Week 8: Insurance

Use 'Print preview' to check the number of pages and printer settings.

Print functionality varies between browsers.

Printable page generated Thursday, 16 May 2024, 9:13 PM

Week 8: Insurance

Introduction

The rationale of insurance – household risk management. When to buy cover and when to self-insure? Apply the financial planning model to insurance decisions.

Martin introduces the final week of the course. The focus here is insurance – both compulsory and optional. How do you decide whether the optional types are worth paying for? In this week you revisit behavioural factors that influence financial decision making, and you tackle the end-of-course test.

Transcript

This course is presented with the kind support of True Potential LLP.

The True Potential Centre for the Public Understanding of Finance (True Potential PUFin) is a pioneering Centre of Excellence for research in the development of personal financial capabilities. The establishment and activities of True Potential PUFin have been made possible thanks to the generous support of True Potential LLP, which has committed to a five-year programme of financial support for the Centre totalling £1.4 million.

8.1 Insurance – setting the scene

How do you choose between the various types of insurance available?

What are the details that you, as a consumer, should focus on to ensure that the cover you’re buying is both necessary and appropriate for your circumstances? Under what circumstances can doing without a policy – known as ‘self-insurance’ – make sense?

Transcript

8.1.1 To insure or not to insure?

If you had complete freedom to make your own decisions about insurance – if there were no legal or contractual requirements to have insurance – which of these insurance products would you buy and which would you not buy?

- Travel insurance for a one-week holiday overseas. Cost of insurance: £50.

- Home insurance in respect of your property being flooded. Cost of annual insurance: £400.

- Extended warranty insurance coverage for breakdown of a washing machine. Cost of three-year insurance: £200.

8.1.2 Why do you buy insurance?

A theme throughout this course has been how households can use financial planning to protect themselves from the financial impact of future events, whether planned or unplanned, expected or unexpected.

Insurance is a method whereby individuals or households (or organisations) can protect themselves against the unexpected. To do this, they pay a sum of money called a premium to an insurer in exchange for being indemnified (protected) against the losses that result from specific perils, under conditions specified in a contract. This contract is called an insurance policy. When you take out an insurance policy you’re transferring to the insurer the risk of the financial loss arising from the peril, and so you’re reducing the potential consequences to yourself.

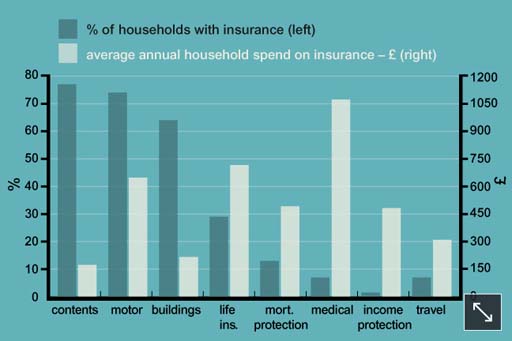

You can see from the chart the actual uptake of various types of insurance in the UK. The chart also shows the average expenditure on each type of insurance policy by those households that buy them, although it doesn’t include insurance cover provided through employers, so it understates total insurance expenditure.

Actuaries provide statistics to insurers to help quantify the risks that insurers are taking on. Insurers need data on the probabilities of the perils for which they offer insurance – death, illness, disease, burglary, accidents and so forth – and data on people of different ages, genders, locations, postcodes and households, so that they can estimate their risks of paying out.

Actuarial data will give an approximation of the future claims that the insurer might face across the range of perils they insure. Insurers will then aim to set premiums so that, on average, total premium income will cover the cost of paying out for claims, building up reserves and making a profit.

Insurers spread their risk by insuring many individuals and households against various risks. By insuring a large number of risks, the average number of times that insurers have to pay out will be more predictable, and so will be the total amount that they have to pay out in any given year. In taking on the risks of many and aggregating them, the insurer faces a more predictable future than individual policy holders would if they had to face their risks themselves.

What are the different strategies for managing risk and uncertainty?

One approach is to ignore the risk. If the peril then materialises, there could be major negative financial ramifications, and so this would be a high-risk strategy.

