2. Budgeting

A budget is one of the best tools we can use to get control of our finances. It’s not about going without things, it’s about deciding what things we want and making sure we have the money when we want to buy them. Setting a budget helps you:

- control your spending and focus it on the things you care about

- check you have enough money to pay your current and future bills without having to borrow unexpectedly

- decide what your goals and spending priorities are – what you want – and plan for how to achieve them

While it may seem easy to borrow money by spending on a credit card or using an overdraft without thinking much about it, this often comes with a high price later, forcing us to cut back harder and go without when we need to pay it back. Budgeting can avoid this by deciding beforehand what we want to spend and helping us stick to it. It can give us the confidence to spend money knowing we’ve planned for it and can afford it, helping us through the financial ups and downs we all face over our lives with the minimum of stress.

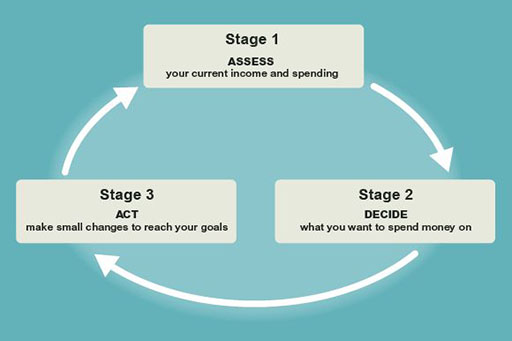

Budgeting is surprisingly easy to do. Over the next four pages we’ll take you through our simple budget planner [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)] and help you create your own budget. Save this to your computer as we’ll be filling it in as we go along. Do you want to own your own house, have a debt-free Christmas, take your family on holiday, or simply stop worrying about money? Whatever your financial circumstances and goals there are three steps to follow, and along the way we’ll give you some practical tips on how to make them a reality:

To illustrate the process we’ll be following the example of 28 year old insurance clerk Jenny, who’s starting to budget with the help of Martin Upton, senior lecturer in finance at the Open University and director of the True Potential Centre for the Public Understanding of Finance.