Use 'Print preview' to check the number of pages and printer settings.

Print functionality varies between browsers.

Printable page generated Wednesday, 4 February 2026, 1:47 AM

Money

2. Money

Introduction

The work that a voluntary organisation does to achieve its purpose inevitably costs money. Even an organisation run entirely by volunteers will need some funds to carry out its activities. In this section you will be looking at where voluntary organisations get their money from and how they can maximise their fundraising. You will also consider how to read the budgets that set out an organisation’s plan for its money.

Section 2 is divided into three topics:

The basics of budgets introduces how voluntary organisations plan and track their income and expenditure and explains some of the key terms around finances in a voluntary organisation.

Sources of financial income explores the four main categories of income for voluntary organisations, and considers their risks and benefits.

Raising more money gives tips and ideas for increasing fundraising success in a voluntary organisation.

In this section you will learn how to find out about a voluntary organisation’s finances, including where it gets its income from, and will consider and explore a real-life case example of an organisation that has increased its fundraising success.

Learning outcomes

By completing this section and the associated quiz, you will:

have a better understanding of budget terms and how to interpret the elements of a straightforward voluntary sector budget

have an awareness of where the money for voluntary organisations comes from

feel more confident trying to raise money from different sources.

2.1 The basics of budgets

Having the skills to read and interpret a budget is useful in all walks of life but particularly in organisations. All organisations set budgets. A budget is a plan expressed in financial terms and it helps organisations to achieve their aims within the resources available to them. It is usually prepared on an annual basis and looks ahead to the following year. Sometimes there is a need to change things or move money around as the year goes on, and unforeseen circumstances arise or new funding comes in, but generally speaking budgets should be regarded as relatively fixed each year.

Most organisations will have a set of budgets by department, function or project as well as their organisational-level budget. Many people who are budget-holders are not necessarily financial experts. In some organisations, volunteers may also be budget-holders and trustees will also need to understand their organisation’s budgets in order to help with developing financial strategy and the overall direction of the organisation. For registered charities, trustees have a legal duty to look after their charity’s money and other assets. In some types of organisations, trustees can be personally liable for any debts. Understanding how to read and interpret budgets at a basic level will always be important and if you are planning to become a trustee you may wish to take your knowledge to a more advanced level.

Although all organisations set budgets, there are a few differences between voluntary and private sector organisations:

voluntary organisations do not talk about profit and loss but about surplus and deficit

registered charities produce a Statement of Financial Activity (SOFA) rather than a profit-and-loss statement

voluntary organisations usually produce an annual report which details all the funding coming into the organisation and going out (expenditure).

You will now look at the main elements of budgets namely income and expenditure.

What is in a budget?

Budgets are practical statements because the budget establishes and directs what activities and actions can happen within the organisation. It is also an estimate of what the organisation needs, that is, it addresses questions such as: how much will salaries be for the year, what expenses staff and volunteers might need to claim, what equipment is needed for this year. It is a way of hopefully avoiding nasty surprises later in the year. Clearly, before a budget can be set, people need to discuss and agree what the expenditure is likely to be in relation to the aims of the organisation for the year ahead. An organisation’s financial staff will usually be involved in the finer details of the financial information but ‘ownership’ of the budget should be perceived as wider and involving all levels of the organisation.

Budgets are usually internal documents although, for example, if you were writing a bid for funding to an external organisation, you would usually include a budget as an estimate of proposed costs. The organisation puts its financial information into the public domain through its annual report and statements for the Charity Commission if it is a registered charity.

In terms of content, budgets set out financial information about:

income: the resources available to the organisation, different departments and projects

expenditure: how these resources will be used.

Income and expenditure

Income is a list of all the money the organisation has coming in or has in the bank as reserves or surplus. If an organisation was not intending to spend the reserves they might not be mentioned, although the budget would usually refer to the expected interest to be earned for that year. In a very small organisation it may be easy to have a good idea of how the organisation is funded and where the money comes from, but in bigger organisations this may not be so apparent. It may be clear how individual projects are funded but not how the money for everything the organisation does is raised. One good way to find out is to look at the organisation’s annual report: it’s a requirement for registered charities to submit the report to the Charity Commission, and even organisations that are not registered usually produce an annual report for staff, volunteers and supporters. However, annual reports are primarily providing information about the previous year rather than the forthcoming year (although most organisations will look ahead too).

Charity reserves – the money that charities hold that has not been spent, committed or designed for a particular purpose– are a controversial issue. The media often criticises charities for holding large reserves whilst still doing fundraising appeals. Yet having reserves probably means that good financial management has been practised. Should the charity lose a key stream of income then they will have enough in the bank to cover the running costs until they can secure alternative income. This prevents their beneficiaries from being left without services that they may rely on. However, because of concerns about financial management in charities, the Charity Commission for England and Wales states that voluntary organisations should ‘explain and justify’ the level of reserves they hold. Therefore, registered charities need a reserves policy.

