4 The credit ranking game

Activity 3 Rank four borrowers

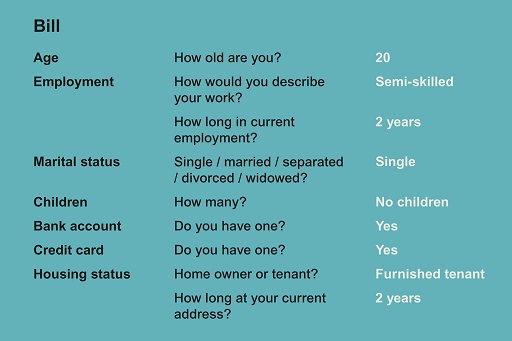

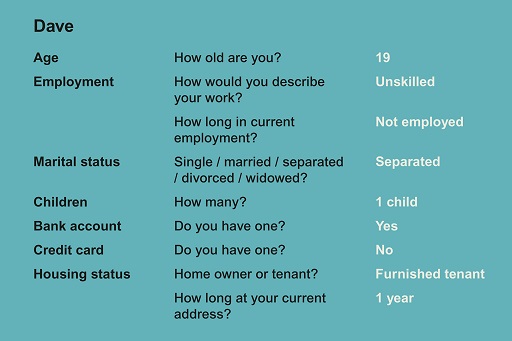

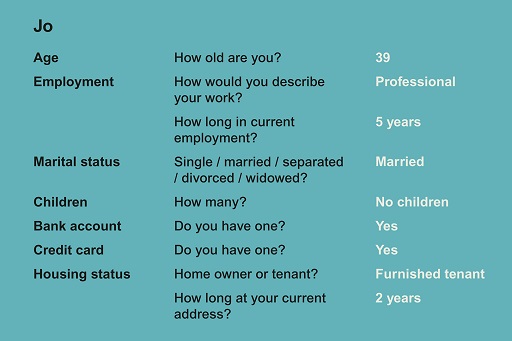

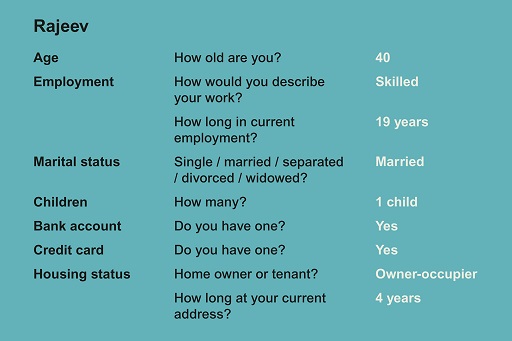

Look at the following credit profiles of four people.

With all the information you gained in the previous section, have a go at ranking four applicants for credit.

Feedback

How did you do? What order of creditworthiness did you put our four borrowers in?

First you should note that the credit scoring models employed do vary from one institution to another. This means that the scores they generate can vary when applied to the same applicant.

The key factors that score well, besides having a good or high level of household income, are those that imply stability and orderliness in the financial affairs of applicants. So stability of both employment and domestic residence scores well.

Being an owner-occupier also scores well – even when the borrowing being applied for is not going to be secured against the property.

Being older helps, as you might be able to demonstrate a record of creditworthiness that stretches back over decades.

Having fewer children also helps as it implies lower household expenditure commitments.

Being in a professional job helps as this is likely to reduce the risk of having periodic gaps in employment that reduce household income.

Having a bank account and credit cards also helps – particularly as they demonstrate that credit scoring tests have been ‘passed’ on previous occasions.

Being married is positive for your score. Being divorced is negative. This is because, again, the inference is that married status carries stability and robustness of household finances.

By contrast being young, having a large number of dependants, living in rented accommodation – particularly if there is a record of moving home regularly – having a poor employment record and limited existing access to banking facilities are generally bad news. Such factors provide no comfort to the credit reference agencies about the solidity and orderliness of household finances and send a message that lending to such applicants is risky. In addition, it is less likely that such applicants will have been able to build up a long-term record of proven creditworthiness. Lending to people with a poor credit score might still happen, but the interest rate charged might be higher – perhaps materially – to reflect the risks involved.

The assessments of credit reference agencies are, though, not based on unquantified assumptions. They’re underpinned by data analysis of statistical relationships between aspects of social status and evidence of credit defaults.

So our model produced the following credit league table ranking:

- Rajeev

- Jo

- Bill

- Dave.