Another approach is to try to eliminate or reduce risk. Strategies here could include fitting house alarms (to reduce the risk of burglary or fire), eating healthily (to reduce the risk of premature death) or not flying (to eliminate a risk of death in an air crash). These might be beneficial in themselves – although they may have costs attached too – but they cannot eliminate all of life’s risks and uncertainties.

A different strategy is risk assumption. This involves taking on the potential financial impact of the peril materialising. It implies a policy of self-insurance: establishing a fund using savings products to cover the costs of any potential financial loss. This can be a strategy adopted by choice by people who are risk takers or who have enough income or savings to cover possible losses. It can also be adopted by default when other types of insurance are not available or are too expensive. Yet where the financial impact of a peril is large and beyond the financial resources of most individuals, many people who can afford to do so pursue a policy of transferring the financial risk, by using insurance to pass it on.

8.1.3 Mick sorts out his insurance

This quiz tests your ability to apply the financial planning model to insurance.

Activity 1

a.

Go to insurer’s website to complete application form and pay the £75 premium

b.

Add up the value of all his possessions

c.

Go to several comparison websites to check cover, prices and exclusions

d.

Check his budget and savings to see what he can afford to pay

The correct answers are b and d.

a.

Go to several comparison websites to check cover, prices and exclusions

b.

Add up the value of all his possessions

c.

Go to insurer’s website to complete application form and pay the £75 premium

d.

Check if the policy covers the TV and games system he subsequently buys

The correct answer is a.

a.

Go to the selected comparison website to choose an insurer

b.

Check if the policy covers the TV and games system he subsequently buys

c.

Check his budget and savings to see what he can afford to pay

d.

Go to insurer’s website to complete application form and pay the £75 premium

The correct answers are a and d.

a.

Add up the value of all his possessions

b.

Go to insurer’s website to complete application form and pay the £75 premium

c.

Compare the selected renewal premium with other providers’ offers

d.

Check if the policy covers the TV and games system he subsequently buys

The correct answers are c and d.

8.1.4 Apply Stages 1 and 2 of the financial planning model to insurance

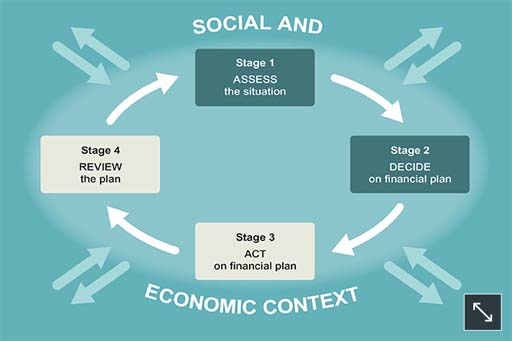

Look again at the familiar model and apply it to insurance. But remember that in practice financial planning needs to be a flexible process, with movement back and forth between the stages.

For Stage 1, where you assess the situation, it’s worth stressing the significance of the perils that can be insured against, as related insurance policies vary according to individual circumstances. Life insurance, for example, is likely to be especially important in a family with children and with one income earner, but may be regarded as irrelevant to a single person with no dependants.

An important factor to consider is what other protection is available. State benefits are part of this equation, as are any benefits available from an employer. With large employers, benefits may include sick pay above the statutory minimum, ‘death in service’ benefits and private medical insurance (PMI).

As part of your Stage 1 planning you need to find out what you are entitled to. Your entitlements may not completely replace the need for additional private insurance, but it’s important to know what they are.

The combination of what the state and an employer provide could eliminate the need for some types of private insurance, or reduce the amount of additional cover needed. The private insurance element can be seen as building on the insurance cover provided by the state and by employers.

A further factor to assess at Stage 1 is your attitude towards risk. Your aversion (or otherwise) to risk will be affected by a number of factors, including age, tastes and preferences. The more risk averse you are, the more likely you are to consider additional insurances.

Stage 2 is when you decide which additional insurance policies are appropriate for yourself or your household. As a rule, the greater the potential financial impact of a peril, the more likely it is that you will consider insuring against it. The key determinant is whether you could bear the cost of a risk materialising – even if the risk is very low.

