3 The savings supermarket: What type of accounts can I get?

Whether it be on the internet, in the print media or simply in the windows of banks and building societies (though they won’t tell you about possible better rates elsewhere!) you’ll find details of hundreds of different accounts, but which to pick depends on their features and your circumstances.

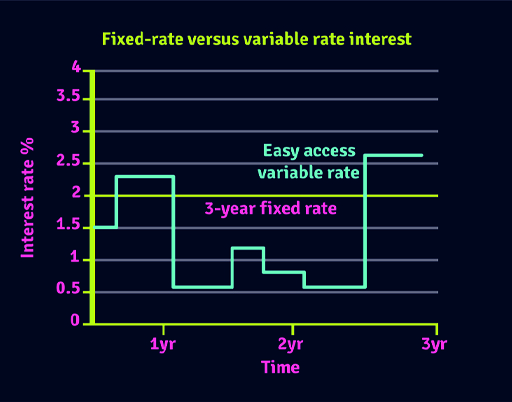

When selecting your savings accounts, one key decision is whether to go for an easy access product where the rate will be variable or a fixed-rate product where the rate is, as the term clearly implies, fixed for the term of the product.

Fixed-rate products are commonly referred to as ‘bonds’, although you should try to get that term out of your head in the context of savings as it’s a confusing term given lots of investments are also called bonds. They’re just savings accounts that pay a fixed interest rate.

Another decision to make is whether to go for a cash ISA or a standard savings account. We explain later on what cash ISAs are in detail, and whether to go for one. Yet the basic premise of them is fairly simple in that they’re just normal savings accounts where there is no tax on the interest, and as they’re just like normal savings accounts, the descriptions below apply to both cash ISAs and standard accounts.

Let’s look at the different types of accounts in some more detail.

Easy access (or ‘instant access’) accounts

These tend to give you easy access so you can make withdrawals at will (though some limit the total number you can make per year). They tend to pay lower rates than fixed-rate accounts, but are a good place to keep your money if you’re going to need it soon (or frequently).

The interest rates on such accounts are variable so they can move up and down, either in line with the Bank of England’s Bank Rate (you looked at Bank Rate in Session 3). But decisions about the exact timing and scale of the moves lie with the bank or building society and can happen at any time, so keep a close eye out.

Make sure you also keep an eye out for introductory ‘bonus’ rates. These are temporary interest boosts to attract new customers. They’re actually a good thing for many, as they effectively act as a minimum rate guarantee during the introductory period, promising you at least some interest. But it is vital to remember the end date for the bonus and switch as soon as it ends, so you don’t languish on a rubbish rate.

Fixed-rate accounts

These often give a better return than their easy access counterparts and you get certainty about the interest you’ll receive. A fixed-rate account is just a savings account where the amount you earn is set in stone over a fixed time period, usually anything from 1 to 5 years.

Usually fixed rates are a little higher than rates on easy access accounts – although sometimes they can be lower. If current savings rates were to increase during that time, you would not benefit from rate rises. On the flip side, they provide protection in case rates drop in that time given their fixed nature.

You can’t usually access the cash during the term (unless it’s held within a cash ISA, though there are penalties to withdraw early from those).

The phrase ‘usually’ is important as there are some exceptions, even outside a cash ISA. A few banks occasionally allow early withdrawals for an additional fee but this is very rare. Plus, immediately after the Covid-19 pandemic hit the UK, many banks relaxed withdrawal rules for people in financial difficulty. Yet if you get a fixed-rate account, unless the terms clearly allow for early withdrawals, do not count on it.

Notice accounts

There is another, less common type of account called a notice account that is a hybrid of the two. Here, you have to give notice when you want to take money out, of say, 60 or 90 days. Rates tend to be variable and you tend to get better rates than on easy access, but they do not tend to be as high as fixed-rate accounts.

Limited access accounts

These are accounts where you can withdraw money but only on specific terms – for example one withdrawal per year or, say, up to two or three withdrawals. More withdrawals will result in a charge being incurred by the saver, usually by a deduction in the interest paid to them.

Regular savings accounts

Most regular savings accounts require you to put money away each month with interest paid yearly. They offer higher interest rates than traditional fixed or easy access savings accounts, but tend to impose rigid terms and conditions, such as limiting the withdrawals you can make, or forcing you to make a deposit every month. After a year, your cash usually sweeps into a bog-standard account – so be prepared to ‘ditch ‘n’ switch’ to a better deal.

Activity 3 Accounts with restrictions on withdrawals

Why would you want to save in an account that restricts withdrawals?

Answer

The simple answer is that accounts with controlled access usually offer (slightly) higher interest rates than instant or easy access accounts. That’s the incentive for you.

For the bank or building society, there is more certainty that you will leave your savings untouched if you place your money into accounts with controls on access, which gives them greater predictability about their cash flows. Remember the money you save is used by the bank to help finance its lending activities – such as loans and mortgages.