1.3.6 Case study: whatever happened to UK savings rates?

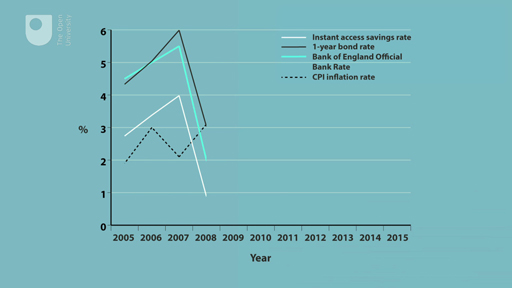

A major development that affected millions of investors in the UK after 2007 came with a fall in interest rates paid on savings accounts.

The audio and the supporting graphics in the video below set out the decline which resulted in investors earning less than the prevailing rate of price inflation with the consequence that the real value of their savings ended up being reduced. The causes of this development are explained in the audio.

The episode is both a classic case of macro-economic policy having both winners and losers and of the realities of inflation risk on investments. Faced with such meagre returns many investors turned to alternative investments to boost their income – but in so doing took on a variety of alternative investment risks.

While the audio covers events in the first half of the 2010s the issues it identifies remain relevant today. The general level of interest rates is determined by the Bank of England’s official rate (Bank Rate) and the returns that savers can expect are therefore inevitably influenced by those economic factors that determine Bank Rate – principally the levels of price inflation and economic activity in the UK.