The obvious example of this is insuring your home – rebuilding costs would be far beyond most people’s means, and so most owners decide that risk shifting makes sense (or have to do so as a condition of their mortgage).

But where the costs of the loss would be smaller, self-insurance may be considered a better alternative. To illustrate, paying the cost of domestic appliance repairs may make more sense than taking out an extended warranty.

Another factor in deciding on insurance is the cost of the insurance policy. Normally, the higher the premium, the less likely someone is to take out an insurance policy. It would be theoretically possible to calculate the expected benefit from an insurance policy, taking into account the financial impact of a peril and the probability of it occurring. However, such calculations are extremely hard to perform in practice.

Your decisions about whether to take out insurances will have a direct impact on your household budget as the more policies you take out the more your expenditure increases. Conversely, by actively seeking ways to reduce the premiums you pay, for example by fitting window locks or a burglar alarm, your expenditure will decrease. This feeds directly back into the budgeting process discussed in Week 3.

One way to think about the impact of insurance payments on your household budget is to realise that the current expense aims to protect you and your household from greater expense in the future.

8.1.5 Apply Stages 3 and 4 of the financial planning model to insurance

Stage 3 is about acting to put the insurance plan into effect. This involves looking at the details of policies and shopping around for the best deal. As you saw for other aspects of financial planning, there is quite a bit of going backwards and forwards during Stages 1–3. Some plans you try to put into action may not work, or the plans may turn out to be more expensive than you first thought, and so the plan will need to be remade.

As the UK’s insurance market is so developed, taking out most types of insurance is relatively easy. Insurance policies can be bought either directly from an insurance company or through an intermediary (usually called a ‘broker’) who can select a policy from different companies. Insurance is also sold by third parties, such as shops that sell extended warranties on their goods and travel agents that sell holiday insurance.

Brokers, such as members of the British Insurance Brokers Association, deal with insurance such as home, motor and travel insurance as well as term life insurance (which is an insurance policy for a defined period). Increasingly, though, insurance is bought on the internet – particularly via the numerous price comparison websites.

Financial advisers are the intermediaries who can give advice on life insurance, complex health insurances, savings and investments (covered in Week 5), and pensions (the subject of Week 7).

In all cases, unless simply ‘executing’ a client’s instructions, the company or intermediary is required to recommend a product that meets individual circumstances and needs. Generally, the more complicated the insurance, the more an intermediary can help you in assessing your situation and needs, recommending and explaining policies, and in assisting in the event of a claim.

Stage 4 is to ensure that you regularly review your financial planning decisions. This feeds into regularly assessing your need for insurance, and into the other stages too. You should always review your insurance needs when policies come up for renewal and when personal circumstances change (for example, when the composition of the household changes or when new assets are acquired).

A common failing in personal financial management is simply to renew with the same insurance provider rather than shop around for a new deal. Such inertia can cost you money, as the best deals are often offered only to new customers – not to existing ones.

As with any plan, you need periodically to check how things have worked out in the light of experience. This gives you the chance to remove ‘double insuring’ – to check that the same risk is not insured twice (for instance, with a travel and a home insurance policy), which would be unnecessary expenditure.

It is also important to remember that the financial planning process takes place inside the social and economic context. One feature of this context is that insurance is heavily marketed, with adverts for various insurance policies on television and in many other media, and with promises of cheaper quotes, often through market comparison websites. This reinforces the need to approach decisions about insurance in a methodical manner, such as through the four-stage financial planning process you’ve been looking at.

8.2 Home insurance

In this section, you will discover which kinds of insurance are compulsory and which are optional. You'll also find out some top tips for managing the cost of home and motor insurance, how to review your own insurance cover and how you might have been affected by mis-sold Payment Protection Insurance (PPI).

Given the size of the potential losses, home insurance is one of the first types of insurance to consider when you first rent or buy your home, and the majority of households, as you saw earlier, usually do decide to take it up.

Home insurance includes buildings insurance for the actual structure (for those who own their own home), and contents insurance for household possessions. Buildings and contents insurance don’t have to be taken out with the same company, and it can be cheaper to shop around for the lowest costs of each separately. However, by using one company for both you may obtain a small premium reduction, and speed up any claims in the event of damage to both home and contents.

