Use 'Print preview' to check the number of pages and printer settings.

Print functionality varies between browsers.

Printable page generated Saturday, 14 February 2026, 7:29 PM

Study Session 12 Financial Management of the OWNP

Introduction

From previous study sessions you should now have a good understanding of the OWNP’s components and approaches towards its implementation. However, one critical aspect of implementation that we have not yet considered is finance. A sound financial management system is an essential element of any programme, especially one of the scale and complexity of the OWNP.

You will remember from Study Session 4 that one of the guiding principles for implementing the OWNP is alignment. Alignment in this context means the coalition of all implementation processes (planning, budgeting, procurement, monitoring, evaluation etc.) with the government of Ethiopia's policies, strategies, manuals and guidelines. Financial management of the OWNP is aligned with the government’s existing rules, policies and guidelines for sound financial management. In this study session you will learn how the financial arrangements of the OWNP are aligned with the government’s system.

Learning Outcomes for Study Session 12

When you have studied this session, you should be able to:

12.1 Define and use correctly all of the key words printed in bold. (SAQ 12.1)

12.2 Identify the different sources of funds for the implementation of the OWNP. (SAQ 12.2)

12.3 Explain the mechanisms for channeling of funds and how they flow from federal to woreda and town levels. (SAQ 12.3)

12.4 Outline the roles and responsibilities in financial management at different levels of government. (SAQ 12.4)

12.5 Describe the financial reporting mechanisms of the OWNP. (SAQ 12.5)

12.1 Good financial management

All projects and programmes require a sound financial management system to ensure they are implemented efficiently and successfully. There are five key components:

- Planning and budgeting system: This enables managers to plan and forecast expenditure on all elements of a programme. Plans should include all proposed activities and items associated with the programme. The budget sets out how much each item is expected to cost and is therefore a forecast of the amount of money required. Plans and budgets are usually prepared annually to include details of programme activities in the year ahead, and often also quarterly or monthly, giving a more detailed breakdown of forthcoming activities.

- Book-keeping and accounting: Accurate and complete records of all expenditure e.g. what was bought, when, by whom and for what purpose.

- Internal control: This means having procedures in place that provide checks and balances within the financial management system. For example, ensuring that all purchases are properly authorised and checking regularly on accurate record keeping.

- Financial reporting: Regular reports that allow comparison of actual expenditure with the forecast amounts included in the budget. Reports may be required on a monthly, quarterly or annual basis, depending on the programme.

- Auditing: Independent external review by a suitably qualified professional who examines financial records to ensure that proper procedures have been followed.

These five principles are reflected in the processes of the OWNP. The financial management system is governed by policies, strategies, manuals and guidelines designed by the Federal Ministry of Finance and Economic Development (MoFED). Before we discuss the responsibilities for financial management at different levels of government, we will look at the sources and channelling of funds for the OWNP.

12.2 Sources of OWNP funding

You have already read about the stakeholders of the OWNP and seen the important role of some of these as sources of funding for the Programme. OWNP funding comes from the following sources, which are described in turn:

- The government of Ethiopia

- External financing agencies (development partners who are donors)

- Non-governmental organisations (NGOs)

- Participating communities in rural areas

- Water utility earnings.

12.2.1 Government of Ethiopia

Direct government financial support for WASH comes from a block grant that is channelled from federal to regional governments for both recurrent and investment costs. A block grant is an allocation of funds, usually on an annual basis, from federal to local levels of government. Investment costs, also known as capital costs, are the costs of new programmes and projects that only occur once. These include design, construction and commissioning costs. Recurrent costs include all the continuous costs of running an organisation or programme. Staff salaries are usually the largest component of recurrent costs.

In addition to the block grant amount there may also be federal government contributions that come as special purpose grants like the MDG fund, Food Security Programme, etc. to regions. Part of these funds may be allocated to WASH at regional level.

