Week 4: Preparing the trial balance and the balance sheet

Use 'Print preview' to check the number of pages and printer settings.

Print functionality varies between browsers.

Printable page generated Friday, 19 April 2024, 9:53 PM

Week 4: Preparing the trial balance and the balance sheet

Introduction

In Week 3 you learned how to record transactions in T-accounts using debits and credits. This week you will learn the crucial process of ‘balancing off’ each T-account in order to record the correct figure for each account in the trial balance. In Week 4 you will learn how to prepare the trial balance and the balance sheet. You will also learn that balance sheets can be presented in different forms of the accounting equation. An important aspect of your study in Week 4 is to learn that the accounting equation can be expanded to reflect the fact that an increase in profit means an increase in capital for any business.

4.1 From T-accounts to the trial balance

You have now learned how to record transactions in T-accounts. Capital, and each type of asset and liability, has its own T-account. These T-accounts are recorded in the general ledger (also known as the nominal ledger). Figure 1 below shows the general ledger and the three categories of T-accounts therein that we have discussed so far.

This flow chart starts with ‘General ledger’. This is linked to three branches that record labelled Assets, Liabilities and Capital.

In order to prevent errors and to make sure that all transactions are properly recorded as debits and credits in the correct T-accounts, a checking procedure takes place at the end of each accounting period. This is known as preparing a trial balance. A trial balance is thus a list of all the debit and credit balances in the general ledger accounts. If all the individual double entries have been correctly carried out, the total of the debit balances should always equal the total of the credit balances in the trial balance. A further important purpose of the trial balance is that it forms the basis for the preparation of the balance sheet.

If the total of the debit balances do not equal the total of the credit balance then there is a mistake somewhere, which needs to be investigated and corrected.

4.2 The T-accounts before their balance is worked out

In order to prepare a trial balance at any time, it is necessary to determine the balance on each account. This process is known as ‘balancing off’ the general ledger accounts. The trial balance can then be prepared by listing each closing balance from the general ledger accounts as either a debit or a credit balance.

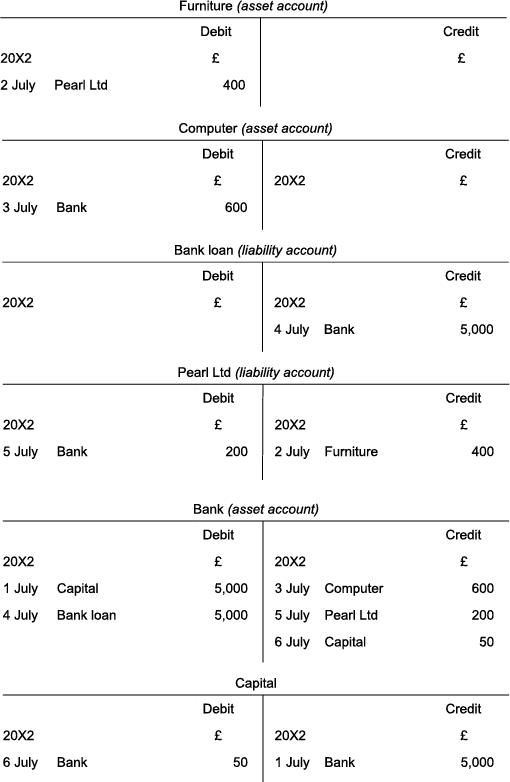

Below are the T-accounts in Edgar Edwards’ general ledger (see Activity 4 in Week 3). The general ledger accounts should be balanced off prior to compiling the trial balance.

4.2.1 The procedure for balancing off T-accounts

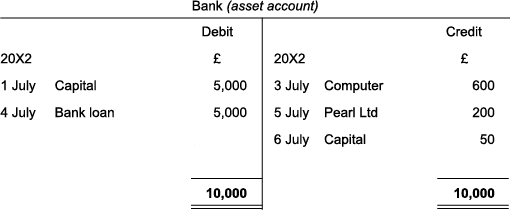

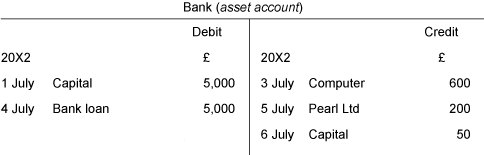

Accounts are straightforward to balance off if they consist of only one type of entry, i.e. only debit entries or only credit entries. In this case, all the account entries are simply added up to get the balance on the account. If, for instance, a bank account has three debit entries of £50 each, then the balance on the account is a debit balance of £150. However, when accounts consist of debit and credit entries, there is a procedure that should be used to balance off these accounts. Take the bank account:

The procedure for balancing it is:

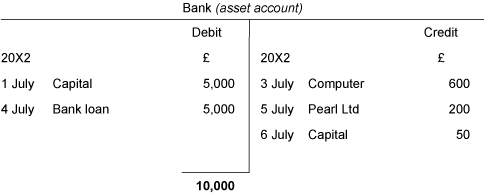

- Add up the side with the highest total.

- Enter the larger figure as the total for both the debit and credit sides.

