6.6 Your investment management check-list

As you move towards the end of Managing my investments let’s revise the step-by-step process for effective management of your investment portfolio.

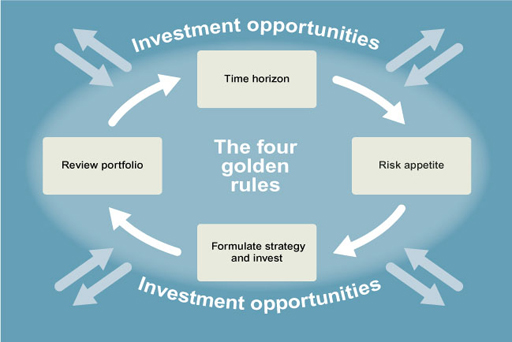

To help, you’ll be guided by the four stage investment management model that was introduced in Week 1 and which you have been employing throughout the course.

First, we have to link our investments to the time horizon that applies to you. Are you a short-, medium- or long-term investor?

Ask yourself:

- What are you investing for?

- When are you likely to need the funds invested? (for example, to finance a holiday [probably short-term], a wedding [perhaps medium-term] or to provide an income in retirement [long-term])

- Have you taken inflation into account? (Since the things you are likely to want to buy with your funds will probably cost more in the future than they cost now.)

Second, check out your risk appetite. In part, this is linked to your time horizon, since the longer the period you can invest your money, the greater the potential to invest in assets which perform best over the long term but which have interim periods where they can fall in value. Your risk appetite must also reflect your personality – if higher risk investments keep you awake at night your life may be happier with lower risk (but also lower return) investments.

So check, in particular, your capacity and preparedness to take the following risks:

- income risk

- capital risk

- liquidity risk.

Third, make your decisions about where and how to invest. Do this proactively, since just leaving your investment funds in a bank account is a passive decision that won’t yield you more than a miniscule return.

Check the following:

- Do you need to take advice before you invest?

- Are you aware of and have you taken into account all the fees and charges that apply to your investments (and which will impact the overall return you get from your investment)?

- Have you checked out the tax liability that arises from the returns you make on your investment? Or to put it another way, are you maximising your tax-free investments (for example, investments in ISAs)?

- How do you invest the money? Do you go to a financial firm or do-it-yourself via internet platforms?

- Will your portfolio of investments be appropriately diversified?

- To avoid poor timing, should you be applying practices like ‘pound cost averaging’?

- And, in particular, do your proposed investments really match your time horizon and risk appetite?

Once you’ve checked these points out it’s time to execute your investment plan.

Fourth, review your investments and do it regularly. Don’t just wait until you get annual statements about your investments. Review the portfolio against changes in the financial markets. What’s happening to interest rates? Where have share prices moved to? Are there opportunities you should be taking or should you be cashing in investments that now seem likely to perform badly going forward?

This fourth stage brings you back to the first two stages. When reviewing your investments, have your personal circumstances changed in a way which affects your time horizon and risk appetite? Perhaps you’ve decided that you need more income in retirement – so do you need to increase your long-term investments? Perhaps the household financial demands on you have fallen (say your children have left home), thereby opening the scope to take on more risk with my investments, since you have more capacity now to bear a loss in pursuit of higher returns.

So get in control of your investments and stay in control – then you can truly say to yourself 'I am managing my investments’.