12.2.2 External financing agencies

(Note: You may recall from Study Session 9 that there is some confusion and overlap between the terms used to describe organisations that provide developmental assistance. ‘External financing agencies’ in the OWNP context means all donors other than NGOs [which are considered separately below]. External financing agencies are also referred to as ‘development partners’, even though this term can have a broader meaning, as discussed in Box 9.1. Frequently this term is capitalised as ‘Development Partners’, also abbreviated to DP, and is generally used to refer to the major donors only.)

Contributions from donors that are made specifically for the OWNP constitute the core budget and are held in the Consolidated WASH Account (CWA), which is described more fully in the next section. Development partners may also provide resources that contribute to the OWNP but not through the CWA. These are included in the resource mapping process for the consolidated annual WASH plans at all levels. (This was described in Study Session 10.)

12.2.3 Non-governmental organisations

NGOs can be both investors in, and implementers of, the OWNP. Their budgets are not aligned with the government financial management rules and policies because they each have their own processes and systems. Their contributions may directly fund their own projects or be channelled to other implementing bodies. However, NGO-planned expenditures on WASH are also included in resource mapping for consolidated annual WASH plans at all levels, from federal to kebele.

12.2.4 Communities

Communities undertaking WASH projects may contribute to construction, installation, or to operation and maintenance. The contribution may be in cash or ‘in kind’ (i.e. providing goods or services instead of money, for example by providing labour or materials (Figure 12.1). Cash contributions from a community will only be used for the specific WASH project being implemented in their village. The amount of contribution depends on the residents' capacity to pay. People who cannot afford to pay the amount in cash, will contribute materials or work as a daily labourer for the project.

12.2.5 Water utility earnings

Contributions from urban residents are through water service charges that provide earnings for the water utilities. The water utilities measure how much water is used by their customers and charge them accordingly (Figure 12.2). They contribute to the OWNP from these earnings.

12.3 Fund flow and channelling funds

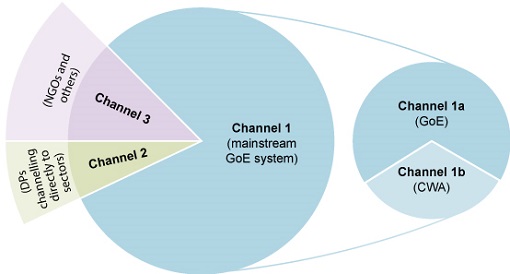

The financial systems of Ethiopia are generally categorised into three ‘channels’, described in Box 12.1.

Box 12.1 Donor funding channels

Channel 1 is ‘on-budget’ and is managed by MoFED, regional Bureaus of Finance and Economic Development (BoFEDs) and woreda Finance Offices. ‘On-budget’ means included in the national annual budget description. Channel 1 is further divided into:

- Channel 1a: funds are transferred through MoFED to regional BoFEDs, and then to WASH sector bureaus and offices

- Channel 1b: also through MoFED but funds go directly to WASH sector bureaus and offices.

Channel 2 funds are made available directly to the WASH sector ministries (MoWIE, MoH, MoE) and then to their respective bureaus and offices at lower levels. Channel 2 is also ‘on-budget’.

Channel 3 funds are directly transferred by donors and aid agencies to service providers and the donor retains financial control. Channel 3 funds are ‘off-budget’, meaning they are outside the control of government and are not included in the national annual budget.

The preferred fund flow for the OWNP uses Channel 1b through the Consolidated WASH Account (CWA). The creation of the CWA marked a major change in fund flow for WASH activity that came about as part of the OWNP. The CWA, as you first read in Study Session 1, is a unified funding channel which allows all funds from major donors to be deposited in one bank account. The CWA provides a mechanism for all the major donors (fund contributors) to pool their resources. This simplifies the fund allocation process and avoids the fragmentation between different donors and programmes, a significant problem in the past. The CWA is opened and controlled by MoFED. Any transfers from the fund are controlled by MoFED, based on the rules and regulations of the government.