A budget aims to be a realistic view on how much money the organisation expects to have for the coming year. This can include grants from other organisations, membership fees, donations, trading activities, interest on reserves and so on. A budget is usually based on looking at previous years to get a sense of how much money came in. Therefore, it is important to have discussions amongst staff and with trustees in order to assess what is needed for the forthcoming year.

Income is usually a mix of unrestricted and restricted funding. Unrestricted funding includes income that can be spent at the discretion of the trustees. Restricted funding includes money given for a specific purpose within the wider objectives of the organisation. It might come from a funder or a public appeal. Restricted funding is becoming more commonplace as the amount of money available from government decreases. It involves a legally binding agreement through a contract, which sets out which services will be provided by the voluntary organisation and what it will be paid for those services. On the positive side, a contract creates a partnership between organisations and may provide a period of secure funding. On the negative side, voluntary organisations may feel these contracts mean a loss of independence and less choice or freedom in deciding which services to provide. This money must be isolated, that is, only used for the purposes for which it was given. The charity needs to have procedures in place for tracking the funding and what expenditure can be applied to it. Some voluntary organisations will also have endowment funds which the trustees are legally required to invest or to keep and use for the organisation’s purposes.

All this information about income needs to be set out clearly in annual reports and budgets.

Activity 1

Table 1 shows an example of predicted income for Oldtown Community Association. It is a registered charity, first set up in 1960, and aims to provide facilities for social welfare, recreation and leisure, maintaining and managing a community centre and hiring the hall for promotion of community activities. It is run by a general committee, which includes a representative from each of the affiliated groups, and an executive committee of volunteers. Membership is £2 per person with affiliated groups paying £10 per year. Their fundraising activities have been fairly successful over the years and the organisation has funding from a Big Lottery Fund grant, which is being used to modernise the community centre. They have applied for a further grant for resurfacing the car park but are still awaiting the decision on that.

| Unrestricted | Restricted | |

| Membership and affiliations | £2 000 | |

| Donations | £300 | |

| Hire of the hall | £20 000 | |

| Fundraising events | £4 000 | |

| BLF grant | £30 000 | |

| Grant application (unconfirmed) | £5 000 | |

| Reserves | £10 000 |

Footnotes

Table 1 Predicted income for Oldtown Community Association.What is the association’s total income?

What is the most important source of income?

Can you foresee any problems with these different sources?

Discussion

The total income is: £56,300. The grant application is unconfirmed so cannot be included; if their application is successful it is earmarked for a specific project which could then go ahead.

The biggest source of income is the Big Lottery Fund grant. However, this is for a specific purpose and is restricted and a one-off amount. In the long term, the hire of the hall raises the most money. The organisation could consider raising their membership fees but given the nature of the organisation, this may not be successful.

In common with many voluntary organisations, funding is uncertain. Membership might fall, donations might fluctuate, fundraising not be as successful as previous years or organisations might not want to hire the hall. However, the modernisation of the hall should provide greater opportunities for more events and income from hiring the hall.

Expenditure involves everything you might have to pay for and could include salaries to staff, volunteers’ expenses, building and energy costs, office and cleaning supplies, computer and website maintenance, publicity and so on. It is important to be realistic about costs, so a new budget would require some research into what new items might cost or how much a building costs to heat per month or per quarter, and so on. Organisations need to be accountable for their expenditure and ensure that income is spent according to their values and purpose. They should also look for cost-effective choices.

Activity 2

Table 2 shows the forecast expenditure for Oldtown Community Association.

| Insurance | £2 000 |

| Energy costs | £3 000 |

| Volunteers’ expenses | £500 |

| Marketing & fundraising events | £1 200 |

| Telephone | £200 |

| Printing & stationery | £150 |

| New computer & printer | £500 |

| New desks & chairs | £1 500 |

| Building work | £32 000 |

| Car park work | £5 000 |

Footnotes

Table 2 Predicted income for Oldtown Community Association.What is the total annual budget expenditure?

What is the single largest category of expenditure?

Compare Table 1 from Activity 1 with Table 2. Does the budget balance, that is, is the estimated income the same as the planned expenditure?

Discussion

The total forecast expenditure is £46,050.

The building work is the highest cost for the financial year. Unforeseen problems mean that the building costs will be more than the grant, meaning that the shortfall will need to be found from elsewhere or they might choose to cut costs elsewhere. However, the committee would need to check the terms of their grant to ensure they are fulfilling them.

The total projected income is £56,300. All being well, they will spend £10,250 less than this which gives them a good contingency, enough to cover the extra projected building costs. The car park work will only go ahead if they get the grant, so that £5,000 is separate. It might be that the committee would review these figures and decide to do some other projects. They also need to keep an eye on their reserves, which inevitably will increase during this year.

Balancing the budget

Organisations need to decide whether their budget should balance in any given year. In some cases, the organisation might want to project an imbalance of revenue over expenses (a surplus), perhaps because of plans for bigger expenditure the following financial year or just as a safety net. A deficit budget might also be acceptable in some cases, for example if there is an urgent need to spend on a big project, on investment in new staff or on service improvement. Trustees and staff will obviously need to look at the different implications. If they are not happy with expenditure exceeding the income then the organisation would need to rethink the plans. This might involve spending some reserves or postponing some activities.

