial tax rate (t0) be 0.1. Suppose that the tax rate falls to t1 = 0.05 (only 5% rather than 10% of national income is taken in tax). Hence the initial reduction in tax receipts is

ΔT = (0.1 − 0.05) × 600 = 0.05 × 600 = £30 million

The reduction in the tax rate to 5% generates a £30 million cut in total tax receipts. This means a £30 million increase in disposable income.

The ‘windfall’ increase in disposable income will lead to an increase in consumption spending, but this increase will be less than the full £30 million. Assuming that the marginal propensity to consume is 0.8, and remains at this value, households will spend only 80% of their additional income. Instead of stimulating aggregate demand, 20% of the tax windfall leaks into savings accounts in banks and building societies. Hence the stimulus to aggregate demand is

b ΔT = 0.8 × £30 million = £24 million

Households will choose to save £6 million of the £30 million tax windfall, and spend £24 million on additional consumption. So aggregate demand is boosted by £24 million.

In addition, the fall in the tax rate increases the value of the multiplier:

The reduction in the tax rate increases the multiplier from 3.57 to 4.17. The combined effect of these two changes is an increase in income of

4.17 × £24 million = £100 million

Activity 14

For a multiplier of 3.57 (as in the above example, with initial tax rate 10% and a marginal propensity to consume of 0.8), calculate the multiplier impact on income of an increase in government spending ΔG = £30 million.

Answer

This activity allows you to compare the above tax cutting example with a fiscal stimulus based on increased government spending. With a multiplier of 3.57, the final increase in income from the increase in government spending is 3.57 × £30m = £107.1 million. Even without the benefit of an increase in the multiplier, an increase in government spending delivers a higher boost to income than an equivalent tax cut: £7 million more in this example.

The key difference between these two types of fiscal policy is the leakage of part of the tax cut into saving. In the current example, the government spends the full £30 million, whereas households spend only £24 million of the £30 million windfall and save the rest. The exact outcome of the comparison does, of course, depend on the values of b and (t0 − t1). The effect of a tax cut will be enhanced if there is a very high marginal propensity to consume, so that most of the windfall is spent, and also if there is a substantial increase in the value of the multiplier owing to a large fall in the percentage tax rate.

Keynes was not very keen on stimulating aggregate demand through tax cuts. As shown by Brown-Collier and Collier (1995), he cautioned that tax cuts do not provide any future benefits to the economy; he also thought that it would be difficult to persuade the public that tax cuts should be reversed once they became established. Further issues relating to these two types of fiscal policy are considered in the analysis that follows.

6.6 Stabilisation policy

You have seen that fiscal policy can be used, in times of economic crisis, to stimulate aggregate demand either by increasing government spending or by reducing taxes. As part of the Roosevelt New Deal, and more recently by President Obama in the USA, these types of fiscal stimulus were used to stabilise the economy in response to problems of severe contraction in national income.

In the golden years of Keynesian economics, however, during the 1950s and 1960s – when the UK Conservative Prime Minister Harold Macmillan pronounced ‘You’ve never had it so good’ – governments did not have to deal with such crises. The news programmes were not reporting people queuing outside banks (as in the 2007 collapse of Northern Rock) or the unemployed queuing outside job centres. Far from there being a problem of unemployment, there was a shortage of labour, which encouraged population movements such as the Windrush migration from the Caribbean to the UK.

For most of this early postwar period, capitalist economies enjoyed continued growth and mild business cycle fluctuations. In such circumstances, there would be repeated periods of boom (high growth) and slowdown (low growth); governments would see their main responsibility as smoothing out the peaks and troughs of the cycle, an approach referred to as ‘fine-tuning’.

This period of sustained growth was attributed in part to the benefits of Keynesian intervention – in sharp contrast to the plethora of disasters that befell the world economy in the 1920s and 1930s. Postwar governments bought into the Keynesian idea that it was their responsibility to manage aggregate demand. In the USA, during the 1960s, the phrase ‘We are all Keynesians now’ (Friedman, 1965) was even used by the right-wing president, Richard Nixon. In the UK, successive Conservative and Labour Chancellors of the Exchequer (Hugh Gaitskell and Rab Butler) were arguably so close to each other that their names were combined in an approach called ‘butskellism’: where the mixed economy, consisting of a viable private sector and a large welfare state, were championed. It was not until the 1970s, when problems of inflation reared their ugly head, that this postwar Keynesian consensus fell apart.

