3 Understanding Income Tax

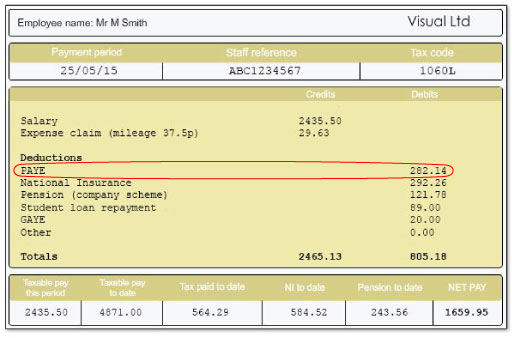

When you earn money by working you don’t receive the whole of your wage (your ‘gross’ pay). Instead, you get your gross pay minus certain payments to the government. What’s left is your ‘net’ pay.

In the UK the top two payments that come out of your gross income are Income Tax and National Insurance. Government’s tax and National Insurance receipts fund all benefits as well as other public services and state provision (for example, state education, the NHS, police, social security, some aspects of transport, the armed services). Depending on your circumstances, your wage might also be topped up with benefits.

Some people have further deductions in the form of contributions to a pension scheme. These schemes are discussed later, in Session 8.

Income Tax is imposed – levied – on almost all types of income (it’s not payable on gifts, lottery winnings, Premium Bond winnings and ISA earnings). When it’s collected through an employer (when the worker is employed rather than self-employed) it’s often referred to as a ‘pay as you earn’ (PAYE) tax.

Income Tax is paid on income that is received by you within a given tax year, from 6 April in one year to 5 April of the following year. It is the single largest source of government revenue, accounting for around a third of all tax receipts.

Watch the following video to find out more about Income Tax.

Transcript

In the UK Income Tax system most people are allowed to earn up to a certain amount of money before Income Tax has to be paid. This is called receiving an ‘allowance of income’, and the type of allowance is called a ‘personal allowance’. In 2023/24 this personal allowance was £12,570. The allowance is higher for certain groups of people, such as those who are registered blind.

The personal allowance has an income limit of £100,000, so if you earn above this limit the allowance tapers away.

Income above the personal allowance is subject to tax at three different standard rates:

- in 2023/24 in England, Wales and Northern Ireland the first £37,700 (after the basic allowance had been taken into account) was taxed at 20%. This is the basic rate tax ‘band’

- above the basic rate ‘band’ and up to £125,140 of taxable income, the rate was 40%

- there was a rate of 45% on taxable incomes over £125,140.

The animation at the top of this step shows how income tax works. It uses the allowances that applied in 2017/18 but the principles relating to how tax is deducted remain the same today.

Note that slightly different tax income ‘bands’ and income tax rates are applied in Scotland as a result of the devolution of powers to the Scottish Parliament. More details can be accessed here: income tax in Scotland [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)] .

Discretion over Income Tax has now been extended to Wales.

By taxing additional income slices at higher rates, the proportion of tax increases with income. UK Income Tax is an example of ‘progressive’ taxation because the proportion of income paid as tax increases as a person’s income increases. This tax structure helps to reduce income inequalities in the country.