However, the focus should not just be on whether the figures balance but also how well the organisation’s objectives and wider resources can be best used to impact on the maximum number of beneficiaries.

2.2 Sources of financial income

Being a voluntary organisation or registered charity does not mean that money has to come from a particular source. Most voluntary organisations get their money from a combination of sources and this helps them to be stable, protecting them from any sudden reductions in funding from one source.

The National Council for Voluntary Organisations (NCVO) divides charity and voluntary sector income into four main categories or streams. These are illustrated in a spectrum of income that goes from ‘asking’ for money to ‘earning’ money. Each stream is accessed and managed differently and relies on a particular relationship, either with an individual or an organisation. Having a good relationship with the donor, funder, purchaser or customer is important to being successful in raising money.

Money that is ‘asked for’ includes donations from members of the public or companies and grants given to a voluntary organisation by a funder for specific projects. Working with gifts or grants, you usually define the aim of your work and ask for support from donors or funders to make it happen.

Money that is ‘earned’ includes payment for goods and services sold to people by trading on the open market as well as through longer-term contracts with larger bodies such as government. With contracts and trading, the purchaser or customer usually defines what they want to pay for and you earn income by meeting their requirements. Each of these categories of income will be explored later in more detail.

Activity 3

A voluntary organisation’s website will often give lots of information about where they get their money from. In a separate window on your computer, open up the website of Windmill Hill City Farm in Bristol: www.windmillhillcityfarm.org.uk

(We have chosen one particular charity as an example for the purpose of this activity. If you wish to look at another charity’s website or compare this charity to another charity of your choice, please do so.)

Have a look around the website. Does it give you any clues about where their money comes from?

Some key things to look out for:

A button to ask you to donate, or a section of the website called ‘Support us’.

This shows that the organisation is asking for money to be donated from the public (gifts).

Thanking funders for their support.

This is a sure sign the organisation has received grants for their projects.

(Tip: Look at ‘What we do’, and then ‘Projects’. Click on some of the projects for more information about them.)

A section of the website aimed at professionals – perhaps social workers or other public sector workers.

This suggests that the organisation is likely to be involved in running public services through an agreement with the government (contracts).

(Tip: Click on ‘What we do’, then ‘Health and social care’.)

A shop or cafe. Do they sell products, merchandise, gifts or cards? Perhaps tickets for events?

This suggests that the organisation is selling products or services directly to the public (trading). (Tip: Click on ‘What’s here’ from the main home page.)

Gifts

Gifts are also referred to as donated income. The money is freely given from donors towards the voluntary organisation’s work or activity. These donors could be members of the public or companies. There are lots of different ways that people can donate to a voluntary organisation.

Activity 4

Below is a list of some of the most popular methods of raising donated income. Match each of the methods with their definition.

Two lists follow, match one item from the first with one item from the second. Each item can only be matched once. There are 9 items in each list.

street collections

regular giving

legacies

major donors

corporate social responsibility

challenge events

payroll giving

community events

Match each of the previous list items with an item from the following list:

a.the name often given to companies’ approach to supporting charities

b.completing a task for sponsorship, e.g. asking friends and family to sponsor you to run a marathon

c.occasions run by volunteers to raise money in their local area, e.g. pub quizzes

d.donations from the public usually through direct debit

e.gifts left in a will after death

f.donations from individuals taken straight from their pay, before tax

g.request for donations from the public, often by volunteers with collection buckets

h.wealthy individuals approached for large donations

i.using the internet to attract a ‘crowd’ of people each willing to contribute to fund a project or idea

- 1 = g,

- 2 = d,

- 3 = e,

- 4 = h,

- 5 = a,

- 6 = b,

- 7 = i,

- 8 = f,

- 9 = c

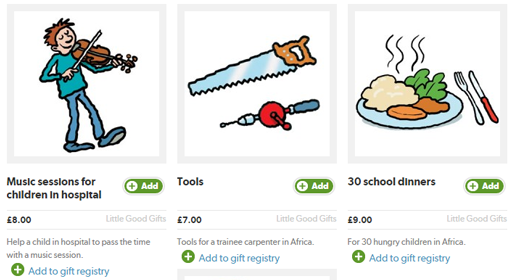

Fundraising products

Another way of asking for donations from individuals is through creating fundraising ‘products’, such as child sponsorship. These ‘products’ parcel the large total amount of money voluntary organisations need to raise into smaller amounts that make all donors feel that they have been able to make a difference.

The figure below shows some examples of fundraising products from the organisation Good Gifts (www.goodgifts.org).

