5 Business impacts

When risks do happen the impact can often have a serious effect on a business. Take a look at these case studies that describe some impacts of businesses getting risk management decisions wrong in different ways.

Remember to open these links in a new tab (right-click on the link and click on the option to open the document in a new tab or window) so you can look at them in relation to the course, and get back to the course easily.

- Piper Alpha timeline (Extended Version) [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)]

- Piper Alpha timeline (Day of explosion)

- Kodak timeline

Now take a look at Video 3, which is the Rolls-Royce timeline.

Transcript: Video 3 Rolls-Royce timeline (Please pause the video when you need to, to ensure you can read through all of the text on-screen. A transcript is also available.)

[Music playing]

1960: During the 1960s aircraft designers believed that supersonic aircraft would take over passenger services and that eventually subsonic aircraft would only be used for lower value, primarily cargo, activities.

1965: However, Juan Trippe, of Pan American Airways, believed that an economic shift was required and approached Boeing to build an aircraft nearly twice the size of anything then available.

With the technology available at the time engineers were also unable to look at double deck aircraft and so to create the necessary size widening the aircraft became the only choice.

This in 1965, under the direction of Joe Sutter, the design of the Boeing 747 began, however it would not be until February 9th 1969 that the aircraft would make its first flight and along the way there were some major hurdles that nearly brought about the bankruptcy of Boeing.

1966: The design relied upon the relatively new and as yet not fully understood technology of high-bypass turbofan engines.

General electric had pioneered the technology in military applications but had not yet developed a commercial offering. Their main competitor in the United States, Pratt and Whitney, were also working on developing this technology and, in 1966, agreed to develop the JT9D for the new Boeing aircraft.

However problems in the development of the JT9D delayed Boeing 747 deliveries to the point where up to 20 aircraft were complete apart from engine installation.

The Boeing 747 also required a completely new facility to be built.

The cost of building the plant and developing the aircraft meant the company had debts in excess of $2bn (a record for any company at that time).

The delays had meant that Boeing had to find more funding, with the hope that the gamble of a monopoly in the very large passenger market would provide the return the investors expected.

1966: In 1966 Pan American Airways’ competitors, American Airlines, recognised that they needed an aircraft that could rival the Boeing 747.

American Airlines approach Douglas and Lockheed to offer designs for a smaller aircraft (~300 passengers), still capable of long distance routes.

The newly formed McDonnell Douglas Corporation, where Douglas at the point of merger had been less than 12 months from failure, offered American Airlines the DC10 aircraft.

The DC10 shared much in common with previous Douglas aircraft, notably the relatively new DC8 and the programme was managed to a very tight budget.

1966: By contrast Lockheed hadn’t produced a civil airliner since the propeller driven Lockheed Electra, although it did have experience in producing large military transport aircraft.

Lockheed wanted to be part of the civilian market and so the Lockheed Tristar was created. The design philosophy had the aim of designing the best and most advanced product of the time, where the technology didn’t exist Lockheed designed and created it.

The cost of developing the necessary technology would result in a high purchase price for the Tristar.

1966: In the mid-sixties Rolls-Royce was extremely active in developing a number of engines, however this changed towards the end of the decade:

In May 1966 Rolls-Royce cancelled the RB178 programme, when it became apparent that the Boeing 747 would not be Rolls-Royce powered.

Before the end of the decade the UK had withdrawn from the Airbus consortium and the RB207 programme was cancelled.

However the company continued to develop the RB211 for the DC10 and the Tristar.

However, Rolls-Royce was developing these concepts on a fraction of the funding of its main competitors.

President Johnson: From mid-1967 until early 1968 Douglas, Lockheed, General Electric, Pratt &Whitney and Rolls-Royce went through many iterations of requirements, each increasing the primary requirements while keeping the costs down.

In February 1968 American Airlines announced it had selected the McDonnell Douglas DC10 as its preferred choice and that its preferred power plant was the Rolls-Royce RB211. By March 1968 President Johnson had received written protests from six senators and five representatives, from states that would benefit if a U.S. engine manufacturer was selected.

