3.2 The official interest rate

In the UK, the official interest rate – also known as ‘Bank Rate’ – is set monthly by the Bank of England, as explained in Box 3.

Box 3 High noon in Threadneedle Street

Prior to 1997, ‘official’ interest rates in the UK were determined by the UK Government, usually after consultation with the Bank of England. Arrangements changed in May 1997 when the incoming Labour Government passed responsibility for monetary policy and the setting of interest rates to the Bank of England to make them independent of political influence. This matches the arrangement in the USA and in the ‘euro zone’, where the Federal Reserve Bank and the European Central Bank respectively set official rates. The rate set by the Monetary Policy Committee (MPC) known as ‘Bank Rate’ is the rate at which the Bank of England will lend to the financial institutions. This, in turn, determines the level of bank ‘base rates’ – the minimum level at which the banks will normally lend money. Consequently, Bank Rate (also known as the ‘official rate’) effectively sets the general level of interest rates for the economy as a whole. Note, though, that for individuals the rate paid on debt products will be at a margin – sometimes a very high margin – over Bank Rate and bank base rates. Indeed, one of the consequences of the financial crisis (see Box 1) was that the margin between Bank Rate and the rate paid on debts widened sharply (except for those products whose rate was contractually linked to the Bank Rate).

Each month, the Bank of England’s MPC meets for two days to consider policy in the light of economic conditions – particularly the prospects for inflation. The MPC’s decision is announced each month at 12 noon on the Thursday after the first Monday in the month. The objective, in 2011, was for the MPC to set interest rates at a level consistent with inflation of 2 per cent p.a. For example, if the MPC believes inflation will go above 2 per cent p.a., they may increase interest rates in order to discourage people taking on debt – because if people spend less, it may reduce the upward pressure on prices. Conversely, if the MPC believed inflation would be much below 2 per cent p.a., they might lower interest rates (also known as ‘easing monetary policy’) – people may then borrow and spend more.

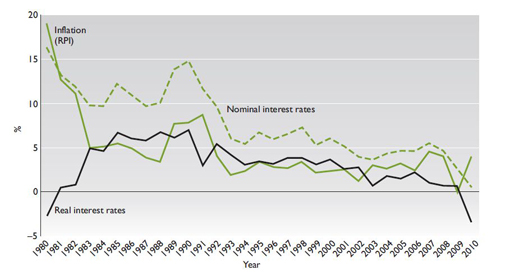

As you can see from Figure 5, official rates of interest tend to be cyclical, rising to peaks and then falling to troughs. Since 1989, the trend in the UK has been for nominal interest rates to peak at successively lower levels. Nominal rates then fell to 3.5 per cent in 2003. In 2010 they were at a record low of 0.5 per cent. They had been at this level since March 2009 as the Bank of England was attempting to stimulate economic activity following the period of recession at the end of the 2000s. However, the benefit of these low nominal interest rates was not fully experienced by borrowers as the margin between the Bank of England’s Bank Rate and the rate charged by lenders on their debt products widened.

Real interest rates are interest rates which have been adjusted to take account of inflation. Looking at Figure 5, when inflation is higher than the nominal interest rate, real interest rates are negative (as they were in 1980/81 and again in 2010/11). Real interest rates are at zero when the rate of inflation and the nominal interest rates are the same; and are positive when the nominal interest rate exceeds inflation. Real interest rates were low in the 1990s and 2000s, falling from 7 per cent in 1990 to just under 2 per cent by 2004. Subsequently they fell further. By 2010 the fall in the official interest rate to an historical low of 0.5 per cent, combined with price inflation of 4.7 per cent, resulted in negative real interest rates of minus 4.0 per cent (ONS, 2010b and 2010c). Unsurprisingly the low interest rates offered on savings encouraged many households to reduce their debts – particularly credit card debts – by running down savings balances.

Most mainstream lenders link interest rates, including mortgage rates, to the official rate of interest, and so the cost of debt, including mortgage debt, declined over this period. This is another reason why debt levels may have risen in the 1990s and until 2007. After 2007, the relationship between the official rate of interest and the cost of debt products was altered by a widening in the margin between them. Nevertheless, at the end of the 2000s interest rates on mortgages and many other debt products were historically low.