Popular causes

The annual UK Giving Survey asks people which cause area they have given to in the last four weeks. The top 5 are

Medical research (26%), animal welfare (25%) and children or young people (24%) were the most popular causes to donate money to. The survey report states:

‘there are are a number of seasonal differences in terms of causes given to in each month, with, for example, donations to children or young people seeing a spike in November, the same time as the Children in Need television campaign. A third (33%) of those who donated in the previous four weeks said they had given to this cause. Although not in the top five overall, donating to homeless people, housing and refuge shelters in the UK remained around 15% each month, though this saw a high of 22% in December, perhaps down to the Christmas giving appeals. As has been seen in previous years, the arts (3%) and sports and recreation (3%) charities are the least popular causes given to.’

Gift aid

The UK government has pledged to return the tax paid on money donated to registered charities via a scheme called Gift Aid. There are rules on which donations you can claim Gift Aid on, but put most simply, charities can claim back 25p on every £1 donated by an eligible individual. Charities will ask donors to fill out a short form confirming that they are a UK tax payer and are happy for Gift Aid to be claimed on their donation.

There is also a small donations scheme that allows charities to claim Gift Aid on the small donations from community events or street collections, without needing each person to fill out a form. Gift Aid cannot be claimed if the person giving the money receives something of value in return, for example if they were buying charity Christmas cards. Gift Aid is an important source of income for the voluntary sector.

Grants

Grants are also money donated to voluntary organisations. They are usually larger amounts of money than gift donations and are given by a funding organisation for a specific purpose or project.

The voluntary organisation will usually write an application to receive a grant from a funder. Grant funders include charitable trusts and foundations set up by companies or individuals to distribute funding to a particular cause: for example the Joseph Rowntree Charitable Trust, which was founded by an individual to address conflict and injustice, or The Lloyds Bank Foundation, set up by the bank to help to break the cycle of disadvantage in the UK. The government also gives out grants at both a local and national level. Most grants are given for specific projects or pieces of work covering a period of two to three years. Grants account for around 10% of the voluntary sector’s income.

In the UK, many voluntary organisations with an annual turnover of between £500,000 and £5 million have traditionally been ‘grant-dependent’. This means that they are receiving most, if not all, of their income from grants.

Activity 5

Can you think of any reasons why being ‘grant dependent’ may be a problem?

Discussion

The grant(s) might stop: Being dependent on any one source of income is risky in case it suddenly stops or reduces. The voluntary organisation is unlikely to have enough funds to continue the work or time to raise alternative funds to keep staff or volunteers. If a grant ends or is withdrawn then the amount of funding lost is usually quite large, compared to losing one individual donation.

There are fewer grants around: There have been fewer grants available in the UK in recent years. This is mostly due to the reduction in grants from government sources, especially Local Authorities. For more than a decade the government has been gradually moving to offering more funding through contracts rather than grants. Overall income to the voluntary sector from government has fallen since a peak in 2009/10.

Risk of ‘mission drift’: Voluntary organisations that are too dependent on grant funding are sometimes in danger of deciding what activities to run depending on what is most likely to win grant funding, rather than what will contribute the most to the organisation’s purpose. There is a danger that they might try to bid for work that has drifted outside of the organisation’s mission.

Even though they are getting harder to find, grants do have some big positives for voluntary organisations, including:

once a grant is secured, it can often provide a large and reliable income for several years. This means grants often have a good ‘return on investment’ as the cost of securing and administering the grant is often relatively low in proportion to the amount of money received.

grants will often pay for activities that might not be particularly attractive to the public or other supporters.

Charities can often build up good relationships with grant funders to make the case as to why an activity is important and help them to understand their area of work.

Contracts

A contract is an agreement to deliver requested goods or services. Because voluntary organisations have a social purpose, there is often a lot of overlap between what they want to achieve and what the government funds services for, for example helping people into employment or with housing, education or health needs. Voluntary organisations are often well placed to deliver government services because they can be very close to the communities they serve.

Delivering public services through contracts with government is a really important source of funding to the sector, accounting for 32% of all income in 2015/16 according to the UK Civil Society Almanac 2018. But unlike grants and gifts, this type of income has not been evenly spread across the voluntary sector. Larger charities have been growing rapidly through winning contracts. Smaller charities often find the administrative processes around winning contracts too complicated and might not be large enough on their own to deliver the full service required. Some small voluntary organisations have still been able to get involved, but often through supporting larger charities or companies to deliver part of a contract (sub-contracting).

Voluntary organisations have been criticised in the press for becoming too reliant on money from government because this threatens their independence, meaning they might feel they cannot speak up against government policies. Competing for contracts can also push them to reduce the quality of their services as they cut costs to be competitive. Voluntary organisations need to strike a careful balance. Just as with grants, if voluntary organisations can avoid being too dependent on money from one source, then they will be in a stronger position to decide which contracts to bid for and which to walk away from.

Trading

Voluntary organisations, including registered charities, are perfectly able to trade (sell) goods and services to individuals on the open market, for example they might sell goods like books, or services like training. There is an important distinction though between two types of trading:

Primary-purpose trading contributes directly to the voluntary organisation’s mission or purpose (it is ‘on mission’): for example, an education charity selling a training course. The training course both meets the charity’s purpose of advancing education and also brings in income. Registered charities can do as much primary-purpose trading as they wish.