The CWA is a very important aspect of the One WASH approach. In the past, overseas donors would each have separate accounts in their own currency. It is a significant change that the CWA is a birr account. This means all WASH funds in any foreign currency contributed from development partners are changed into Ethiopian currency (birr) before being disbursed and used by implementing organisations. CWA funds are therefore considered to be government funds and are not linked to the identity of the fund source.

The term ‘non-CWA’ is applied to all funds that are not pooled in the CWA. Non-CWA fund contributors give their commitments directly to the implementing organisations at federal, regional or woreda levels. In this situation, the government financial management system is not applied.

In Study Session 9 you learned about the different types of stakeholder in the OWNP. Based on the flow of funds, how would you categorise the stakeholders channelling funds through the CWA and those outside the CWA?

Major stakeholders channel funds through the CWA and associated stakeholders channel theirs outside the CWA.

The relationship between the funding channels described in Box 12.1 and the CWA, and how this fits into the overall picture of finance in the OWNP is shown in Figure 12.3. As you can see, the CWA is only a part of the overall funding system for the OWNP. Significant contributions to the OWNP budget also come through Channels 1a, 2 and 3.

12.3.1 Flow of funds through the CWA

There are two main stages in the flow of funds from Development Partners through the CWA, which are, simply, in and out. These two stages can be broken down into six steps:

Step 1: Development Partners (DPs) establish bilateral agreements with MoFED.

Step 2: DPs inform MoFED of their annual contribution.

Step 3: DP contributions are channelled to foreign currency special accounts at the National Bank of Ethiopia for each DP.

Step 4: DPs’ contributions are transferred from each foreign special account into the Consolidated WASH Account (birr).

Step 5: MoFED disburses funds into WASH accounts established for the implementing agencies at federal and regional levels.

Step 6: On instruction from MoFED, the National Bank of Ethiopia transfers funds to the three WASH sector Ministries (MoWIE, MoH and MoE) and MoFED for federal level expenditures. The Bank also transfers funds to BoFEDs for onward transfer into accounts opened for the three WASH sector Bureaus and BoFED for regional level expenditures. Where applicable, zonal finance offices will receive funds from BoFED for WASH expenditure at zonal level. At woreda level, woreda finance offices will open a bank account to receive funds from BoFED for Woreda WASH Team expenditure, including disbursement to WASHCOs.

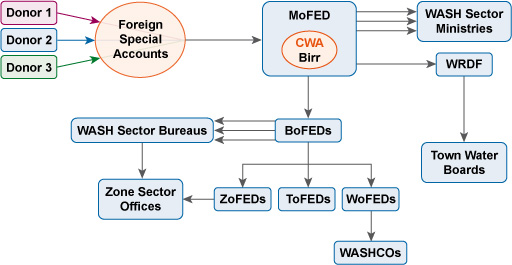

Figure 12.4 summarises these main steps in the flow of funds through the CWA.

To give an example of how this system operates: World Bank Ethiopia has given US$205 million to the Ethiopian government to increase the provision of water supply and sanitation services. From the total budget, US$43 million is allocated to WRDF for the construction of WASH facilities for medium-sized towns. MoFED opened a dollar account for the World Bank and received this budget, then changed this to birr and deposited in the CWA. Based on requests made through approved consolidated plans, MoFED disbursed this budget to WRDF and the other federal and regional implementers, down to woreda level.

12.4 Responsibilities for financial management

Each level of government has specific financial management responsibilities as outlined below.

12.4.1 Financial management at federal level

Responsibility for the overall financial management system of the Programme at federal level lies with MoFED. They are responsible for opening foreign currency accounts to receive funds from donors and then transferring these funds into the CWA. From the CWA, funds are transferred by MoFED to special accounts opened for the other three WASH Ministries (MoWIE, MoH, and MoE) and the regional BoFEDs on the basis of approved plans and budget reports.

