5.4 Statement of cash flows

The statement of financial performance shows the profit of the company based on the accrual concept. This differs from net cash (cash income less cash expenses) because the statement of financial performance shows revenues and expenses in the accounting financial year to which they relate, rather than when the income or expense is received or paid. Income is recognised in the financial year it has been earned and expenses are recognised in the year they have been incurred in the process of generating the associated income.

The cash flow statement focuses only on cash receipts and payments. The cash flow statement shows the main areas of cash generation or expenditure under three main categories:

- cash flow from operating activities

- cash flow from investing activities

- cash flow from financing activities.

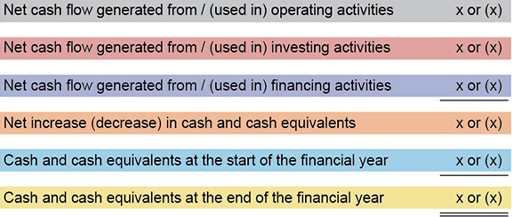

Figure 9 shows the summary format of the cash flow statement.

The cash flow statement shows the change in cash and cash equivalents over the financial year (the fourth line in Figure 9).

The cash flows from operating (the first line), investing (the second line) and financing (the third line) activities are shown separately, and the total of the different activities gives the increase or decrease in cash over the year (the fourth line).

The net increase or decrease in cash over the year (the fourth line) is then added to the opening cash position at the start of the year (the fifth line) to obtain the closing cash position at the end of the year (the sixth line).

This can be checked against the cash position of the company in the closing statement of financial position.

Note that the net cash flow may show an increase or decrease.

Opening and closing cash and cash equivalents may be positive or negative, i.e. overdrafts. Positive cash balances are shown under current assets in the statement of financial position and negative cash balances or overdrafts are shown as under current liabilities in the statement of financial position.

The cash flow statement shows if a company is able to generate enough cash from its operations. It also shows how much cash is used in investment activities. Investment activities are intended to generate cash in the future. The cash flow statement shows if cash is raised through financing activities rather than from operations.