If you have a mortgage on your home you don’t have to take out the home insurance offered by your mortgage company. You can make your own (often cheaper) arrangements. If you rent your home you won’t need buildings insurance as that is the responsibility of your landlord. But you should think about contents insurance (also called possessions insurance).

The costs of both elements of home insurance are determined by the risk factors associated with the particular policy and circumstances. Remember that insurance companies ask questions to try to ascertain the risk as accurately as possible. For example, the location of the property will enable judgements about whether it is subject to flooding or subsidence or other natural perils (and thus whether it will require a higher buildings insurance premium). Also, the rate of burglary in the area will be one of the main risk factors considered for contents insurance.

Here are some of the main variables to think about when assessing exactly the kind of contents insurance you need – adding them to your policy will increase the cover but also the premium.

- If you have limited possessions (for instance, when setting up home), a basic policy offering only a small amount of cover may be enough – this will keep the premium low.

- Paying for cover for £30,000 of contents insurance when you have only £15,000 worth of items would be wasting money.

- Having cover that does not equal the actual value of your possessions will mean that only a proportion of any actual claim will be paid.

- Accepting a higher excess in return for a lower premium is like a small element of self-insurance. It may help you to build up a no-claims discount by paying for small claims yourself.

- Different insurers may charge different premiums for the same cover, so decide exactly what kind of cover you require before shopping around for the best deal.

8.2.1 Keeping down the cost of home insurance

The video presents some of the main variables that will influence the level of home contents insurance premiums.

Transcript

8.2.2 Motor insurance

UK law requires all car drivers to take out car insurance.

If you own a car the legal minimum obligatory insurance you must take out is third-party insurance. This will insure you against any damage you inflict on another person or their property (for example, your passengers, other drivers and their cars). However, it won’t cover your own costs.

Third-party, fire and theft insurance offers a higher level of cover. It will also pay for repairs or provide compensation if your own car is a write-off because of fire or theft.

Comprehensive insurance, as its name says, is comprehensive cover. It not only covers you for third party, fire and theft, it also covers damage or loss to your own car, whatever the cause.

Some policies include roadside assistance or a replacement car.

8.2.3 How to keep down motor insurance premiums

The video offers practical details on motor insurance, as well as some suggestions on how to keep your premiums low.

Transcript

8.2.4 Travel insurance

Insurance for travel has changed radically since the 2000s, partly due to an increase in foreign travel but also because of changes in the insurance market itself.

Travel insurance covers:

- the risk of disruption to your holiday

- theft of your belongings

- the risk that you might cause injury, damage or loss to others

- the risk of medical problems while abroad.

If you have a medical emergency while travelling abroad you could end up with significant health-care bills, or large costs if you have to be repatriated to your home country. A European Health Insurance Card (EHIC) is available through UK post offices. It allows you access to emergency medical services throughout the European Economic Area (EEA) and Switzerland on the same basis as local nationals. You may have to pay towards the cost of those services in some countries, so an EHIC is not a substitute for full medical insurance.

Traditionally, travel policies were often offered for a single trip as part of the purchase of a foreign holiday, or you could make your own insurance arrangements for each trip you took. However, the market changed and increasingly people began to make insurance arrangements for their travel generally (rather than for a single trip) by buying insurance for a fixed time period.

This trend was enhanced by changes to the law in the UK that prevented holiday firms from forcing customers to pay over the odds for compulsory single-trip insurance. Since then, the market has expanded with the entry of new insurers and brokers, and new products have become available.

As with all other types of insurance, shopping around for the precise cover you require may reduce your costs. Different policies can cover different parts of the world. They may or may not include winter sports (an activity with a rather high probability of accidents). They vary as to how long any individual trip may be within a given time period.

One recent trend has been for travel insurance to be included with a particular credit card or bank account – but check carefully whether such ‘bundled’ policies meet your requirements.

8.2.5 Other general insurance

It may seem as though every time you buy a consumer item, you’re offered an extended warranty for it. This form of insurance policy is offered by retailers who earn commission from the insurers whose policies they sell.