Two main types of fiscal policy were developed during this period. First, governments can use discretionary stabilisers, actively adjusting fiscal policy in response to boom or slowdown in economic activity. If the economy is overheating (growing too fast), for example, the government might decide to increase tax in order to temper aggregate demand – and vice versa under a slowdown. As you saw earlier in this section, the impact of using this type of discretionary stabiliser will tend to be amplified by the multiplier effect. Since for Keynes, in general, the economy is likely to operate at output levels less than full employment, discretionary stabilisers are required to snuff out high unemployment.

Yet if the public sector is sufficiently large, in a butskellite type mixed economy, then its very presence can dampen down the business cycle. If growth slows, for example, and there is an increase in unemployment, then under a welfare state workers will receive unemployment benefit. So although they are not earning the wages that they earned under employment, unemployed workers are still able to consume, albeit at a lower level. Such a transfer payment can be thought of as a negative tax, affecting consumer expenditure in a similar way to a tax cut.

This second type of fiscal policy is referred to as an automatic stabiliser – a fiscal response to a slowdown in economic activity that happens without any active decisions on the part of the government. Governments, of course, have to choose to keep the system in place to facilitate this automatic spending, but they do not have to actively direct the spending from day to day.

At the same time as government transfer payments will automatically increase during a slowdown, tax revenue will fall. At lower levels of income, tax receipts such as those out of income (Income Tax) and profits (Corporation Tax) will fall. The welfare and tax systems in the economy create their own adjustments in aggregate demand, making the slowdown less pronounced than it would have been without the state sector. Similarly, in an upturn, as incomes increase so does the proportion of income directed to tax.

In recent years, policymakers have found these stabilisers to be very attractive, since they can smooth out both peaks and troughs of the business cycle. Tax-based automatic stabilisers provide a symmetric approach to fiscal policy, with attention paid to both sides of the business cycle. In the early 2000s, this was the official position of the European Central Bank (ECB): ‘Automatic stabilisers are the appropriate way to stabilise output, as they have foreseeable, timely and symmetrical effects […] there is normally no need to engage in additional discretionary fiscal policy-making for stabilisation purposes’ (ECB, 2002, pp. 41, 46, quoted by Lodewijks, 2009, p. 3).

This contrasts sharply with the Keynesian consensus of the 1960s, when it was thought that automatic stabilisers were insufficient to manage the business cycle. US President John F. Kennedy argued in 1962 for a ‘shelf of public works’ that could be introduced if unemployment rose – together with increases in the period for which unemployment benefits would be paid (Lodewijks, 2009, p. 4). The problem, for the USA, is that state spending has tended to constitute a smaller part of national income than in European countries such as the UK, so automatic stabilisers do not have as much impact.

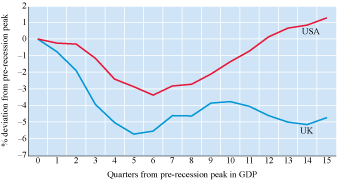

Despite its weaker automatic stabilisers, the USA enjoyed a stronger recovery than the UK in the period immediately following the economic crisis of 2008. Adam Posen, a member of the Bank of England’s Monetary Policy Committee, has explained this recovery as being in part due to differences in the discretionary fiscal policy:

For almost the entire period since March 2007, and particularly since March 2010, the US has run a looser overall fiscal stance – a more stimulative fiscal policy – than the UK, even taking the full operation of the larger automatic stabilisers in the UK into account. Cumulatively, since 2007Q1, the difference has amounted to 3 per cent of GDP.

