5.2.2 Statement of financial performance

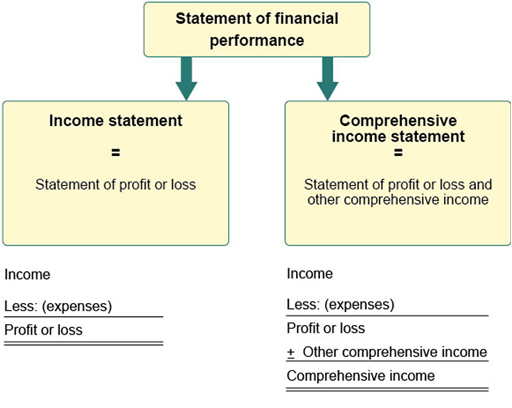

As mentioned above, the IASB calls the income statement the statement of financial performance. However, the IASB requires listed companies to prepare one ‘statement of profit or loss and other comprehensive income’ or a separate ‘statement of profit or loss’ and a separate ‘statement of comprehensive income’.

Why is there not just one type of statement of financial performance?

This is because a statement of financial performance can be prepared from the following two perspectives on what ‘the bottom line’ in a statement of financial performance should show.

Profit or loss – that is, net profit (or loss) generated from transactions which is recorded in the retained earnings account and is distributable to shareholders in the form of dividends. In this case, the statement of financial performance can also be called ‘statement of profit or loss’ or ‘income statement’.

Comprehensive income – that is, profit generated from transactions plus income as a result of any changes in assets and liabilities from other causes other than dividend payments and share capital increases or decreases. For example, the increase or decrease in the market price of investment assets or other non-current assets, changes in the estimations of pension assets or liabilities. These are beyond the scope of this course because they are too advanced.

In this case, the statement of financial performance can also be called ‘statement of profit or loss and other comprehensive income’ or ‘comprehensive income statement’. To complicate matters further, these two can also be presented separately as a statement of profit or loss and a statement of other comprehensive income.

Figure 8 expresses the explanation above visually.

Below is an example of the statement of financial performance for Cleopatra Ltd.

| Note | £ | |

|---|---|---|

| Sales revenue | 620,000 | |

| Less: Cost of sales | (352,500) | |

| Gross profit | 267,500 | |

| Less: Administrative expenses | 3 | (120,100) |

| Less: Distribution expenses | 3 | ( 49,750) |

| Operating profit (profit before interest and tax) | 97,650 | |

| Less: Finance costs | ( 2,400) | |

| Profit before tax | 95,250 | |

| Less: Corporation tax | (19,050) | |

| Net profit for the year | Total 76,200 |

- Administrative expenses and distribution costs: distribution costs include the depreciation of vehicles and vehicle running expense. All other expenses are included in administrative expenses.

Activity 11 Comparing sole trader and company financial statements, Part 2

The purpose of this activity is to compare the income statement of a sole trader with the statement of profit or loss of a company and identify the differences.

Refer back to the income statement for Ian Hodgins.

Identify how the statement of financial performance for Cleopatra Ltd (a company) is different from the income statement for Ian Hodgins (a sole trader).

Feedback

The differences in the format of the income statement for a sole trader and the format of the statement of financial performance (profit or loss statement) for a company are as follows:

- The statement of profit or loss for a company is simpler than the income statement for a sole trader because details are provided in the notes to the financial statements.

- In the statement of profit or loss for a company, administrative expenses and distribution expenses are headings that capture a number of items that would be shown separately in the income statement for a sole trader. The reason is, again, that details are usually provided in the notes.

- Operating profit (or profit before tax and interest, if there are no extraordinary items) and profit before tax are items that do not appear in the income statement for a sole trader because income tax is dealt with as part of the sole trader’s personal tax return.