Secondary trading also known as Non-primary purpose trading is done solely to bring in money that can be used to fund the charity’s other activities (it is ‘off mission’): for example, an animal charity selling Christmas cards. There is no reason for the charity to sell cards other than to bring in money. There are strict financial limits though on secondary trading, and once those limits have been reached the charity needs to create a separate trading company and run the secondary-trading activities through that. The profits can still be transferred back to the charity, but it makes sure that the charity is protected from the risk if the trading activities go wrong.

Generally, it is much better to raise money ‘on-mission’. This is because it means that all the money the charity is spending is going towards achieving its purpose. It also means that if you aren’t successful at raising lots of funds, at least the organisation will have spent its money on charitable activities, not fundraising ones.

Secondary trading can be much more risky for a voluntary organisation, because when it goes wrong they can lose money and still not contribute to their purpose or mission. The examples below illustrate what the risks can be.

Box 1 When secondary trading goes wrong

A charity decides to raise money by producing Christmas cards, which will be sold to their supporters. Their head of marketing chooses the card designs and arranges for 5000 packs to be printed. It costs £10,000 to print the cards, which they sell for £3 per pack, hoping to make £1 profit from every pack sold. Overall this would give them £5000 profit, to be used to fund their work.

However, it turns out that the head of marketing’s choice of designs is not very popular. They only sell 50 packs, making just £50 profit on those sold. The charity has just spent more than £9000 of charitable funds on making Christmas cards that are not selling.

Box 2 When primary purpose trading goes wrong

A different charity decides to raise money by holding an auction of pieces of artwork designed by the disabled people they work with. They spend £10,000 arranging the event, booking the venue, paying for refreshments and hiring a celebrity to compere the event.

On the day they don’t raise as much as they’d hoped – only £5000 through the sale. However, the event is well attended by some wealthy individuals and some local politicians and proves to be a great chance to raise awareness of some of the challenges facing disabled people. It also gets quite a bit of media coverage and increases the confidence of the disabled artists whose work has been showcased.

As these two examples show, the primary purpose trading still has some clear benefits for the charity even though it hasn’t made money, whereas the secondary trading initiative was a disaster, costing the charity money and not furthering its cause.

An appropriate funding mix

Thinking back to the idea of ‘mission drift’, it is really important that voluntary organisations have the right funding to pay for the things that they want to do to achieve their purpose. Voluntary organisations should start by thinking about what they want to achieve, and then work out which types of funding are the right fit. Usually there will be several options, and for many registered charities the best choice is to raise some money that is unrestricted. This means that the donor or funder hasn’t specified what the money should be spent on and the charity is free to choose how, or when, to spend it. The two methods that raise the most unrestricted income for charities are individual donations (gifts) and selling goods or services (trading).

Having a diverse funding mix also allows charities to have more control over their activities and protects them from any sudden reductions in funding from one source. For example, income from legacies, whilst usually unrestricted, can be hard to predict and uneven: the charity cannot know when the donor will die and the donation be made. A voluntary organisation that is quite reliant on legacies might want to develop a trading idea or a grant-funded project to give the organisation a bit more stability.

Activity 6

Registered charities must report their income and expenditure to the Charity Commission for England and Wales. This information is made publicly available on the Commission’s website and is a very useful resource for anyone wanting to find out more about a charity’s funding.

In a separate tab or browser window on your computer, open up the Charity Commission website: https://www.gov.uk/ government/ organisations/ charity-commission

Select ‘Search for a charity’ and in the purple charity search box enter ‘Windmill Hill City Farm’ (or other charity of your choice). Click on the organisation name when it comes up. On the charity overview page (at the top of the left-hand menu) you can see their total income and total expenditure.

Click on ‘Financial history’ in the left-hand menu. The financial history bar chart shows their income in the blue bars and expenditure in the orange bars.

Has their income increased or decreased in the last few years?

Discussion

Windmill Hill City Farm’s income increased from £917,226 in 2011 to £1,326,342 in 2015. This was an impressive increase of over 40%.

If you would like to find out more about Windmill Hill City Farm’s finances you can download their latest accounts from the ‘View accounts’ tab in the left-hand menu and then select the most recent year. These accounts contain a written summary from their Chair of Trustees near the beginning that gives a clear account of the different areas of the charity’s funds. Pages near the end of their accounts contain tables that list their different types of income. In particular, you can see a list of all the grants that they received within that year.

2.3 Raising more money

Whilst in the longer term it is advisable to raise income from a diverse range of sources, when considering how to raise more money for your work in the short term (the next year or so) the first strategy should be to maximise the kind of successful fundraising you do already. This is because completely new ideas usually carry the most risk: they take time, money and other resources to set up and there is no guarantee of success.

For every category on the income spectrum that was covered in Section 2.2, increasing success will rest on two pillars:

Knowing and understanding your audience (donor, funder, purchaser or customer)

The ‘fit’ of your organisation or project with their wants, needs and interests.