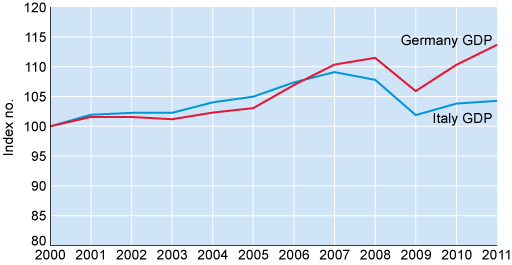

While Obama introduced a fiscal stimulus, the Conservative/Liberal Democrat Coalition in the UK implemented a fiscal contraction. Posen pays particular attention to the increase in VAT announced by Chancellor of the Exchequer George Osborne in his emergency Budget of 22 June 2010, from 17.5% to 20%. Posen argues that this VAT rise helps to explain the fall in private consumption since the peak of the business cycle, compared to the USA, as shown in Figure 21 by the divergence of the two lines after Quarter 10. The argument is that the increase in VAT, and its anticipation by consumers, led to lower consumer spending, which spilled over to fewer jobs and lower income throughout the economy.

This diagram is a time series line chart. The data source is Posen, 2012.

The vertical axis is labelled ‘Percentage deviation from pre-recession peak’ and is marked from minus 7 to plus 2, at intervals of 1. The horizontal axis is labelled ‘Quarters from pre-recession peak in GDP’ and is marked from zero to 15 in intervals of 1.

There are two lines on the chart, one for the USA and one for the UK.

Both lines start at zero on the vertical axis. The line for the USA is above the line for the UK at all points thereafter.

The USA line declines steadily to a low point of just below minus 3%, in the sixth quarter from the pre recession peak in GDP. It then rises steadily to reach plus 1% in quarter 15.

The UK line declines to almost minus 6% in quarter 5, rises slightly to minus 4% in quarter 10 and then declines again to minus 5% at the end of the period.

6.7 Government debt and crowding out

You have discovered that governments can boost aggregate demand either by increasing government spending or through cutting taxes. There is, however, an elephant in the room, which you must have noticed, and this section has so far studiously ignored (just to keep things simple): how can a fiscal stimulus be paid for? Surely if the government spends more to get the country out of a crisis, it runs the risk of squeezing the private sector, or even worse, bankrupting itself. These two issues are considered first by looking at government debt, before turning to a consideration of how the private sector can be squeezed by government spending.

The debt problem

You cannot spend your way out of recession or borrow your way out of debt.

This common sense mantra has been espoused by those on the right of the political spectrum in response to the economic crisis of 2008, such as the Tea Party movement in the USA. The alternative political position is captured in the T-shirt below, worn by supporters of the anti-cuts movement.

Photo of T-shirt. Printed on front the words 'The cuts won't work, they'll just make it worse'.

Rather than spending in a recession, the government orthodoxy (traditionally referred to as the ‘Treasury view’ or ‘sound finance’) has been to balance its budget by cutting expenditure. This ‘sound finance’ view, traditionally associated with the nineteenth-century Liberal Prime Minister William Gladstone, is not limited to recessions. It more generally states that the government budget should be balanced at all times (or in slight surplus so as to pay down past debt).

The balanced budget approach has been the cornerstone of the Conservative/Liberal Democrat coalition government since coming to power in 2010. With a target to balance the budget by 2016, it introduced a programme of severe cuts in government spending. In his 2010 emergency Budget, George Osborne proclaimed:

This is an emergency Budget, so let me speak plainly about the emergency that we face. The coalition Government have inherited from their predecessors the largest budget deficit of any economy in Europe, with the single exception of Ireland … That is why we have set a brisk pace since taking office.

The coalition government also argued that they inherited the largest level of debt incurred by a British government during peacetime. As shown in the box opposite, when the last Conservative/Liberal coalition was in power, led by Lloyd George (before he became a Keynesian), a similar austerity programme, known as the Geddes Axe, was implemented.

The Geddes Axe: a brief explanation

After the First World War, Britain was gripped by enormous debts and a growing sense of panic that the Government was hugely wasteful.

The national debt had risen dramatically from £677 million, about a quarter of the GDP, in 1910. By 1920 it was £7.81 billion, larger even than the country’s GDP. A vast civil service, that had come together to administer the war effort, was still operating at full capacity, while spending on education had increased substantially. Many of the middle classes complained how their tax bills had shot up.

The Government was under pressure to do something. The Times newspaper noted in 1922: ‘There are signs of an astonished realisation of the alarming bill for civil pensions that in a few years will be a millstone on the taxpayer’s neck.’

The Anti-Waste League, formed by Lord Rothermere, had put up candidates and won three by-elections during 1921.

