6.6 Stabilisation policy

You have seen that fiscal policy can be used, in times of economic crisis, to stimulate aggregate demand either by increasing government spending or by reducing taxes. As part of the Roosevelt New Deal, and more recently by President Obama in the USA, these types of fiscal stimulus were used to stabilise the economy in response to problems of severe contraction in national income.

In the golden years of Keynesian economics, however, during the 1950s and 1960s – when the UK Conservative Prime Minister Harold Macmillan pronounced ‘You’ve never had it so good’ – governments did not have to deal with such crises. The news programmes were not reporting people queuing outside banks (as in the 2007 collapse of Northern Rock) or the unemployed queuing outside job centres. Far from there being a problem of unemployment, there was a shortage of labour, which encouraged population movements such as the Windrush migration from the Caribbean to the UK.

For most of this early postwar period, capitalist economies enjoyed continued growth and mild business cycle fluctuations. In such circumstances, there would be repeated periods of boom (high growth) and slowdown (low growth); governments would see their main responsibility as smoothing out the peaks and troughs of the cycle, an approach referred to as ‘fine-tuning’.

This period of sustained growth was attributed in part to the benefits of Keynesian intervention – in sharp contrast to the plethora of disasters that befell the world economy in the 1920s and 1930s. Postwar governments bought into the Keynesian idea that it was their responsibility to manage aggregate demand. In the USA, during the 1960s, the phrase ‘We are all Keynesians now’ (Friedman, 1965) was even used by the right-wing president, Richard Nixon. In the UK, successive Conservative and Labour Chancellors of the Exchequer (Hugh Gaitskell and Rab Butler) were arguably so close to each other that their names were combined in an approach called ‘butskellism’: where the mixed economy, consisting of a viable private sector and a large welfare state, were championed. It was not until the 1970s, when problems of inflation reared their ugly head, that this postwar Keynesian consensus fell apart.

Two main types of fiscal policy were developed during this period. First, governments can use discretionary stabilisers, actively adjusting fiscal policy in response to boom or slowdown in economic activity. If the economy is overheating (growing too fast), for example, the government might decide to increase tax in order to temper aggregate demand – and vice versa under a slowdown. As you saw earlier in this section, the impact of using this type of discretionary stabiliser will tend to be amplified by the multiplier effect. Since for Keynes, in general, the economy is likely to operate at output levels less than full employment, discretionary stabilisers are required to snuff out high unemployment.

Yet if the public sector is sufficiently large, in a butskellite type mixed economy, then its very presence can dampen down the business cycle. If growth slows, for example, and there is an increase in unemployment, then under a welfare state workers will receive unemployment benefit. So although they are not earning the wages that they earned under employment, unemployed workers are still able to consume, albeit at a lower level. Such a transfer payment can be thought of as a negative tax, affecting consumer expenditure in a similar way to a tax cut.

This second type of fiscal policy is referred to as an automatic stabiliser – a fiscal response to a slowdown in economic activity that happens without any active decisions on the part of the government. Governments, of course, have to choose to keep the system in place to facilitate this automatic spending, but they do not have to actively direct the spending from day to day.

At the same time as government transfer payments will automatically increase during a slowdown, tax revenue will fall. At lower levels of income, tax receipts such as those out of income (Income Tax) and profits (Corporation Tax) will fall. The welfare and tax systems in the economy create their own adjustments in aggregate demand, making the slowdown less pronounced than it would have been without the state sector. Similarly, in an upturn, as incomes increase so does the proportion of income directed to tax.

In recent years, policymakers have found these stabilisers to be very attractive, since they can smooth out both peaks and troughs of the business cycle. Tax-based automatic stabilisers provide a symmetric approach to fiscal policy, with attention paid to both sides of the business cycle. In the early 2000s, this was the official position of the European Central Bank (ECB): ‘Automatic stabilisers are the appropriate way to stabilise output, as they have foreseeable, timely and symmetrical effects […] there is normally no need to engage in additional discretionary fiscal policy-making for stabilisation purposes’ (ECB, 2002, pp. 41, 46, quoted by Lodewijks, 2009, p. 3).

This contrasts sharply with the Keynesian consensus of the 1960s, when it was thought that automatic stabilisers were insufficient to manage the business cycle. US President John F. Kennedy argued in 1962 for a ‘shelf of public works’ that could be introduced if unemployment rose – together with increases in the period for which unemployment benefits would be paid (Lodewijks, 2009, p. 4). The problem, for the USA, is that state spending has tended to constitute a smaller part of national income than in European countries such as the UK, so automatic stabilisers do not have as much impact.

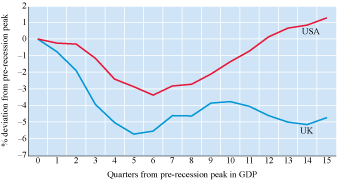

Despite its weaker automatic stabilisers, the USA enjoyed a stronger recovery than the UK in the period immediately following the economic crisis of 2008. Adam Posen, a member of the Bank of England’s Monetary Policy Committee, has explained this recovery as being in part due to differences in the discretionary fiscal policy:

For almost the entire period since March 2007, and particularly since March 2010, the US has run a looser overall fiscal stance – a more stimulative fiscal policy – than the UK, even taking the full operation of the larger automatic stabilisers in the UK into account. Cumulatively, since 2007Q1, the difference has amounted to 3 per cent of GDP.

While Obama introduced a fiscal stimulus, the Conservative/Liberal Democrat Coalition in the UK implemented a fiscal contraction. Posen pays particular attention to the increase in VAT announced by Chancellor of the Exchequer George Osborne in his emergency Budget of 22 June 2010, from 17.5% to 20%. Posen argues that this VAT rise helps to explain the fall in private consumption since the peak of the business cycle, compared to the USA, as shown in Figure 21 by the divergence of the two lines after Quarter 10. The argument is that the increase in VAT, and its anticipation by consumers, led to lower consumer spending, which spilled over to fewer jobs and lower income throughout the economy.