Typically, extended warranties cost a large amount relative to the actual item, and do not pay out in all circumstances where the item becomes faulty. You need to examine this type of insurance with great caution, and perhaps consider self-insurance for items such as televisions and music centres. New electrical items and ‘white goods’, like washing machines, are generally reliable and unlikely to break down in the early years after purchase, the time period usually covered by extended warranties.

Payment Protection Insurance (PPI) is a type of insurance that, in recent years, has fallen into disrepute. In theory, it’s aimed at protecting your credit card or loan repayments. However, because PPI was offered largely at the ‘point of sale’ of taking out such cards or loans, it was subject to claims of serious ‘mis-selling’.

Consumers took out policies in the absence of any competition, often buying something they did not need or at an inflated premium. Alternatively, PPI was totally unsuitable because exclusions meant that the consumers weren’t covered anyway, perhaps because of health conditions or the nature of their employment.

In 2005 Citizens Advice made a ‘super complaint’ about PPI to the Office of Fair Trading. In 2009 the Competition Commission decided to ban PPI policies from being sold alongside cards, loans and mortgages. Then in 2010, after a flood of consumer complaints to the Financial Ombudsman, the FSA issued new rules effectively forcing firms that had mis-sold PPI to refund customers directly, rather than requiring them to go through the Ombudsman.

It has been estimated that as many as four million people might be in line for compensation for mis-sold PPI policies, with financial firms setting aside more than £20 billion for compensation payments (Guardian, 2014). Consumers who still want to take out PPI can do so independently of taking out the debt product, perhaps through shopping around on comparison websites and comparing the premiums and the details of the policies very carefully.

General insurance is an almost endless topic: if there is a risk of a peril, there is probably an insurance that could cover it, or that could be designed to cover it. Reportedly, American singers Mariah Carey and Jennifer Lopez insured themselves for up to $1 billion, and in 2006 England footballer David Beckham was reported to have insured himself for £100 million against injury, illness or disfigurement.

More prosaically, there is insurance covering the risk of rain disrupting organised outdoor events, as well as weddings insurance and insurance against the unexpectedly large costs of twins.

Pet insurance is one of the UK’s fastest growing areas of insurance, with now almost seven million pet insurance policies, or around one-third of all pets being covered by insurance (YouGov, 2010).

If you decide to take out pet insurance or any other general insurance you should consider it carefully, using the financial planning process.

8.2.6 Reviewing your insurance

Work through a financial planning process for your general insurance needs and decide on an insurance plan for you and your household. If this seems too big a task, concentrate on just one area of insurance – maybe home or travel insurance.

Try to be precise. For instance, be as specific as you can in terms of the amount of cover needed, and what excess you will accept.

When you’ve made the plan, obtain the information you’ll need to act on it by asking for quotes for insurance products from different companies. You may want to use the telephone or internet for this.

Now look at your current insurance in the area(s) you’ve selected:

- Do you find that you can make any savings over current insurance costs?

- Have you checked that you haven’t got double insurance for any particular risks?

- Can you revisit your budgeting process in the light of any savings you identify?

8.3 Life insurance and other types of insurance

In this section, you will learn what your options are for life insurance and when it makes sense to buy these products. You will also look at supplementing the cover provided by the state, like NHS cover for medical matters, and also the revolution in pricing of insurance.

Where someone’s income is the major (or sole) part of household income, or their unpaid work is necessary to the care of others, the death of that person would risk making the dependants or co-dependants suffer serious hardship. So protection insurance, such as term life insurance, may be important. However, life insurance may be irrelevant to a single person with no dependants.

Around 40% of all households decide to take out life insurance. Many life insurance products take the form of term insurance, which insures against the financial consequences of death within a specified term of perhaps five, ten or 20 years. You can choose a term that mirrors the length of a large debt such as a mortgage. Mortgage providers often insist on life insurance and for many homeowners it makes sense to have it.

Term insurance can be level term insurance, where the amount covered will remain the same during the whole of the cover term. Or it can be ‘decreasing’ term insurance, when the amount covered decreases over the length of the term. This is typically used to protect against a debt that declines over time such as a repayment mortgage.