The U.S. Congress was concerned that the import of Rolls-Royce engines would result in a United States payments deficit of $3,800 million and the loss of up to 20,000 jobs.

McDonnell Douglas finally selected the General Electric CF6, a civilian derivative of the TF39 that had been developed in the early 1960s to power the Lockheed C5 Galaxy, as the power plant for the DC-10.

The McDonnell Douglas DC10 would take its first flight on the 29th August 1970, it would enter service with American Airlines on the 5th August 1971. The Lockheed Tristar would now become Rolls-Royce’s sole route to market in the widebody segment.

The Rolls-Royce RB211 was an innovative engine. The unique 3 shaft design promised a more efficient, compact and rigid engine, although it was more complex to design and maintain. In addition to this Rolls-Royce offered a promising advance in technology, a fan built from a carbon fibre material known as Hyfil, this would provide a significant weight saving over its titanium equivalent.

As early as 1967 the company knew that the project’s target of entry into service in 1971 was challenging. The project suffered a serious setback with the sudden death of Adrian Lombard, the chief engineer, and by the end of 1969 the RB211 was under thrust, over weight and unable to meet the fuel burn consumption targets.

In May 1970 the project suffered a further major setback when the much promised Hyfil material failed critical tests and thus the design would have to revert back to a more conventional titanium blade.

This design was also fraught with problems when it was realised that only one face of titanium billet possessed the right metallurgical qualities for the blade.

By 1970 the development costs were double those originally estimated and each engine would cost more.

1971: In Feb 1971 Rolls-Royce was placed into receivership. As the sole power plant for the Lockheed Tristar, and with Lockheed facing significant re-design work if the RB211 was unavailable it became a matter of national importance in both the United Kingdom and the United States that Rolls-Royce should remain viable.

The UK government nationalised Rolls-Royce, with US government guarantees for Lockheed loans that enabled the completion of the Tristar programme.

As part of the agreements new contracts were signed between Rolls-Royce and Lockheed to cancel late delivery penalties and increase the sale price of the engine.

1972: The Tristar’s first flight was in November 1970, but it wasn’t until April 1972, almost 18 months later and 6 months since the DC-10 had entered service, that the aircraft entered service with Eastern Airlines.

When the Tristar did start flying, and before it entered service, it was clear that it did not meet the performance expectations that had originally been laid out and much of this gap was down to the capability of the engines.

However, now under state control, Rolls-Royce’s focus was tightly focused on ensuring that it could deliver the engines required for entry into service. In parallel, but by contrast McDonnell Douglas and General Electric recognised that there was a market for a larger version of the DC-10 and were quick to develop and bring to market a more capable variant of the aircraft that could serve longer routes.

Eventually Rolls-Royce did develop an engine that improved the performance of the Tristar, but it was too late to gain the market share required and in the end only 250 Tristars were sold, when business case had been for around 500 aircraft, by comparison around 400 DC-10s were sold. The failure of the Tristar ultimately forced Lockheed to withdraw from the civil aerospace market.

The competition with the Tristar had also had an impact on McDonnell Douglas who could only afford to offer a modified DC-10, the MD-11, rather than develop a new generation of twin engine aircraft. Ultimately inabilities to provide an offering in the new twin engine era lead to the downfall of McDonnell Douglas.

1974: The possibility of a twin engine widebody aircraft was being discussed while the Boeing 747 was being developed. As well as Lockheed and McDonnell Douglas, in 1967 the British, French and West German governments agreed to develop the A300 Airbus.

By 1968 it was possible for the aircraft to use any of the three main engine manufacturers’ offerings then available.

By the end of 1968 it became clear that the Rolls-Royce offering, the RB207, was losing out to the RB211 in terms of concentration and effort and that limited funding at Rolls-Royce meant that both could not be developed in parallel.

