Compliance

| Site: | OpenLearn Create |

| Course: | 501(c)(3) Status for Neighborhood Associations |

| Book: | Compliance |

| Printed by: | Guest user |

| Date: | Saturday, 22 November 2025, 12:08 PM |

1. Understanding Compliance Requirements

Image by Adobe Stock

One crucial aspect of becoming a 501(c)(3) as a neighborhood association is understanding and adhering to compliance requirements. Compliance requirements are legal obligations that a nonprofit organization must meet in order to maintain its tax-exempt status. These requirements are put in place by the IRS to ensure that nonprofits operate ethically and transparently.

To meet compliance requirements, a Neighborhood Association seeking 501(c)(3) status must maintain accurate financial records, file annual informational returns (Form 990), and adhere to specific activities that fall within the scope of charitable, religious, educational, or other tax-exempt purposes. Additionally, the association must ensure that its board of directors acts in the best interest of the association and complies with conflict of interest policies.1

Failure to comply with the IRS regulations can result in penalties, fines, and potential loss of tax-exempt status. It is essential for Neighborhood Associations aspiring to become 501(c)(3) organizations to educate themselves on compliance requirements and seek professional guidance to navigate the complex process successfully.

1. Department of the Treasury, “Complaince Guide for 501(c)(3),” Internal Revenue Service, 2016, https://www.irs.gov/pub/irs-pdf/p4221pc.pdf.

2. Record Keeping

Image by StockCake

Good record-keeping practices not only help with annual reporting but also ensure the overall health and sustainability of your Neighborhood Association. By maintaining accurate financial records, meeting minutes, membership lists, and other important documents, your association can track your progress, make informed decisions, and build trust with your stakeholders.

It is important to keep record of:

- Copy of your Neighborhood Association's Form 1023 (non-profit application)

- Financial records (discussed in the next section)

- Bylaws

Your Neighborhood Association is required to provide a written acknowledgment of contributions if a donor requests it. This written acknowledgement must contain your Neighborhood Association name, the amount of monetary contribution, description of any contribution of property, and a statement that no goods or services were provided in return.1

Be sure to keep record of contributions throughout the year so that you are able to provide accurate written acknowledgments.

When in doubt, keep a record of everything!

1. Internal Revenue Service, “Charitable Contributions: Written Acknowledgments,” IRS, November 25, 2024, https://www.irs.gov/charities-non-profits/charitable-organizations/charitable-contributions-written-acknowledgments, 1.

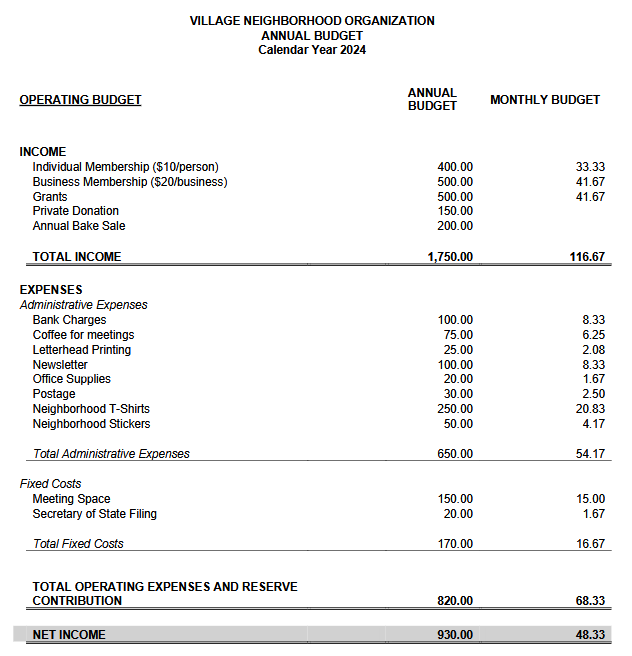

3. Example Budget

1. Planning and Neighborhoods and City of Springfield, Success Through Neighborhood Organization: A Neighborhood Resource Guide § (2024), 26.

4. Annual 990-N/990-EZ

As you read earlier, as a 501(c)(3), your Neighborhood Association must file an annual 990-N/990-EZ. Throughout the year, keep record of the things you will need for the form. This includes:

- Employer identification number (EIN) (received by completing SS-4 form)

- Tax year

- Legal name (i.e. ___ Neighborhood Association) and mailing address

- Any other names your Neighborhood Association uses

- Name and address of a principal officer of your board

- Web site address (if your Neighborhood Association has one)

- Financial records

5. Potential Pitfalls and How to Avoid Them

As a Neighborhood Association looking to become a 501(c)(3) organization, there are several potential pitfalls that you should be aware of in order to avoid common mistakes that could jeopardize your nonprofit status. One common pitfall is failing to meet the IRS requirements for tax-exempt status, such as not operating exclusively for charitable purposes or not having a proper organizational structure in place. Another pitfall is not keeping accurate records and failing to file required annual reports, which could result in penalties or loss of tax-exempt status.

To avoid these pitfalls, it is important to thoroughly understand the IRS requirements for 501(c)(3) organizations and to ensure that your Neighborhood Association complies with all regulations. This includes having a clear mission statement that demonstrates your charitable purposes, establishing a board of directors with proper oversight and governance, and maintaining accurate financial records. Additionally, it is crucial to file Form 1023 or 1023-EZ with the IRS to apply for tax-exempt status and to submit annual Form 990 informational returns to maintain your status.