There is also a type of term life insurance (called family income benefit) that pays an income rather than a capital sum to family members. You could consider this if you have no substantial debts to cover. It could be used, for instance, to provide an income that replaces that of the person who died, or an income that can be used to buy replacement childcare or elderly care if a parent or a carer dies.

Some life insurance is not for a specified term, but is open-ended, or whole of life, cover. This is rather more expensive than term insurance, and is often used to build up an investment rather than dealing with the consequences of an untimely death. The cost of cover will depend on age and state of health.

Endowment policies, unlike term insurance, build up an investment value and pay out at the end of the term if the policyholder has not died. As you saw in Week 6, these kinds of policy were commonly associated with house purchases. Where the policy was purchased with a mortgage, the insurance cover provided protection against death during the term, while the pay out at the end was intended to be sufficient to clear the outstanding mortgage debt.

However, since endowment policies are stock market-linked investments, there was no guarantee that the policy would grow enough to pay off the mortgage in full. Following controversies over their ‘mis-selling’, and poor stock market performance throughout the 2000s, use of endowment policies for mortgages has been in sharp decline, with under four million policies left in operation by 2010. But endowment policies are still used for insurance-based savings products and bonds.

Some life insurance tips:

- Life insurance can be written ‘in trust’, so that any pay out goes straight to the beneficiary rather than into the deceased’s estate. This avoids the danger of having to pay Inheritance Tax, and avoids delays that can be caused by legal processes.

- The amount of cover you require should be calculated before buying life insurance. This might include paying off debts (including a mortgage), and providing capital from which to produce some income for surviving household members. No one should take the level of cover offered without assessing their personal needs.

- If you wish to take out life insurance you need to think about the possible effect of inflation on the policy – how much is any pay out of capital or income going to be worth in the future?

8.3.1 Health insurance

Private medical insurance (PMI)

PMI is expensive, and questions have been raised about the lack of facilities in some private hospitals, such as the absence of accident and emergency facilities. Some people have political or moral objections to paying for private health care in a society with an NHS system. In 2009 the British Medical Association expressed concern that some PMI providers were preventing or restricting patient choice about the consultant or hospital that can treat them (BMA, 2012).

A decision about whether or not to supplement the care on offer in the UK from the NHS with private medical insurance (PMI) will depend on individual factors. For example, someone running a business that may lose trade while they wait for an operation may have a greater need for PMI than someone who is not in that position.

Other factors to consider may include your perception of local NHS waiting lists and facilities, or ancillary aspects of care such as being looked after in a private room, or being able to exercise more choice over where and when treatment takes place.

PMI usually covers hospital charges, treatments, drugs, diagnostic tests, outpatient treatments, and may pay cash for hospital stays when the insured opts for the NHS rather than private health care. Conversely, there are many substantial exclusions, such as all long-term and degenerative illnesses common in old age, AIDS, pregnancy, having vaccinations, and alcohol and drug misuse. PMI premiums have risen substantially in recent years for the same reason that term life cover premiums have been falling – advances in medical technology, procedures and available drug treatments. As a result, PMI can be very expensive in later life.

Partly in response to the rising costs, providers increasingly offer budget plans and pared-down policies with a larger excess that can limit the cost, as well as innovations such as links with gym memberships and so on.

NHS dental provision still exists on a patchy basis. While most people will have to pay 80% of treatment costs on the NHS, there are still some categories of people who are entitled to free treatment, such as children, people in receipt of certain benefits, pregnant women and people on a low income (including students), who can obtain an HC2 certificate by completing a form available from the dentist or local social security office. Being a pensioner does not guarantee access to free dental care. There are specific dental insurance policies available, as well as dental health plans. The latter require a monthly subscription in return for access to dental work – usually for no additional charge, or the subscription perhaps covers 75% of the costs incurred for certain ‘routine and restorative’ work. An individual’s monthly subscription will vary according to the condition of their teeth, although some schemes may be available through an employer on a group basis.