What this means in practice will now be considered in more detail for two of the income categories: gifts and grants.

Gifts from individuals: increasing the lifetime value

The quickest way to raise more money from individuals is to increase the amount your existing donors are giving you. This is often referred to as maximising the ‘lifetime value’ of a donor. It costs a lot more, both in terms of time and money, to recruit new donors, so it’s important to look after the ones you already have.

Larger voluntary organisations will often have a lifetime value plan that takes donors on a journey through different ways of giving that relate to their interests. For example:

The trick to maintaining and maximising the loyalty of existing supporters is to think about two things:

their motivation for giving

their ability to give more.

You can try to work these two things out based on the information you have about the donor. For example, do they have a job? Where do they live? Are they involved in any hobbies? How did they first get in touch with the charity? Charities developing major donor programmes (i.e. when they’ll be asking for large amounts of money from an individual) often use wealth-screening companies to find out as much as they can about potential donors. Providing opportunities and information that are tailored to the motivation of those able to give more is most likely to generate more money.

Increasing the lifetime value of a donor has to be underpinned by strong marketing and communications. For instance, the organisation will need to keep in touch with donors, keep them informed about what the charity is doing and show them how their support is making a difference. This doesn’t have to cost a lot of money. Many charities communicate effectively with their donors using social media or emails.

Activity 7

Below is a short description of a small charity that needs to raise more money and a list of different fundraising ideas.

Charity A is a local visual arts organisation working with adults with disabilities. The charity raises the majority of its income from individual donations (gifts). This is mostly collected through local events, raffles and sponsored challenges. The fundraising is undertaken by a small but loyal group of volunteers, the majority of whom have a personal connection to the charity. They now need to raise £30,000 to cover the cost of staffing and equipment for a new art class for people with disabilities. They will also need around £50,000 to cover the charity’s general running costs in the next two years.

Which three of the following ideas would you advise the charity to try first in order to raise more money from their existing supporters?

A fundraising product, such as ‘buy a book’ or ‘buy some art materials for a disabled artist’

a crowdfunding appeal for new equipment

charging to hire out their building facilities to the community

holding a showcasing event, letting supporters directly see the charity’s work

a membership scheme (asking donors to ‘join’ for a regular amount, usually to receive a benefit or pledge support for a cause)

applying for grants to pay for more services

seeking sponsorship from a company

Discussion

It is suggested that the charity try:

A challenge for Charity A is that their small group of volunteers cannot give much more themselves, and they are having to repeatedly ask their friends and family to donate. Creating a fundraising product will provide a new opportunity for donors to feel they could give again and is also likely to present an opportunity to capture the donors’ details so that the charity can communicate with them directly in future.

Launching a crowdfunding appeal will also present the opportunity to capture details online for future contact, and also to attract new donors and spread the word about the charity.

Running a showcasing event could support both of these ideas by helping donors to better understand the aims of the charity and to become directly involved with the charity, paving the way for more types of fundraising in the future.

Grants: Writing better bids

For organisations that receive a lot of their income from grants, making sure grant applications are successful is crucial. Otherwise you waste time, and also squander the opportunity as many grant funders ask that you don’t apply again for a while, sometimes several years.

Many voluntary organisations employ a member of staff with experience of writing successful bids. However, many do not and instead grant applications are written by whoever has the best knowledge of the project they wish to gain funding for or is the most skilled at writing.

There is no such thing as a typical grant application and no ‘one-size-fits-all’ approach: you need to tailor each opportunity to the funder you are approaching. This means that in order to write good funding bids, you probably need to spend sufficient time on each one. But before you begin writing, you first need to do the planning. In this stage make sure you do the following:

Check:

Check the funder’s priorities and preferences, and how they might fit with your aims.

Most grant funders set out some criteria. Some are looking to support a broad group of people, for others it might be a specific geographic area or type of project. If you don’t fit their criteria, it’s not worth applying to them. Look at the funder’s’ website and the list of organisations they’ve funded in the past, and if in doubt give them a call to check. This research is much quicker than a wasted application.

Think:

Once you know what the funder is looking for and what they are interested in, try to put yourself in their shoes: think about how your project might fit with this and how it could be described to make the most of that fit.

Think about what kind of evidence the funder will require to support your case. If you are applying to a larger trust or government body, they may want to see large-scale numbers to evidence statements. If you are applying to a smaller trust or company, they may respond better to the evidence from a case study or personal experience.

Think about who you could involve in the preparation of your funding application. By drawing on the knowledge around your organisation you can strengthen your offer to the funder. For example, those delivering a service may have ideas about how the funding could be best used or management staff might have a realistic view of costs.

When it comes to sitting down and writing the application, consider that the funder will be looking for answers to the following questions:

‘What makes you special?’

There are many thousands of voluntary organisations competing for funds. Think carefully about what really makes you different, whether it’s your people, your approach or the need you are tackling. Describe this and show your energy for your organisation and for the project you are looking to fund. That way you will infect others with your enthusiasm. Tell funders about your organisation’s track record: projects you’ve successfully managed and the difference they’ve made, other funding successes and experience of staff or volunteers.

