Use 'Print preview' to check the number of pages and printer settings.

Print functionality varies between browsers.

Printable page generated Saturday, 21 February 2026, 9:13 PM

2. Budgeting

2. Budgeting

A budget is one of the best tools we can use to get control of our finances. It’s not about going without things, it’s about deciding what things we want and making sure we have the money when we want to buy them. Setting a budget helps you:

- control your spending and focus it on the things you care about

- check you have enough money to pay your current and future bills without having to borrow unexpectedly

- decide what your goals and spending priorities are – what you want – and plan for how to achieve them

While it may seem easy to borrow money by spending on a credit card or using an overdraft without thinking much about it, this often comes with a high price later, forcing us to cut back harder and go without when we need to pay it back. Budgeting can avoid this by deciding beforehand what we want to spend and helping us stick to it. It can give us the confidence to spend money knowing we’ve planned for it and can afford it, helping us through the financial ups and downs we all face over our lives with the minimum of stress.

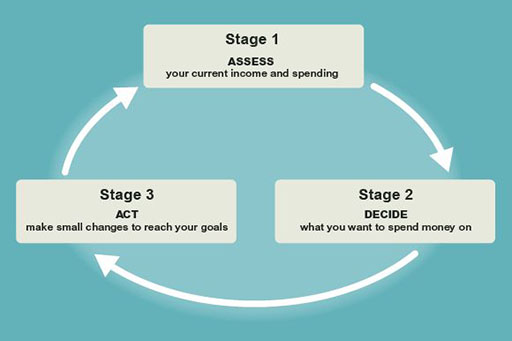

Budgeting is surprisingly easy to do. Over the next four pages we’ll take you through our simple budget planner and help you create your own budget. Save this to your computer as we’ll be filling it in as we go along. Do you want to own your own house, have a debt-free Christmas, take your family on holiday, or simply stop worrying about money? Whatever your financial circumstances and goals there are three steps to follow, and along the way we’ll give you some practical tips on how to make them a reality:

To illustrate the process we’ll be following the example of 28 year old insurance clerk Jenny, who’s starting to budget with the help of Martin Upton, senior lecturer in finance at the Open University and director of the True Potential Centre for the Public Understanding of Finance.

Transcript

Stage 1. Assess: work out your income

We start by working out our current income in a typical month. Have the budget planner included in this course to hand as we’ll be filling it in as we go along. It can help to look at recent bank statements or payslips when doing this. Let’s start with the income part of the first column – “Assess”:

Step 1: Work out your monthly pay. This should be the amount you receive after tax, and can be found by looking on a recent pay slip from your employer or a recent bank statement. If you are paid weekly you can convert this to a monthly amount by multiplying by 52 and dividing by 12.

Step 2: Add any additional income, such as benefits you receive, income from investments, or child maintenance payments. If these are irregular estimate how many times a year each happens and convert these into monthly figures – multiply each by the number of times a year and divide by 12.

Step 3: Add these together to give your total income. If you’re in a one-person household this is how much cash you have available each month. If you have shared finances it is usually best to create a household budget by repeating these steps for each household member and combining the results.

Here’s the income part of Jenny’s budget to give you an example:

Extension: are you claiming all the benefits you’re entitled to?

Stage 1. Assess: calculate your spending

We continue filling in the “Assess” column in the budget planner by calculating your spending in a typical month. If you completed the income side as a household continue to do so here as well.

Step 1: Find a recent statement for all bank accounts and credit cards you regularly use.

Step 2: Note down your rent or mortgage and any other regular monthly bills you pay – e.g. council tax, utilities, phone, TV, direct debits and standing – and enter these into your budget planner. If you have any weekly bills convert these to a monthly amount by multiplying by 52 and dividing by 12.

Step 3: Divide the rest of your day-to-day spending into the categories within the budget planner. Don’t include annual or one-off payments here like holidays or furniture, we’ll come to these later, but try to estimate which category any cash you’ve spent best fits into.

Step 4: We’re trying to create an accurate picture of your spending in a typical month, however many items of spending can vary greatly from month to month. Have a look at the figures you’ve entered and adjust any that seem higher or lower than usual. Most of us underestimate our spending and it’s vital we avoid nasty surprises, so try to estimate spending on the higher end of what you think is typical. If you have bank statements from a few recent months it can be useful to compare these to help you decide.

