5 What are potential investors looking for?

It is easy to get caught up in your own ideas and beliefs in the value of what you are doing – and this is a good thing. However, in order to get investors and those a little more distant from it to literally buy into it, they need to see the mutual value.

Reflection

Take a moment to reflect on what kind of enterprise you might invest in and why. What factors might you take into consideration? What would you expect in return? Capture your thoughts below.

You may have additional terms or values that you take into consideration over and above external investors, however, generally speaking, potential investors seek a return through regular repayments, dividends or on an increase in the future value of their shares. They will want to understand past performance as an indication of the viability of your plans. For example, can you demonstrate your profit margin? This tells them how well you control your costs. A higher profit margin indicates more resilience to unforeseen situations and events. There are other facts and figures you may want to gather to satisfy investors of your prospects:

- The rate of growth compared with your past, competitors, and the current state of the economy will provide an indicator of the attractiveness of providing a loan or investment.

- Your own personal track record, particularly if you are starting out, to provide relevant history of success. Do you have any particular skills or resources or capabilities that you intend to exploit (refer back to Session 6). Is there a particular technology or knowledge for which you have a patent? Is there a new demographic or geographic market that you are targeting? All of the work you have done to define your business model and your value proposition – as emphasised in Session 3 – needs to translate into ways in which investors can see a return.

- Your effectiveness in collecting cash from customers to manage cash flow, if you have been trading for a while.

- Evidence of any collateral or assets that provide security.

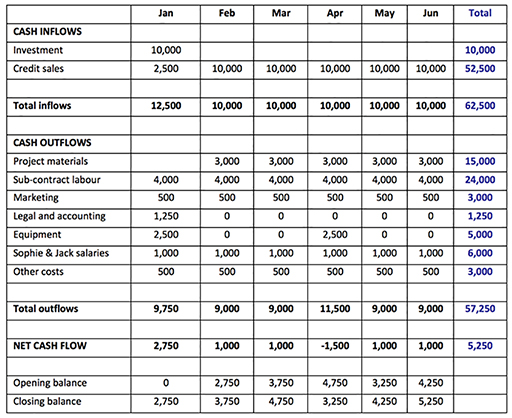

Some businesses are seasonal or cyclical and so need to plan for shortfalls of cash after periods of high demand, e.g. Christmas or Hanukkah. Demonstrating that supply can meet demand at the peak point of the cycle is important for business continuity. A cash flow forecast will help you pace your expenditure in order to cope when sales are low and cash is scarce. Having a cash contingency plan in place for when cash inflows drop will make for more comfortable reading by investors and other stakeholders.

Can the cash flow forecast withstand a short-term, sharp shock like an equipment breakdown or loss of a major client order? Is there sufficient cash to recover, repair and recommence operations?

There may be many other questions, so be prepared by evaluating and testing your cash flow forecast.

Next you will look at debt financing.