1.1.1 The life course

Considering the life course as a series of stages provides a means of thinking ahead and seeing an overall pattern.

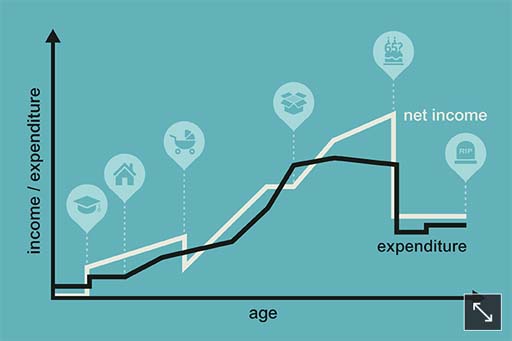

Figure 1 illustrates a ‘typical’ pattern where youth, adolescence and young adulthood lead on to becoming part of a couple, where adulthood entails working and having dependent children who later on become independent themselves. The later part of the life course is usually marked by old age and retirement from working.

Of course, the life course won’t be the same for everyone; some people won’t form part of a couple or won’t have children, and some will experience family breakdown or bereavement.In relation to personal finance, the idea of the life course is helpful because it encourages planning ahead for the financial implications of each stage. For example, many people delay thinking about their provision for retirement because they don’t want to think about growing older, but they often come to regret this later in life when they realise that they would have benefited from earlier planning. Thinking in terms of stages in the life course might help to overcome this natural aversion. It provides a framework for thinking about possible life events such as marriage, parenthood, retirement, or even death, and this can make it easier to think ahead constructively.

No one can know exactly what will happen in the future. Financial capability – the ability to understand finances and make sound financial decisions – involves thinking ahead and planning for what might happen in the future; this includes not only things that we hope for, but also things that we hope will not happen.

Sensible planning takes into account the fact that the future may bring events that can be anticipated, as well as unexpected events with financial implications – unexpected bills or periods of illness or unemployment. Planning for the unexpected is one important aspect of financial capability.