Step 5: Make a list of your annual or irregular spending, such as Christmas presents, durable goods, holidays or car repairs. Again, it’s important not to underestimate how much you spend on these, as irregular spending can easily add up and break a budget. Convert these to monthly figures by estimating how many times a year each tends to happens, multiplying each by this and dividing by 12.

Step 6: Add these up to give you a total spending figure.

Once you have a total income and spending figure, subtract your spending from your income, as shown in the budget planner. What is the result? This should represent how much you’re saving or borrowing in a typical month. If it is positive, you should see your bank balance rise each month, and if negative it is likely to be falling. Is this the case? If not, revisit your income and spending as it’s easy to miss something.

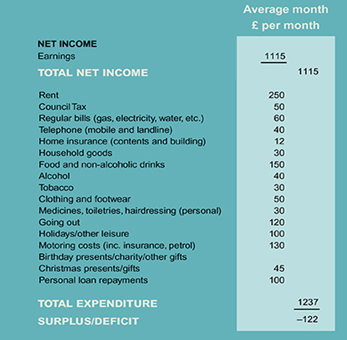

Have a look at Jenny’s budget to get the idea:

Stage 2. Decide: what do you want?

Now you’ve assessed your current income and spending, you can start deciding what you want. Go to the “Decide” column in your budget planner and fill it in as you do the steps below – we’ll come back to your budget table later on but need to focus on your goals first. What are your goals, and what do you need financially to achieve them? What are your spending priorities – what kind of spending makes you happy? How can you do both while guarding yourself and your family against financial shocks that may lie ahead?

Step 1: Make a list of your goals – things you want or would like to achieve. They might be a particular holiday you want to have, an item you want to own, an experience, a new skill you want to learn, or a change in your circumstances such as being debt free or being more confident and less worried about your finances. They could just be being able to spend more money on a certain area, such as your children, clothes or going out more. I’d suggest thinking of around 2-10 goals.

Step 2: Imagine yourself in the near future with each goal achieved or not achieved, and concentrate on the difference each makes. For example how happy would you be if you’d just come back from a particular holiday, if you owned your own home, or if you were free of money worries, compared to how you are now? This may sound like a silly exercise but research shows matching your personality to what you spend money on can have a bigger impact on your happiness than how much money you have, and one of the most positive effects of budgeting is to refocus your spending towards things that really make you happy.

Step 3: Narrow your list to the 1-2 goals you think would make you happiest. Write them in the goals table on your budget planner.

Step 4: Think about the implications of each goal – what needs to happen to achieve each? What actions do you need to take? You may find there are trade-offs between different goals. If so, try to identify which are most important for you to achieve.

You’ll notice that goal 3 is already filled in: regularly save a small amount into a savings account. There is a huge amount of evidence that having even a small amount saved in case of an emergency significantly reduces the impact financial shocks have on us, and that we all underestimate how likely a shock is to occur. Things like your car or boiler breaking down, losing your job, falling ill, or any of the host of other reasons you might need to find some money quickly. Debt charities estimate that half of all households who find themselves in serious debt problems – around 500,000 people – wouldn’t do so if they have £1000 saved. Saving a small amount regularly, even if you can only afford a few pounds a month, may be the single most important thing you can do for your and your family’s financial wellbeing. Later on we’ll show how virtually everybody can do this.

Transcript

Stage 3. Act: make small changes towards your goals

After having realised what you want, you know your goals and you want to get there. To achieve your goals you’ll likely need to reduce your spending in some areas. This isn’t easy and will require effort, but by working out what’s important to you and focusing on small changes to your habits you can often have a much bigger impact with less pain than you’d expect.

Always keep in mind the positive – the goals you’re working towards, why they matter to you, and how your life will be different when you reach them. You’re not cutting spending, you’re moving it from things you currently spend it on to what you’ve decided you really want.

Go to the “Assess & Act” table of your budget planner. With each step look at the current spending figures in your budget planner, consider how you want to change it, and write the new figure in the budget column.

Step 1: Explore ways you can save money without noticing it. For example are you paying for a gym or subscription you no longer use? Have you got extended warrantees or specific insurance to cover goods already covered by your home insurance? Could you get a better deal on your mobile phone, TV, mortgage, credit card, insurance, or energy bills? We’ve collated some tips on saving money for personal finance experts below, though these are far from exhaustive. Money Saving Expert has many more tips on saving money, and an active forum where you can ask questions.

