6.4 Prospect theory

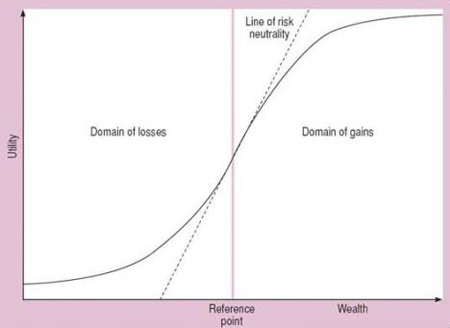

Kahneman and Tversky (1979) developed ‘prospect theory’ to describe this combination of risk and loss aversion. This suggests that whether an individual is risk seeking or risk averse will depend on where they are in relation to a personal reference point. The reference point divides the area where they feel as if they are in loss from the area where they feel they are in gain. This point is not usually zero, and will change over time. For example, a professional financial trader who is paid a bonus of £100,000 may experience this as a gain if he had been expecting a lower bonus. But say he had expected £200,000 and had committed to a house purchase on that assumption. In these circumstances he will experience the bonus as taking him into the domain of losses. In the first instance the reference point was somewhere between current wealth and current wealth plus £100,000. In the second case the reference point is at current wealth plus £200,000. Prospect theory suggests that because people are loss averse, they are risk averse above the reference point and risk seeking below. Figure 2 illustrates this.

The shape of the curve above the reference point displays risk aversion for the same reasons we set out in our discussion of expected utility theory. An extension of the same arguments shows the line below the reference point to represent risk-seeking behaviour. If you are having trouble seeing this, try drawing in lines to show a loss and gain of ‘a ’ at points x1 and x2 above and then below the reference point in the same way we did on the previous figure.