1.1 Sole traders

A sole trader is a business entity owned by a natural person (a human being). In the UK, there is no formal procedure for setting up or winding down a sole trader business. However, the sole trader is responsible for registering with Her Majesty’s Revenue and Customs authority (HMRC) as self-employed, and for registering for Value Added Tax (VAT) if the taxable revenue is more than £85,000 (at the time of writing).

In other countries things may be slightly different. For example, in the Netherlands, all types of business must register with the Chamber of Commerce. Registration with the Chamber of Commerce will automatically result in registration for income tax and VAT purposes as well.

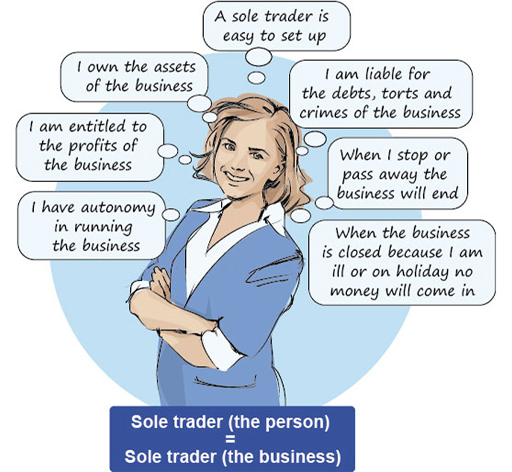

In the eyes of the law, the sole trader as a person and as a business are one and the same. The implications are that the owner of the sole trader business:

- raises finance by investing his or her own money, borrowing money from family or friends, obtaining a personal (unsecured) loan, or a loan secured on assets

- personally owns the assets of the business

- has unlimited liability for the debts, torts and crimes of the business

- is entitled to the profits of the business

- makes the decisions on the nature and running of the business.

In addition, when the owner decides to stop working or passes away, the sole trader business will have to be wound up.

Unlike many entities, the type and format of financial statements are not specified by regulations for sole traders in the UK. However, sole traders would normally prepare basic financial statements adequate for taxation purposes, as well as for their own needs. You will look at these in more detail later in the course.

See Figure 3 for a summary of sole traders.