‘So what?’

Funders will want to see details of how you intend to spend the money: who is going to run the project, what are they going to deliver and when. But don’t forget that they will also be looking to know what difference you think it will make to the people or animals that you will work with.

‘How do you know?’

You will need to give evidence for what you are saying: evidence of the need for the work, information about the people who will benefit or a demonstration of past successes. By using a client survey to establish need, or drawing on the local area statistics on deprivation, health or housing, you can add authority to your case. Remember that you are writing for humans though and that humans love stories, pictures, videos and real-life case studies as well to engage them.

You will also need to tell the funder in the application how you plan to assess the progress of your project by collecting evidence as you go. It is best practice for funders to allow you to budget around 5–10% of the overall budget for ongoing monitoring and evaluation, although this will vary by funder.

When writing, consider that funders have a lot of papers to read and will not re-read muddled applications. Make yours as clear and concise as you can. Only use technical terms if the funder will understand them and if you’re sure they add value. Once you’ve written it, get someone else to check it before you submit it.

Don’t forget that funders want to spend their money: you just need to make it easy for them to support your project. If you submit the application and it isn’t successful then don’t be afraid to ask the funder for detailed feedback. It will help you to make the next application better.

Activity 8

Ethical considerations

When fundraising, voluntary organisations face a dilemma in balancing the need to raise as much money as possible for their cause with doing it in an appropriate and ethical way, particularly from members of the general public and companies.

From the public

The pressure on charities to increase the amount of unrestricted income they generate from the public has led some to employ some fundraising practices that have been criticised. You may have seen some of the press headlines about charities repeatedly contacting donors and sending emotive material to them. The possible negative impact on vulnerable donors, such as older people, was of particular concern. Whilst the majority of charities were not associated with the scandal, it will have a lasting impact on how all charities fundraise.

Until recently, charities were most concerned about not appearing to spend too much charity money on fundraising. They wanted to be able to say that as many ‘pennies in the pound’ as possible went straight to their cause. So they used whichever fundraising tactics generated the most money for the smallest cost. Door-to-door fundraising, direct mail and street fundraising all generated very good returns. They were therefore seen as sensible, ethical choices because they were making the best returns from the charity’s investment and had the smallest financial risk.

However, the mood about what is ethical is now changing with the attention on any possible negative effect on the individual donors themselves. The press stories highlighted that some individuals had been bombarded by fundraising requests from a small number of charities, causing them considerable distress. These cases galvanised action to increase regulation of charity fundraising. The voluntary sector established a new Fundraising Regulator with a code of fundraising practice, a complaints system for the public and a fundraising preference service to allow donors to remove themselves from email and phone lists.

From companies

Another interesting dilemma that voluntary organisations face is considering whether to accept money from corporate sources that have general ethical questions surrounding them, for instance a donation from a company that sells animal fur, a tobacco company or a bank that allegedly invests in the arms or weapons trade.

Strictly speaking, voluntary organisations have a responsibility to promote and serve their beneficiaries above all else and if the funding organisation doesn’t have a directly negative effect on their beneficiaries then there is no official reason that they cannot accept the money. But many voluntary organisations hold values that they live out through their work that lead them to decline money from companies that do not hold the same values. There is no particular regulation in this area and it is up to the individual voluntary organisation to debate the pros and cons of sources of income.

A fundraising case example

Windmill Hill City Farm in Bristol is a registered charity with a very diverse and sustainable mix of income across all the four income categories. This includes:

Gifted income: Requests for individual donations and a farm membership scheme.

Grants: From a range of funders for projects such as their ‘People Grow’ project to develop community gardens engaging families, schools and the community in general.

Contracts: The charity delivers services for the local authority including a drop-in mental health group, two groups for older people and several sessions of supported volunteering for people with learning difficulties or mental health issues.

Trading: They sell a number of things that contribute directly to their mission (on-mission) and those that are purely to raise money (off-mission). The on-mission trading includes courses and workshops, nursery and other childcare and services for schools. The off-mission trading includes venue hire, a gift shop, café and meat production.

As you will have already noted from the previous topic, the financial history from the Charity Commission website shows that the organisation increased its income from £917,226 in 2011 to £1,326,342 in 2015. In the context of the recession during those years, when many charities struggled to maintain their levels of income, this was an impressive increase of over 40%.

In order to raise more money for their work, the staff and trustees of Windmill Hill City Farm have squeezed as much value as they can out of both their physical space and the relationships with their supporters. This is a great strategy: making the most out of the assets they have.

One of the key fundraising relationships that they have maximised was with parents of young children living in the Bristol area. They have increased the lifetime value of those relationships by offering lots of opportunities for the parents to engage with the charity and to donate money and purchase goods or services.

On their first visit to the farm, as well as visiting the animals and playground, parents can:

buy lunch or a coffee in the café

- buy a gift from the shop

- take part in one of the free or charged-for children’s activities

- drop some coins into a donation box.