The Airbus consortium thus switched their engine choice to General Electric CF6 engines that would be made in co-operation with French engine manufacturer SNECMA.

In April 1969 the British government withdrew from the Airbus venture, at which point the West German and French government agreed to each equally fund the programme, the UK firm Hawker-Siddeley remained a major subcontractor within the programme. On the 28th September 1972 the A300 was unveiled to the public, one month later it flew for the first time; 7 months after the Tristar went into service.

The aircraft entered service in 1974 and initially its sales were very slow due to the oil crisis, however 10 years later the aircraft had secured 26% of the overall market segment and a total of over 500 A300 have been sold, it was also certified to be able to accept either a General Electric or a Pratt & Whitney power plant.

Now have a go at Activity 2.

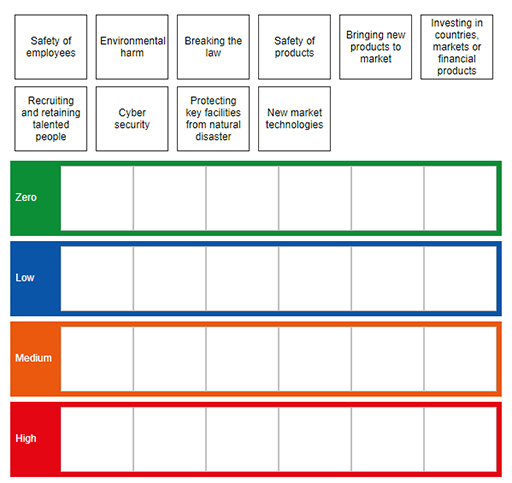

Activity 2 Risks to scale

Click on the link below to load this interactive activity. Place these risks on the scale provided based on your work experiences of taking risks. For example if you think that organisations should normally aim to make an aspect of their business (say, cyber security) ‘low risk’ then select ‘low’.

Discussion

| Zero | Low | Medium | High |

|---|---|---|---|

| Breaking the law | Investing in volatile countries, markets or financial products | New market technologies | |

| Safety of employees | Recruiting and retaining talented people | ||

| Environmental harm | Bringing new products to market | ||

| Safety of products | |||

| Cyber security | |||

| Protecting key facilities from natural disaster | |||

| Changes to regulations, tariffs or access to markets caused by governments |

- Zero: While you might want ‘Zero risk’ for something (e.g. a zero risk attitude to employee safety) in practice the only way this can be achieved is to remove the risk completely, therefore in many cases achieving ‘zero risk’ is impossible.

- Desire to take little risk: Although ‘zero risk’ is impossible, there are many areas where risk exposure should be minimised. These would typically be risks where we could harm people or the environment or break laws or regulations. However, there may be critical business activities that should not be exposed to high levels of risk: protecting facilities and IT might also be areas where risks are not wanted.

- Ability to accept some risk: There will then be areas where some risk is acceptable in order to achieve goals. When investing in countries it might be desirable to operate in areas with high growth and easy access to the necessary resources, but it would be considered an unacceptable risk to operate in areas with high corruption and low ethical standards. Similarly in recruiting and retaining talent, taking the steps to obtain the best people is key but exploiting individuals or using labour practices that might be viewed as unfair would be an unacceptable risk.

- Accepting high risks: There will be some areas where the company is prepared to take high risks. In bringing a new product to market, especially if the product is essential to the success of the company, the company may be willing to put a vast amount of investment behind the project. Similarly in investing in new technology, if a company believes the technology is a ‘game changer’ it may try to ensure significant capital is available, the stakes for not doing so may be too high not to invest (see Rolls-Royce or Kodak earlier).

Throughout this activity it is important to recognise that risks do not occur in isolation. This means that a company will have differing risk appetites across and even within its activities. For example it may have a high-risk appetite for introducing new technology, so will do everything it can to bring it to market, but because it has a low-risk appetite for breaking the law, ‘doing everything it can’ excludes breaking any laws.