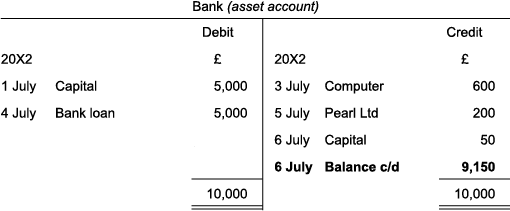

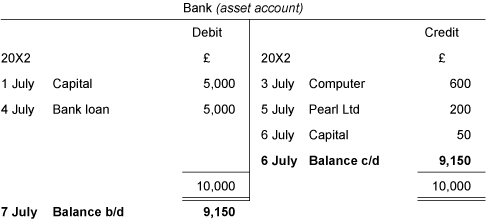

- For the side that does not add up to this total, calculate the figure that makes it add up by deducting the smaller total (600 + 200 + 50 = 850) from the larger total (10,000). Enter this figure (10,000 – 850 = 9,150) so that the total adds up, and call it the balance carried down. This is usually abbreviated as ‘Balance c/d’.

- Enter the balance brought down (abbreviated as Balance b/d) on the opposite side below the total figure. (The balance brought down is usually dated one day later than the balance carried down as one period has closed and another one has started.)

Edgar Edwards’ bank account in the general ledger has now been balanced off. The debit side was greater than the credit side, therefore leaving a debit balance of £9,150. The balance on the bank account reflects that £10,000 has come into this asset account and £850 has gone out to leave the debit balance of £9,150. This is why on the opposite side to the ‘Balance c/d’ figure, a ‘Balance b/d’ figure is needed to represent a closing debit balance.

The brought down balances at the end of the accounting period will be the opening balances of the next accounting period.

Using the rules above, all of the other accounts in Edgar Edwards’ general ledger accounts can now be balanced off.

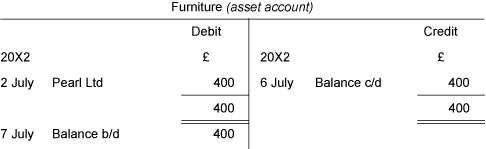

The furniture account has a single entry on one side. This amount is the total as well as the balance in the account.

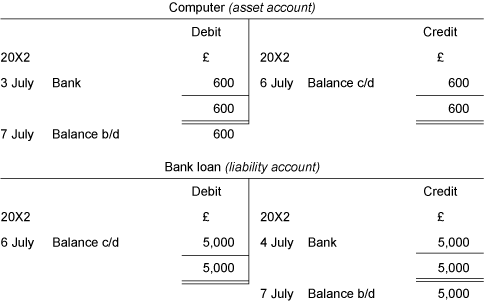

The computer and bank loan accounts have single entries on one side, like the furniture account, so they need to be treated in the same way.

In the next activity you will balance off the two accounts that we have not yet dealt with, the liability account ‘Pearl Ltd’ and the capital account. In order to do this you will need to follow the four-point procedure that was used to balance off the bank account. In this activity you will again not enter the answer in a box but will instead have an opportunity to work out the answer mentally before you click on the ‘Reveal answer’ button.

Activity 1 Balancing off a T-account where there is both a debit and a credit

Complete the entries in the following two accounts for Edgar Edwards Enterprises in order to correctly balance off the accounts:

Answer

The account for the liability, Pearl Ltd, has a debit and a credit entry so the method used above to balance the bank account can be used to balance the Pearl Ltd account and also the capital account below.

Now all the general ledger accounts have been balanced off, a trial balance can be prepared by listing all the balances (brought down balances) on Edgar Edwards’ general ledger as follows:

4.3 The trial balance

If (a) all the double entries for the six transactions for Edgar Edwards were correctly recorded in the relevant T-accounts and (b) all the relevant T-accounts were correctly balanced off, then a correct trial balance for Edgar Edwards can be prepared.

This will be shown in the next activity.

Activity 2 Preparing a correct trial balance

Complete the trial balance below. Your answer should have the correct debit or credit balance for each of the relevant six accounts as well as the total for all debit and credit balances.

Edgar Edwards Enterprises

Table 1 Completion of trial balance

Answer

| Debit | Credit | |||

| £ | £ | |||

| Bank | 9,150 | |||

| Furniture | 400 | |||

| Computer | 600 | |||

| Bank loan | 5,000 | |||

| Pearl Ltd (a payable) | 200 | |||

| Capital | ______ | Total 4,950 | ||

| Total 10,150 | Total 10,150 |

From the trial balance it can be seen that the total of debit balances equals the total of credit balances. This demonstrates that for every transaction the basic principle of double-entry accounting has been followed – ‘for every debit there is a credit’.

In the final section of this week we will go back to our accounting equation to show that the balances from the trial balance can be used to prepare the balance sheet.

4.4 The balance sheet

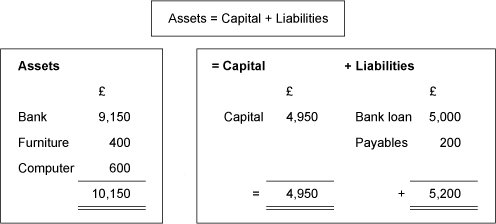

Returning to our example of Edgar Edwards in Activities 1 and 2, the completed trial balance contains all the elements of the accounting equation.