All BoFEDs and the WASH sector ministries are responsible for reporting to MoFED on all OWNP financial matters. Based on these reports, MoFED prepares a single consolidated report and distributes this to the Development Partners and other stakeholders.

12.4.2 Financial management at regional level

The regional BoFEDs are responsible for managing government and CWA funds at regional level. They have a number of specific tasks, including opening regional, zonal and woreda bank accounts at the nearest area branch of the Commercial Bank of Ethiopia and transferring funds for OWNP implementation. (Note that the National Bank of Ethiopia is used for accounts at federal level and the Commercial Bank of Ethiopia at regional and lower levels.) They also provide technical support to the implementers to ensure that proper accounting systems are established and competent accounting staff employed. They are responsible for preparing and submitting regional financial reports to MoFED and to regional government.

12.4.3 Financial management at woreda level

Woreda offices of Finance and Economic Development (WoFEDs) have similar responsibilities for proper accounting systems and competent accounting staff at woreda level. As a member of the Woreda WASH Team (WWT), the WoFED assists the WWT in the planning and budgeting process. They collect and aggregate the required financial data and information and submit reports to the Woreda Administrative Council (Cabinet) and BoFED.

12.4.4 Financial management at town level

As you learned in Study Session 10, towns are categorised into three levels:

What are the three categories of town?

Towns that have utilities managed by a Water Board, towns with utilities but without a Water Board, and those with only WASHCOs.

Larger towns in the first two categories with populations greater than 20,000 receive funds by loan through the Water Resources Development Fund (WRDF). Towns with a population of fewer than 20,000 receive funds by grant through the relevant BoFED. These two funding arrangements for towns are further described below.

Loan financing

Water utilities are directly responsible for opening a special bank account to receive loans from the WRDF and must have proper accounting systems in line with government policies and procedures. (You learned about the WRDF in Study Session 9.) They also collect and aggregate required financial data and report regularly to the WRDF. Like the federal WASH sector ministries, the WRDF is responsible for reporting to MoFED on all financial matters with respect to towns financed through loans under the Programme.

Grant financing

The grant component for urban WASH projects may be transferred in two possible ways. One option is from BoFED to the town’s Finance and Economic Development office (ToFED). The other is for the region or zone to control funds on behalf of the town, which may be the case if the town does not have the capacity to do this for themselves. If small towns recognise that they lack capacity to implement the WASH fund, they can assign the regional or zonal WASH bureaus to take on this role. They will request BoFED to transfer the grant amount to the regional or zonal water sector institution to implement their activities.

Any grant transferred from BoFED to the ToFED office is disaggregated into water supply and sanitation components based on the approved budget. The grant for water supply improvement is transferred to the water utility, if there is one. Other WASH components (sanitation and hygiene) are managed by the Town Finance and Economic Development office.

12.5 Budget preparation

Budget preparation means drawing up a detailed plan that sets out all the activities of a project and allocates an amount of money, the forecast expenditure, against each item. A budget is an essential part of planning for the implementation of projects and programmes so that future costs are fully understood. As noted in Section 12.1, budget preparation is an important component of good financial management.

For the OWNP, each implementing agency starting at woreda level is required to prepare a work plan with a related budget for each budget year and send it to the next higher level for review, approval and consolidation. The Regional WASH Coordination Office (RWCO) is responsible for consolidating the regional budget from all regional implementers and for getting it approved by the Regional WASH Steering Committee (RWSC) before submission to the National WASH Coordination Office (NWCO). The NWCO prepares a consolidated budget for all regional and federal implementing ministries and submits this to the National WASH Steering Committee (NWSC) for approval.

Think back to Study Session 7 where the organisational relationships of the OWNP were described. What types of relationship are demonstrated by these budget approval processes?

The RWCO has a horizontal relationship with the RWSC and a vertical relationship with the NWCO, to which it submits the budget for approval. The NWCO and NWSC are both at national level and so have a horizontal relationship, but the NWSC has overall responsibility for the OWNP so there is also an element of vertical relationship between them.