Step 2: Rule out spending you cannot change. Look at the current spending table of your budget planner. Which items do you consider essential spending that you could not reduce at all? We all have lines we are not willing to cross but be strict with yourself when ruling out changes.

Step 3: Think about changes in your life you’d like to make that could also save you money. For example you may want to stop smoking, drink less alcohol, have a meat-free day, or cycle to work rather than driving. These are all difficult changes to make but the financial benefit could provide the additional motivation you need to make that change.

Step 4: Work out the one or two areas where spending money makes you happy and try to find cheaper alternatives for everything else. Most of us have one or two things we really care about and many others where we’d barely notice the difference. Personally I don’t mind buying cheaper clothes, taking tea bags to work rather than going to the coffee shop, having friends over instead of going to a bar, swapping the gym for a run, or driving a cheap-but-reliable car, but I love food and would struggle to cut my grocery bill. Focusing your spending in this way minimises the pain of cutting back, and you may even find you can afford to spend more on the area you particularly care about. Budgeting is not about going without but about deciding what you want and where you can afford to treat yourself.

Step 5: If you still need to reduce your spending further, consider what you could bear to go without and compare it to your goals. Often the small changes above are enough to meet your goals without feeling like you’re giving too much up, but sometimes you’re faced with difficult choices. Ask yourself if each goal is worth what you’d have to go without to reach it. Imagine your future with each trade-off and compare which future you prefer.

Does your new budget enable you to reach your goals? If not then repeat steps 1-5 above, or revisit your goals and decide if they’re realistic and whether you’re willing to make the changes necessary to achieve them.

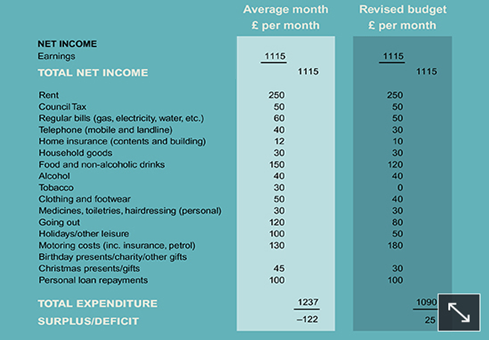

Here’s Jenny’s new budget as an example:

Once you have your budget, try to stick to it. This is easier said than done, but by simply writing down how much you want to spend on different areas it can help you follow it. Always keep in mind why you’re doing this – your goals – to help with motivation.

Tips on how to save money

There are so many ways to save money. Here are a few of the more common ideas from personal finance experts.

- Paying some bills by direct debit may save you money, for example utility bills. (But check this carefully as some bills such as household and car insurance may cost more if paid monthly by direct debit.)

- Think about remortgaging. Saving 1% on a £100,000 mortgage saves up to £83 a month.

- Shop around when it’s time to renew insurance. Premiums are often increased each year, relying on customers not bothering to switch to another company. Also check that you’re not paying for any ‘extras’ you didn’t ask for or want.

- If you’re paying high interest on your credit cards, look for 0% deals on balance transfers but check for transfer fees. If you have payday loans or other expensive debt talk to your back or credit union about taking out a cheaper loan.

- Switch suppliers of gas, electricity, telephone or internet connection. Consider a water meter. There are major savings to be had in these areas.

- Think about whether a branded item is really value for money.

- Cut down on the number of takeaway meals you have – cutting from two to one a week would typically save over £250 a year.

- Call your mobile phone supplier and ask them if there’s a better tariff to suit your needs.

- Buying in bulk for items such as contact lenses saves a lot of money.

- Buy fresh fruit and vegetables in season. Check whether a local market is cheaper than the supermarket.

- Turn off lights, don’t leave stand-by buttons on and turn down the thermostat to save large amounts on energy bills (and help the environment) each year.

- Make a shopping list and stick to it. Try to use money-off coupons from papers and magazines where possible.

- Think carefully about buying extended warranties – they are usually poor value for month and household goods are often covered on home insurance policies.

- If you have internet access, look for price comparison websites to find the best deals.

Revisit your budget if your goals or circumstances change or unexpected expenses arise. It can be useful to put it in a prominent place to remind you – I pin mine to the fridge.