9 Applying Steps 1 and 2 of the decision-making model to insurance

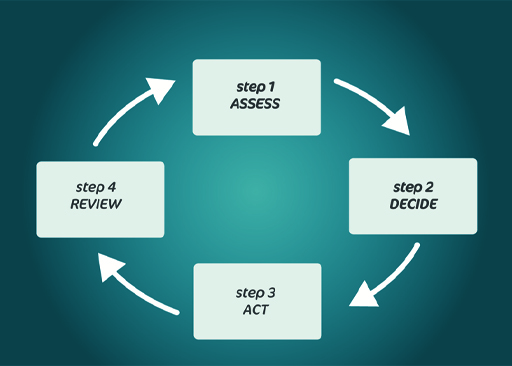

Now you’ll look again at the four-step model and see how we can apply it to insurance.

For Step 1, where you assess the situation, it’s worth stressing the significance of the perils that can be insured against, as related insurance policies vary according to individual circumstances. Life insurance, for example, is likely to be especially important in a family with children and with one income earner but may be regarded as irrelevant to a single person with no dependants.

An important factor to consider is what other protection is available. State benefits are part of this equation, as are any benefits available from an employer (if you’re employed).

With large employers, benefits may include sick pay above the statutory minimum, ‘death in service’ benefits (a form of life insurance that usually covers three or four times your salary) and private medical insurance (PMI).

As part of your Step 1 planning you need to find out what you are entitled to. Your entitlements may not completely replace the need for additional private insurance, but it’s important to know what they are, as they may reduce the amount of additional cover needed.

A further factor to assess at Step 1 is your attitude towards risk. Your aversion (or otherwise) to risk will be affected by several factors, including age, tastes and preferences. The more risk averse you are, the more likely you are to consider additional insurances.

Step 2 is when you decide which additional insurance policies to buy. As a rule, the greater the potential financial impact of a peril, the more likely it is that you will consider insuring against it. The key thing to consider is whether you could bear the cost if the worst were to happen – even if the risk is very low.

The obvious example of this is insuring your home – rebuilding costs would be far beyond most people’s means, and so most owners decide that risk shifting makes sense (or must do so as a condition of their mortgage).

But where the costs would be smaller, self-insurance may be considered a better alternative. To illustrate, it may be cheaper to buy a new mobile phone rather than paying for the insurance for it over several years.

Another thing you need to think about is the cost of the insurance policy. Normally, the higher the premium, the less likely someone is to take out the policy.

However, while it’s theoretically possible for you to calculate the expected benefit from an insurance policy, it’s difficult to do in practice. You might be able to calculate the financial loss you’d suffer, but it’s unlikely you’d be able to calculate an accurate figure for how likely it is for your car to be stolen, or for you to drop and break your mobile phone.

Your decisions about whether to take out insurance policies will have a direct impact on your household budget: the more policies you take out, the more you have to pay for them.

But it’s worth looking at ways you can bring premiums back down. For example, fitting window locks or a burglar alarm may bring your home insurance premiums down.

One way to think about the impact of insurance premiums on your household budget is to realise that the current expense aims to protect you and your household from greater expense in the future.