7.1 Facing the competition

Activity 16

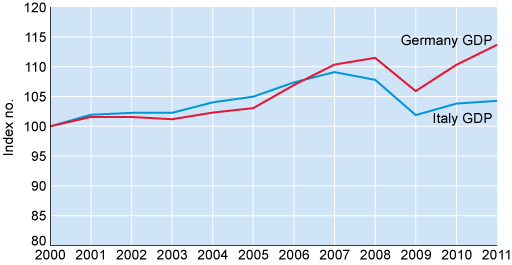

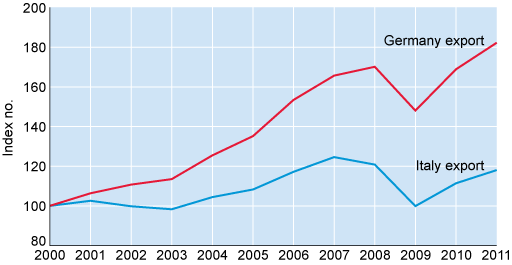

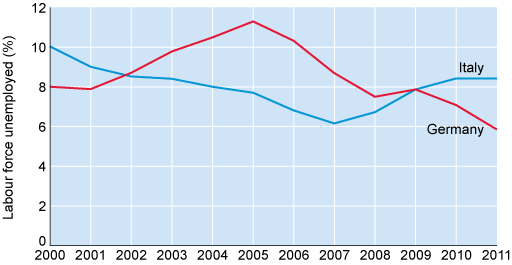

Examine the three figures shown below. Pause for a moment and consider what story they tell us about how these two economies are performing.

How do you think the macroeconomics relate to the performance of firms in these two countries?

Answer

The three figures above give a brief overview of the recent performance of the Italian and German economies. They suggest a contrasting economic performance. From 2007 the performance of Italy’s GDP has fallen behind Germany’s, as shown in Figure 24, particularly in the period following the economic crisis. Over the last decade, Germany has continued to improve its export performance, whilst Italy’s export levels have struggled to increase beyond the level in 2000. Interestingly, the unemployment rate in Germany has fallen since 2005, having started at a much higher rate than in Italy. Germany’s unemployment has continued to fall, even in the period following the economic crisis. In contrast, unemployment in Italy has remained between 6–8 per cent, and increased starting from 2008.

The difference in performance at a macro level may suggest some insight into the aggregate performance of firms in each country; it may suggest that German firms have some advantages over their Italian counterparts. For instance, investment in human capital in a country should help to increase the productivity of firms and make them more competitive internationally. So we might expect German firms, on average, to perform better than their Italian peers. However, even if there are differences in the macro performance of two countries, when we look at the micro level, we may be able to detect common characteristics of firm behaviour that can be related to higher performance, whether firms are based in Italy or Germany.