3.2.1 Following the double-entry rules

The following example shows how T-accounts work to record a transaction as a double entry.

On 1 June 20X5 a business purchases a computer for £7,000 on credit from a supplier, Jones Limited.

According to the duality principle both the computer account (an asset account) and the Jones Limited account (a liability account) will be increased by £7,000 to reflect the credit purchase.

The transaction is recorded in the two separate T-accounts according to certain steps and rules that apply to every transaction.

For every transaction you need to follow three steps:

Step 1: Identify the two accounts affected.

Step 2: Decide the effect on each account. Perhaps one account is increasing and one is decreasing, or both accounts are increasing, or decreasing. (This ensures that that accounting equation A = C + L is always kept in balance after every transaction.)

Step 3: Record the entries.

If a transaction increases an asset account, then the value of this increase must be recorded on the debit or left side of the asset account. If, however, a transaction decreases an asset account, then the value of this decrease must be recorded on the credit or right side of the asset account. The converse of these rules applies to liability accounts and the capital account. These rules are summarised below and should be memorised.

| Account name | Effect of transaction | Debit | Credit |

|---|---|---|---|

| Asset | Increase | Debit | |

| Decrease | Credit | ||

| Liability | Increase | Credit | |

| Decrease | Debit | ||

| Capital | Increase | Credit | |

| Decrease | Debit |

Box 2 Stop and reflect

Why do you think the rules of double entry must be memorised?

These rules of double-entry accounting must be memorised as they form the basis of further work in this course as well any further study you do in accounting. The best way to remember them and to see how they work is to work through the following example and activity, so that double entry slowly becomes second nature to you.

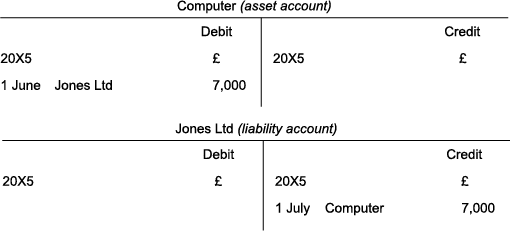

In our example below, and according to the double-entry rules, the increase to the asset account ‘Computer’ must show a debit of £7,000, while the increase to the liability account ‘Jones Limited’ must show a credit of £7,000.

Each T-account, when recording a transaction, names the corresponding T-account to show that the transaction reflects a double entry. So, in the computer account the £7,000 debit is described as ‘Jones Limited’, and in the Jones Limited account the £7,000 credit is described as ‘Computer’.

Box 3 The reason why your bank account says your positive bank balance is a credit

When you have money in the bank, the bank statement shows that your account has a credit balance. This is because when the bank receives money from you they credit your account in their books as your deposit is a liability to them. If you tell them to pay your money to someone else (perhaps a mortgage payment or a mobile phone bill) the bank will have effectively given the money back to you and so the bank will debit your account. According to the same rules of double entry, if you have your own bank account, your deposit will be an asset in your books and thus a debit in your bank account. Any payment from this asset account will thus be a credit entry to show that the asset has decreased in value. Always remember that the bank’s records are a mirror image of your own as your deposit is a liability to them but an asset to you.