4.2 Chinese oil companies and Sudanese politics

China started oil exploration in Sudan in 1995, initiated by Khartoum’s request the previous year for help in oil development, under isolation from the West and its own neighbours. China was also at the time under Western sanctions following the Tiananmen Square incident in 1989, where student led protests calling for more democracy and public accountability to the people were brutally put down by the ruling party. Thus, saw in Sudan an opportunity to establish energy-based cooperation with a country for which it faced little competition at a time when its domestic oil reserves were in decline (Large, 2008). A team from the Zhongyuan Oil Company (under Sinopec) was sent to Sudan in 1994 to inspect the potential of oil exploration, and it found high geological similarities between the Sudanese oil fields and that of China’s own Daqing oil fields, providing an excellent opportunity for Chinese NOCs to get involved in Sudan’s oil development (according to interviews with CNPC specialists in July 2018).

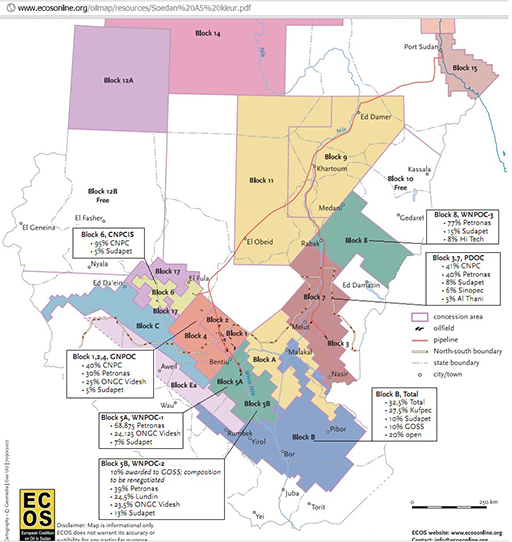

Following a visit by Sudanese President Omar al-Bashir to Beijing in September 1995, CNPC signed a petroleum contract to develop Block 6 in Sudan’s Heglig Oilfield. In order to spread the investment risk and to enable Sudan to avoid placing all of its eggs in one (Chinese) basket, the Greater Nile Petroleum Operating Company (GNPOC) was established in 1997 as a joint venture, involving CNPC (40 per cent of stake) Petronas (Malaysian, 30 per cent), Talisman (25 per cent) and the newly created Sudan Petroleum Company (Sudapet, 5 per cent).

Sudapet was established in 1997 as a national oil company, completely owned by the Ministry of Petroleum/Sudan Petroleum Corporation (SPC), to represent the Sudanese government in various consortia. Sudan’s share (which could range from 5 to 33 per cent) in petroleum licenses are held by Sudapet and any transaction or joint venture with other companies is exercised through the Deputy Chair of SPC (Sidahmed, 2016). According to Sidahmed, however, Sudapet never publishes annual reports, or provides information regarding its financial position or data regarding its upstream and downstream operations.

The presidency of GNPOC has been held by a Chinese executive due to CNPC’s dominant share within the consortium. When Talisman decided to withdraw in 2002, it sold its 25 per cent stake for US$758 million to India’s Oil and Natural Gas Corporation. In March 1997, the GNPOC consortium won the right to develop Blocks 1, 2 and 4 in Heglig, and in April 1999 a 1,506 km-long oil pipeline linking Heglig oilfield to Port Sudan was built, allowing Sudan to supply its crude to international markets. In August 1999, two decades after its oil discovery, Sudan was for the first time exporting its oil (Shinn, 2007). Thanks to the Chinese and other partners’ investment, by 2010 Sudan was able to declared that it owned 6.7bn barrels of proven oil reserves, compared with 0.3bn barrels in 1990 (Li, 2011).

The bilateral trade relations between China and Sudan resulted in substantial development in the new century. Chinese NOCs, such as CNPC and Sinopec, became major players in Sudan’s oil sector, both upstream and downstream; they also built a refinery and a tanker terminal in Khartoum (Large, 2009; Goodman 2003). By 2005, Sino-Sudanese trade reached US$3.9bn and China became Sudan’s top trade partner. However, such a relationship was quite imbalanced: while oil counted for 71 per cent of Sudan’s exports to China, it counted for just 5.2 per cent of China’s oil imports, and China’s exports to Sudan (mainly mechanical and electronic goods) was only 0.2-0.3 per cent of China’s total export trade (Tian, 2006, p. 4; Large 2008 pp. 6-7). Before the partition of the two Sudans in 2011, oil from Sudan accounted for 5.1 per cent of China’s oil imports, ranking 7th after Saudi Arabia (19.8 per cent), Angola (12.3 per cent), Iran (10.9 per cent), Russia (7.8 per cent), Oman (7.2 per cent) and Iraq (5.4 cent) (Tian, 2006).

Over the past few years, because of the constant conflicts between the two Sudans and/or within South Sudan, oil production in both countries has been severely affected, and the oil exports from Sudan in 2015 were less than 1.4 million mts and only 720 thousand mts in 2017; oil from South Sudan during the same period was only 6.6mts and 3.4mts respectively, accounting for less than 1 per cent of China’s oil imports (Tian, 2018).