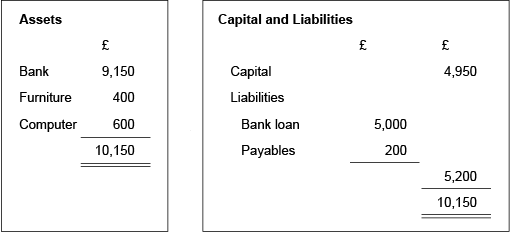

The accounting equation is the basis of the balance sheet, which shows the total of assets, in this case £10,150 balancing with the total of capital and liabilities £10,150.

Although it may be acceptable to prepare a balance sheet with assets on one side and capital and liabilities on the other (known as the horizontal format) it is more conventional to show assets at the top and capital and liabilities at the bottom (known as the vertical format).

Balance sheets are commonly prepared in a vertical format of the accounting equation. This gives the owners clear information about the assets of the business, the liabilities of the business (the amount it owes) and the capital or owner’s interest in the business. The balance sheet is normally produced at the end of each trading or financial year and is a snapshot of the financial position of the business on the last day of the financial year.

4.4.1 Preparing a balance sheet

In your final activity for Week 4 you will prepare a balance sheet in the vertical format for Edgar Edwards Enterprises at the end of the day on 6 July 20X2.

Activity 3 Preparing a balance sheet in a conventional format

Complete the balance sheet below. Your answer should have the correct figures for the individual asset, liability and capital balances as well as the correct figures for total assets and total capital and liabilities. (Non-current assets refer to assets that are typically held in a business for longer than a year. Current assets are assets that are typically held for less than a year. Likewise non-current liabilities refer to liabilities that are typically held in a business for longer than a year. Current liabilities are liabilities that are typically held for less than a year.)

Edgar Edwards Enterprises

Balance Sheet as at 6 July 20X2

Table 2 Completion of a balance sheet

Answer

Edgar Edwards Enterprises

Balance Sheet as at 6 July 20X2

| £ | |

| Non-current assets | |

| Furniture | 400 |

| Computer | Total 600 |

| 1,000 | |

| Current assets | |

| Bank | Total 9,150 |

| Total assets | Total 10,150 |

| £ | |

| Capital | 4,950 |

| Non-current liabilities | |

| Bank loan | 5,000 |

| Current liabilities | |

| Payables (Pearl Ltd) | Total 200 |

| Total capital and liabilities | Total 10,150 |

The capital of a business is the value of the investment in the business by the owner(s). As you learned in Activity 3 in Week 1, if a business makes a profit, the value of the investment by the owner (capital) increases. The best way to understand how this works is to look at the effect of profit on the accounting equation.

4.5 The effect of profit on the accounting equation

In both Week 2 and Week 3 we looked at the accounting equation:

| Assets = Capital + Liabilities |

The three elements (assets, capital and liabilities) are presented in the balance sheet. The profit earned by the business increases capital, and we have already seen that Profit = Income/Revenue – Expenses. The accounting equation can, therefore, be expanded to:

| Assets = Liabilities + Capital + (Revenue – Expenses) |

The income statement (also known as the profit and loss statement) shows in detail the elements of the equation: Revenue – Expenses = Profit or Loss. A deep understanding of the income statement is beyond the scope of this free course. An understanding of such a statement, as well as much other useful material, is included in the Open University module, B124 Fundamentals of accounting.

Summary of Week 4

If (a) all the double entries for every transaction and financial event are correctly recorded in the relevant T-accounts and (b) all the relevant T-accounts are correctly balanced off, then a correct trial balance can be prepared. The trial balance shows the double-entry rule that ‘for every debit there is a credit’.

The balances from the trial balance can be used to prepare the balance sheet. Balance sheets are commonly prepared in a vertical format of the accounting equation. The accounting equation can be expanded to Assets = Liabilities + Capital + (Revenue – Expenses) to reflect the fact that an increase in profit means an increase in capital.

End-of-course conclusion

This free course, Fundamentals of accounting, has introduced you to the essential concepts and skills of accounting in four interactive weeks of study. You should now be familiar with the rules of double-entry bookkeeping that are crucial for both financial and management accounting. You should also have an understanding of how transactions are recorded in ledger accounts, and how such accounts are balanced off to prepare the trial balance and the balance sheet.

If you want to build on the skills and knowledge gained from studying this course, you might be interested in taking the Open University course B124 Fundamentals of accounting.

Acknowledgements

This free course was written by Jonathan Winship.

Except for third party materials and otherwise stated (see terms and conditions), this content is made available under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 Licence.

Every effort has been made to contact copyright owners. If any have been inadvertently overlooked, the publishers will be pleased to make the necessary arrangements at the first opportunity.

Don’t miss out

If reading this text has inspired you to learn more, you may be interested in joining the millions of people who discover our free learning resources and qualifications by visiting The Open University – www.open.edu/ openlearn/ free-courses.

Copyright © 2015 The Open University