Hopefully, they will enjoy their visit and have a good impression of the farm. And because there are lots of different things happening at different times of the year, parents are likely to return regularly with their young children, spending money each time.

The parents’ relationship with the farm may then lead them to:

- choose to send their children to nursery there

- recommend the farm to friends and school teachers

- join the membership scheme

- choose to hire a room at the farm for their child’s birthday party.

When there are special appeals, such as to renovate a pig sty, these parents are already supporters of the farm and are likely to donate.

The farm has a very broad appeal. Their strapline is ‘A place where people grow’. This shows that the farm is a physical location, where people grow things and look after the environment, but that it is also where people themselves are nurtured and grown. This will help them to be flexible in their grant applications and to find a good match with funders.

2.4 Key points from Section 2

In this section, you have covered the following:

- The difference between restricted and unrestricted funding, the benefits of the latter as the most flexible income for voluntary organisations, and how to treat it differently in a budget.

- The four categories of income for voluntary organisations that sit on a spectrum from ‘asking’ to ‘earning’: gifts, grants, contracts and trading, and the types of activity that underpin them. You have considered how important it is for voluntary organisations not to become too reliant on just one source of income but to achieve the right funding mix to achieve their purpose. You have also explored the difference between raising money ‘on-mission’ and ‘off-mission’ and why charities need to take extra care with ‘off-mission’ fundraising.

- Raising more money, in the short term, requires voluntary organisations to build on what they already do and develop their relationships with donors, funders or customers. This means getting to know them better, working out their motivations, needs and wants, and emphasising the parts of the voluntary organisation’s work that best fit with those.

- The Charity Commission website is a rich source of information for finding out about a voluntary organisation's finances.

2.5 Section 2 quiz

Well done, you have now reached the end of Section 2 of Taking part in the voluntary sector, and it is time to attempt the assessment questions. This is designed to be a fun activity to help consolidate your learning.

There are only five questions, and if you get at least four correct answers you will be able to download your badge for the ‘Money’ section (plus you get more than one try!).

- Now try the Section 2 quiz to get your badge.

If you are studying this course using one of the alternative formats, please note that you will need to go online to take this quiz.

I’ve finished this section. What next?

You can now choose to move on to Section 3, Volunteering, or to one of the other sections so you can continue collecting your badges.

If you feel that you’ve now got what you need from the course and don’t wish to attempt the quiz or continue collecting your badges, please visit the Taking my learning further section, where you can reflect on what you have learned and find suggestions of further learning opportunities.

We would love to know what you thought of the course and how you plan to use what you have learned. Your feedback is anonymous and will help us to improve our offer.

- Take our Open University end-of-course survey.

Glossary

- crowdfunding

- A relatively new method of raising funds, usually online. A specific project, activity or item is described, with a target amount that will pay for it. Supporters are then invited to pledge money to make it happen.

- direct mail

- Fundraising appeals sent by post.

- endowment funds

- Money given or left to the charity from someone’s will. Charity law specifies how this money can be used.

- open market

- An unrestricted market where any buyer or seller can trade goods and services. In the case of the voluntary sector, usually voluntary organisations develop the goods or services first, then advertise and sell them to individuals or other organisations.

- purchaser

- The individual or organisation that is purchasing goods or services via a contract. Often also called the ‘commissioner’.

- street fundraising

- When charities ask for donations, either immediate or subsequently by direct debit, from people on the street.

References

Acknowledgements

This free course was written by Julie Charlesworth (tutor at The Open University) and Georgina Anstey (consultant from the National Council for Voluntary Organisations).

Except for third party materials and otherwise stated (see terms and conditions), this content is made available under a Creative Commons Attribution-NonCommercial-ShareAlike 4.0 Licence.

The material acknowledged below is Proprietary and used under licence (not subject to Creative Commons Licence). Grateful acknowledgement is made to the following sources for permission to reproduce material in this free course:

Figures

Figures 1 and 3: adapted from National Council for Voluntary Organisations (NCVO) (2016) UK Civil Society Almanac [Online].

Figure 2: courtesy Good Gifts, https://www.goodgifts.org/.

Figure 4: © Meilun/iStockphoto.com.

Figure 5: https://www.gov.uk/ government/ organisations/ charity-commission, https://www.nationalarchives.gov.uk/ doc/ open-government-licence/ version/ 3/.

Figure 6: Steve Debenport/iStockphoto.com.

Figure 7: © Yarinca iStockphoto.com.

Figure 8: © my-site/iStockphoto.com.

Figure 9: © BrianA Jackson/iStockphoto.com.

Figure 10: © o01shorty100/iStockphoto.com.

Figure 12: courtesy http://www.windmillhillcityfarm.org.uk/.

Every effort has been made to contact copyright owners. If any have been inadvertently overlooked, the publishers will be pleased to make the necessary arrangements at the first opportunity.

Don't miss out

If reading this text has inspired you to learn more, you may be interested in joining the millions of people who discover our free learning resources and qualifications by visiting The Open University – www.open.edu/ openlearn/ free-courses.