Budgeting takes place based on forms and procedures designed by MoFED. Sector offices at all levels from federal ministries to woreda offices are responsible for requesting WASH budgets from the level above them. This is based on a comprehensive resource mapping of all resources available to WASH at the given level, i.e. federal, regional, zonal or woreda/town.

12.6 Financial reporting

The purpose of financial reporting is to provide information about the OWNP that is useful to participants, both for accountability and for decision making. As described in Section 12.1, financial reports should compare actual expenditure with the budget that was set. The OWNP requirements are that financial reports should be prepared and submitted quarterly (four times a year) by WoFED, BoFED and MoFED. WoFED reports to BoFED and BoFED reports to MoFED. MoFED compiles these reports and submits a consolidated report to its development partners. The financial reporting at each level provides information to the fund providers on how much of the budget has been spent over the specified time period and for what purposes. This is used to inform the decisions about setting budgets and the disbursement of funds for the following phase.

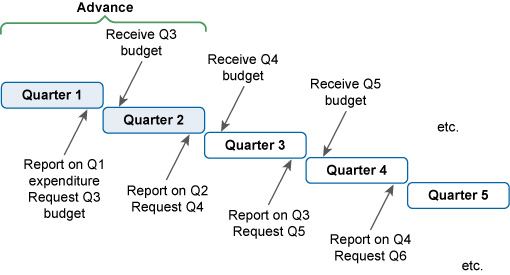

Disbursement of funds by MoFED and BoFEDs to the implementing agencies follows a regular pattern. Initially, each implementing agency receives a first quarter and second quarter advance based on its approved annual work plan and budget. At the end of the first quarter (three months), the agency prepares a report on expenditure during that quarter, together with a request for replenishment of the funds to cover the amount budgeted for the third quarter, less the amount of unused funds from the first quarter. This ‘rollover’ system means that implementing agencies always have in hand their budget for the forthcoming quarter. The system is shown diagrammatically in Figure 12.5.

To give an example, imagine that a region has a 4 million birr budget (one million birr for each quarter) for the current year to implement WASH activities in their region. Based on the approved budget plan, the region has received 2,000,000 birr for the first two quarters (six months) to fund the initial phase of the programme. After three months, the regional BoFED compiles a financial report on funds used by the regional water, health and education bureaus. Let’s say this compiled report of all first quarter expenditure was 650,000 birr. BoFED reports this figure to MoFED and asks them to disburse the 1,000,000 birr for the third quarter. However, MoFED deduct the unspent 350,000 birr from this figure, and therefore disburses only 650,000 for the third quarter instead of one million birr.

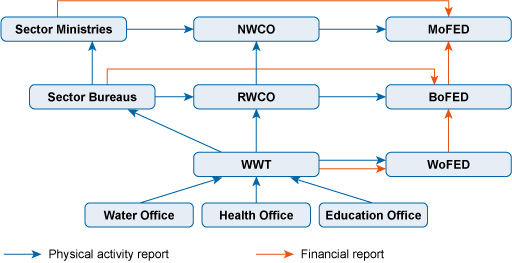

The complete process of reporting is illustrated in Figure 12.6.

This diagram shows the interconnections between the upwards reporting on WASH activities undertaken by the implementing agencies and how this feeds into the financial reporting from the woredas and regions to MoFED.

Summary of Study Session 12

In Study Session 12, you have learned that:

- Good financial management requires a planning and budgeting system, book-keeping and accounting, internal control mechanisms and financial reporting and auditing processes.

- The financial management of the OWNP is governed by policies, strategies, manuals and guidelines developed by the Ministry of Finance and Economic Development (MoFED). This also assures the alignment principle of the OWNP.

- OWNP funding comes from the government of Ethiopia, external financing agencies (development partners), non-governmental organisations (NGOs), participating communities in rural areas, and water utilities’ earnings.