Health cash plans

These are different to PMI in that they offer small, direct cash payments in the event of certain medical circumstances, in return for a monthly payment that is effectively a subscription to belong to the plan (rather than an insurance premium). They also tend to focus on an individual’s (or family’s) primary health care needs, whereas PMI will focus more on specialist diagnostics and private hospital treatment. Health cash plans are traditionally offered by not-for-profit, mutual organisations like Health Shield and the Simplyhealth Group, which incorporates many previous plan providers like HSA and HealthSure. These plans enable policy holders to claim cash if they undergo common medical treatments such as dental and optical care, physiotherapy and sometimes complementary medicine, which PMI often does not cover.

Health plan providers generally offer a number of types of plan, ranging in cost and in the potential level of cash to be paid back to customers. Such plans are often available through employers who may operate a scheme whereby they obtain a discount for their employees. People take out these plans because they are seen as affordable and very simple. The number of health cash plans held in the UK is just over three million, with the vast majority of these being paid for by individuals rather than employers (Laing and Buisson, 2010). Another interesting development is that some providers of PMI (such as BUPA) who have been facing a declining market have entered the health cash plan market. This might in future serve to blur the distinction between the two types of financial product.

8.3.2 Income protection insurance

If the ability to work and earn income is impaired or lost, there’s a major risk to the financial well-being of an individual and their household. The long-term illness or disability of someone providing care can also cause major financial loss to a household if an alternative form of care has to be found and paid for.

Private insurance policies in this area are a complement to the protection that may be offered by employers and by the state. For example, in the case of serious illness, in the UK the state will offer some support through the National Insurance and benefits system, and some employers may do so too. Yet state benefits will produce an income that is well below average, and that may be insufficient to sustain an existing standard of living. So in addition to finding out what’s available from an employer, it is also important to consider what self-insurance is available: for how long could assets produce an income, or be used up, to sustain someone in a medical crisis?

Income protection insurance (IPI) (also known as permanent health insurance or PHI): designed to pay an income (sometimes tax-free) when a person is unable to work due to serious illness or injury, if necessary through to retirement. Its take-up has been very limited, perhaps because it is a complex product and subject to adverse selection, so that the premium can be too high for the people most interested in taking it out, such as those in poor health.

Critical illness cover (CIC): this used to be a simpler product than IPI but has become increasingly complex in recent years. It pays a lump sum tax-free payment if the insured is diagnosed with a restricted range of major disabilities or life-threatening illnesses, such as heart attack, stroke, some cancers, or nervous diseases, or if permanently disabled and unable to carry out basic tasks. Assessment often revolves around whether the insured is able to undertake certain basic tasks of daily living without assistance. Once payment has been made against such a policy, the insurance ceases and the insured is free to spend the money as they wish, for example, to make adaptations to the home, or pay for private nursing care.

It’s important to appreciate that only a precise list of conditions is covered in CIC and, as treatments and survival rates improve, the list is becoming increasingly hedged around by small print. Moreover, the most common reasons for being unable to work are back problems and mental stress – neither of which would trigger a CIC pay out. Similarly, rare or undiagnosed conditions result in no pay out. Consequently, CIC could not meet an assessed need of providing protection against any loss of income from being unable to work. Many insurers offer CIC in combination with life assurance, which can be on a level or, in the case of mortgage cover, a decreasing basis. CIC can be added on to an endowment policy when arranging a mortgage. Once again, these combinations should be considered carefully according to need, particularly if taking them out together would produce a discount. In this case, it is important to think about why such a discount is being offered. CIC policies vary – some have the option of a guaranteed or a renewable premium. The former is more expensive, but means the premium will not increase even if, for example, new screening methods result in more claims being made. Some policies are now available that offer reduced premium payments for less serious, more ‘survivable’ types of disease, and others offer ‘cancer-excluded’ policies for cancer survivors.

Accident, sickness and unemployment (ASU): this insurance covers these three named eventualities. It can be a standalone policy, it can be sold as loan payment protection insurance or, as mentioned in Week 6 it can be sold when connected with a mortgage, as mortgage payment protection insurance (MPPI). The distinguishing feature of ASU insurance is that the pay-out is (normally) limited to a maximum of two years, whereas PHI pays out until recovery or retirement. MPPI needs to be considered as part of the decision on an overall ‘insurance plan’, not just in terms of state benefits and assets but also in terms of other insurance arrangements and policies. For instance, it might be duplication to have both income protection insurance and MPPI, depending on circumstances. Normally, MPPI policies are offered at a particular rate and pay up to a maximum of approximately 125% of monthly mortgage outgoings, with payment normally starting a short period after the peril happens.