David Lloyd George, the prime minister, acted by appointing a businessman Sir Eric Geddes to head the new Committee on National Expenditure, which was soon dubbed ‘The Great Axe’. It highlighted waste in all areas of public spending, including details such as there being a ratio of one cleaner for every vehicle in the Army. Between 1921 and 1922 it recommended economies totalling £87 million, about 10 per cent of the country’s entire GDP.

Though the cabinet only agreed to £52 million of cuts, these were enormous for the time and in the end, total cuts were larger than either of these figures. He was hailed a ‘superman’ by one leading businessman, but the axe hit some people very hard and led to a large reduction in social benefits, particularly secondary education.

The biggest cuts were in the Army and Navy. The defence budget was cut by 42 per cent in the space of one year. But other workers were hit too.

Civil Service numbers were cut by 35 per cent – mostly female staff hired during the war.

At the close of 1921, wage cuts averaging 8 shillings a week had been imposed on 6 million workers. This equates to a £58 fall in today’s money and led to growing anger against the government.

The cuts were driven by a Treasury desperate to keep a control of its debts, but they partly caused Britain’s woes in the 1920s – a period of far greater economic trouble for the country than it ever experienced during the 1930s. The General Strike in 1926 can, in part, be explained by the mounting resentment caused by the cuts, though some economists argue it helped Britain exit the vicious recession of 1919 to 1921 quicker than it might otherwise have done.

The Geddes Act, introduced by one of the great Liberal administrations, ironically gave impetus to a burgeoning Labour Party. The number of seats it held rose from 59 in 1918 to 142 in 1922, reflecting a new coalition across class lines. It went on to form its first administration in 1924.

It was in the aftermath of the Geddes cuts in the 1920s that Lloyd George and Keynes formulated their arguments as to why governments could spend their way out of recession. Keynes once said ‘When the facts change I change my mind. What do you do, sir?’ – a mantra that would equally apply to Lloyd George during this period. Keynes also argued that a government spending programme could be easily paid for, without threatening government finances.

Thus far this section has made reference to both a budget deficit and government debt. It is important to be clear about how these differ.

Government debt, also called the national debt, is the total amount of money owed by the government to all those from whom it has borrowed. It is a stock, that is, an accumulated amount, not an amount measured per period of time.

The primary budget deficit is the excess of government expenditure over tax receipts in a given time period, usually one year – so it is a flow. In any year when there is a deficit, the national debt will increase. If there is a budget surplus (tax receipts exceed expenditure), then the government may decide to use part of it to reduce its outstanding debt. If tax receipts exactly match government spending, then this is referred to as a balanced budget.

Balancing the budget

The policy of balancing the budget can be looked at from a Keynesian perspective. Suppose that the government increases its spending by £30 million and balances this increase by raising £30 million in taxation. To earn this additional revenue from tax, the tax rate is increased from 5% to 10%. The economy starts at an income level of £600 million. The overall effect can be analysed in three steps.

Step 1 The tax increase

The additional £30m taken in tax reduces disposable income by £30m, but £6m of that £30m would have been saved had households still received it (assuming a marginal propensity to consume of 0.8), so the initial fall in aggregate demand resulting from the tax increase is only £24m. The increase in the tax rate from 0.05 to 0.1 reduces the multiplier, as you know from the earlier example, from 4.17 to 3.57. Applying the multiplier of 3.57 to the £24m fall in spending gives a fall in income due to the tax increase of 3.57 × £24m = £85.7m.

Step 2 The increase in government spending

The increase in government spending gives an initial boost of £30m to aggregate demand. Again applying the multiplier shows that there is an increase in income of 3.57 × £30m = £107.1m.

Step 3 The net effect

You have seen that the tax increase alone would reduce income by £85.7m but that the increase in government spending would increase income by £107.1m. To calculate the net effect of these tax and spending changes, I need to subtract 85.7 from 107.1. I conclude that income increases by £107.1m − £85.7m = £21.4m to a new equilibrium level of £621.4m.

So even though the increase in government spending has been backed by a tax increase, the overall impact is expansionary. The government can effectively gather what households would have saved as tax revenue and spend it. It may even be possible to spend your way out of a crisis and balance the budget.