2.3 Steps to success

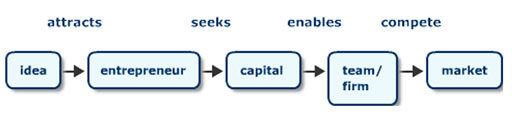

The entrepreneur or business owner needs to have a defining belief that the idea will work and sufficient energy to drive it to be ready to launch on the defined market. Sometimes the finance required comes from personal funds, sometimes from grants and sometimes from banks, venture capitalists or other sources of funding.

Wherever the capital is coming from it is important to be clear what the goals are in the short and longer term. If the funds are coming from personal or family sources you may not require a formal business plan, more a convincing conversation. However, it is best practice, wherever the finance comes from, to have some form of business plan – a plan that has clear goals that map out your route to success.

Your goals need to be SMART to be helpful.

- Specific

- Measurable

- Achievable

- Resource-related

- Timed.

For example, ‘I want to have a business that provides me with a good source of income’ sounds fine initially, but what is ‘good’? For some, an income of £10,000 would be fine, while others may require £50,000 or £100,000.

A SMART goal might be: ‘In two years time (timed) I will have a turnover of £500,000 (measurable and specific) with a 20 per cent profit margin (measurable)’.

It can be a matter of judgement whether the goal is achievable, which will depend on your market and starting position. Ensuring that the goal is ‘achievable’ does not mean it has to be soft or easy to achieve; it needs to be challenging, too.

When you work for someone else, the goal needs to be agreed with your manager; when you are the company owner the resources required need to be specified and need to be agreed with your board of directors, the bank manager, your family, and your staff where appropriate.

Task 9: Defining the business goals

- Think about where would you like your business to be in 12 months’ time. You will refine these goals as you work through the course and you gather more information to inform them. These short-term goals will inevitably be described in greater detail than those covering a longer time period.

- Now write down your goals for your business in three to five years’ time.

- Check that they are SMART

- Share your goals with other entrepreneurs in your local networks.

Along with the clear statement of your business idea, this is the first step to building your plan. This information will be required in your BPPR [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)] . It defines the strategic direction you will be following – but more about that to follow.