- Channelling of funds from the Consolidated WASH Account is through MoFED, BoFEDs and WoFEDs. Other sources, such as NGOs, either give directly to the implementing organisations or are implementers themselves.

- For urban WASH, funds are transferred to towns based on their population. Large towns with populations greater than 20,000, have utilities with a Water Board and receive funds by loan through the Water Resources Development Fund. Towns with a population of fewer than 20,000 receive funds by grant.

- MoFED is responsible for receiving funds from the development partners, opening foreign and birr accounts and the overall financial management system of the OWNP. BoFEDs, WoFEDs and ToFEDs also have responsibility for managing at their own levels.

- Financial reports start at woreda level. These should include information on expenditure of all funds from different sources which are consolidated, reported to BoFED and then to MoFED.

Self-Assessment Questions (SAQs) for Study Session 12

Now that you have completed this study session, you can assess how well you have achieved its Learning Outcomes by answering these questions.

SAQ 12.1 (tests Learning Outcome 12.1)

Identify the terms being described in the following sentences:

- All the continuing costs of running an organisation or programme, of which staff salaries are usually the largest component.

- An allocation of funds, usually on an annual basis, from federal to local levels of government.

- Funds that are outside the control of government and are not included in the national annual budget.

- Banking facility when all WASH funds in any foreign currency contributed from development partners are changed into Ethiopian currency (birr) before being disbursed and used by implementing organisations.

- The costs of new programmes and projects that only occur once. They include design, construction and commissioning costs.

Answer

- Recurrent costs

- Block grant

- Off-budget

- Birr account

- Capital costs

SAQ 12.2 (tests Learning Outcome 12.2)

From the following list, identify which are possible sources of funding for implementing the OWNP.

- A.Water utility earnings

- B.Communities

- C.Development partners/non-governmental organisations

- D.Government

- E.All of the above.

Answer

- E.In different ways these groups can all provide funding for the OWNP.

SAQ 12.3 (tests Learning Outcome 12.3)

Which one of the following statements about the flow of Consolidated WASH Account funds is correct?

- A.From MoFED to WASH sector ministries and BoFED, then from BoFED to WASH sector bureaus and WoFED.

- B.From MoFED to WASH sector ministries and BoFED, then from WASH sector ministries to WASH sector bureaus.

- C.Both are correct.

Answer

A is correct. The flow goes from MoFED to WASH sector ministries and BoFED, then from BoFED to WASH sector bureaus and WoFED. (Look at Figure 12.4 to help you answer this question.)

SAQ 12.4 (tests Learning Outcome 12.4)

- a.What is the role of the Ministry of Finance and Economic Development in the financial management of OWNP at the federal level?

- b.What is the difference between CWA funds and non-CWA funds?

Answer

- a.MoFED is responsible for the opening of foreign currency accounts to receive funds from development partners and transfers these funds into a Consolidated WASH Account (CWA) (birr account).

- b.CWA funds are considered to be government funds and are not linked to the identity of the fund source. The term non-CWA is applied to all funds that are not pooled in the CWA. Non-CWA fund contributors give their commitments directly to the implementing organisations at federal, regional or woreda levels.

SAQ 12.5 (tests learning Outcome 12.5)

Which one of the following statements about the financial reporting of Consolidated WASH Account funds is correct?

- A.Reports are sent from WoFED to WASH sector ministries and to BoFED, then from BoFED to regional WASH sector bureaus and MoFED.

- B.Reports are sent from WoFED to BoFED, and from regional WASH sector bureaus to federal sector ministries, and then to MoFED.

- C.Reports are sent from WoFED and from regional WASH sector bureaus to BoFED, then from BoFED to MoFED who also receive reports from federal WASH sector ministries.

Answer

C is correct. Reports are sent from WoFED and from regional WASH sector bureaus to BoFED, then from BoFED to MoFED who also receive reports from federal WASH sector ministries. (Look at Figure 12.6 to help you answer this question.)