8.3.3 Gender and insurance

A decision in 2011 by the European Court of Justice (ECJ) meant that from December 2012 insurance companies in Europe could no longer take gender into account when pricing their insurance products. This move has had a major impact on the insurance industry.

Do you think the decision is rational, taking into account what you’ve learned about how insurance products are priced?

Who have been the gender winners and losers from this decision? In particular, think about car insurance and life insurance.

8.3.4 Winners and losers?

Women are losers when it comes to both car and life insurance – in both respects they are a lower risk than men and this should, with risk-based pricing, make insurance cheaper for women. By contrast men are losing out through the removal of the gender differential on annuities. Men used to get higher annuities due to lower average life-span – women got lower annuities due to longer average life-span. The differential has now been removed – although in recent years the average life-span gap between men and women has been narrowing.

You’re almost at the end of the course and in the next section you will complete the end-of-course test. It’s made up of 15 multiple-choice questions which cover the entire content of the course. Then Martin returns for a final round-up.

End-of-course test

This test allows you to test and apply your knowledge of the material in across the entire course.

Complete the End-of-course test now.

Open the quiz in a new window or tab then come back here when you're done.

End-of-course guide and round-up

Martin says a final goodbye as the course comes to a close.

Transcript

The purpose of the course has been to provide you with the information and skills to manage your financial affairs effectively.

Week 1 explained how you can structure and operate a financial planning model for you or your household.

Weeks 2 and 3 looked at the cash flows of household income and expenditure and at how these can be measured to enable you to create both a budget and a projection of future net cash flows in future years.

Weeks 4, 5 and 6 built towards the construction of the household balance sheet. Week 4 looked at debts (liabilities) whilst Weeks 5 and 6 looked at savings, investments and home ownership (assets). Compiling the household balance sheet provides a clear summary of a household’s net wealth and enables you to test the strength of the balance using measures like the current asset ratio.

Week 7 looked at the key issue of planning for your pension and at the different forms of pension provision in the UK. The information here should be used to check how much income you will get in retirement and whether this will be sufficient for you.

Week 8 has concluded the course by looking at insurance products. You should check your own current insurance arrangements using the information provided this week to review whether you have sufficient (or perhaps too much?) insurance cover, given the nature of the activities and risks to which you and your household are exposed.

Well done for completing this OpenLearn course on personal finances.

Now you've completed the course we would again appreciate a few minutes of your time to tell us a bit about your experience of studying it and what you plan to do next. We will use this information to provide better online experiences for all our learners and to share our findings with others. If you’d like to help, please fill in this optional survey.

References

Acknowledgements

This unit was written by Martin Upton and Jonquil Lowe.

Except for third party materials and otherwise stated in the acknowledgements section, this content is made available under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 Licence.

The material acknowledged below is Proprietary and used under licence (not subject to Creative Commons Licence). Grateful acknowledgement is made to the following sources for permission to reproduce material in this unit:

Unit image

Figures

Figure 9 contains images © istock/AndrewJShearer/KLH49/vikif/asbe/stephanmoorris

Figure 14 © iStockphoto.com/pixdeluxe

Audio visual

Insurance – Setting the scene contains archive material © BBC

Keeping down the cost of home insurance contains images © 123RF

Every effort has been made to contact copyright owners. If any have been inadvertently overlooked, the publishers will be pleased to make the necessary arrangements at the first opportunity.

Don't miss out:

1. Join over 200,000 students, currently studying with The Open University – http://www.open.ac.uk/ choose/ ou/ open-content

2. Enjoyed this? Find out more about this topic or browse all our free course materials on OpenLearn – http://www.open.edu/ openlearn/

3. Outside the UK? We have students in over a hundred countries studying online qualifications – http://www.openuniversity.edu/ – including an MBA at our triple accredited Business School.

Copyright © 2014 The Open University