Stage 1. Assess: calculate your spending

We continue filling in the “Assess” column in the budget planner [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)] by calculating your spending in a typical month. If you completed the income side as a household continue to do so here as well.

Step 1: Find a recent statement for all bank accounts and credit cards you regularly use.

Step 2: Note down your rent or mortgage and any other regular monthly bills you pay – e.g. council tax, utilities, phone, TV, direct debits and standing – and enter these into your budget planner. If you have any weekly bills convert these to a monthly amount by multiplying by 52 and dividing by 12.

Step 3: Divide the rest of your day-to-day spending into the categories within the budget planner. Don’t include annual or one-off payments here like holidays or furniture, we’ll come to these later, but try to estimate which category any cash you’ve spent best fits into.

Step 4: We’re trying to create an accurate picture of your spending in a typical month, however many items of spending can vary greatly from month to month. Have a look at the figures you’ve entered and adjust any that seem higher or lower than usual. Most of us underestimate our spending and it’s vital we avoid nasty surprises, so try to estimate spending on the higher end of what you think is typical. If you have bank statements from a few recent months it can be useful to compare these to help you decide.

Step 5: Make a list of your annual or irregular spending, such as Christmas presents, durable goods, holidays or car repairs. Again, it’s important not to underestimate how much you spend on these, as irregular spending can easily add up and break a budget. Convert these to monthly figures by estimating how many times a year each tends to happens, multiplying each by this and dividing by 12.

Step 6: Add these up to give you a total spending figure.

Once you have a total income and spending figure, subtract your spending from your income, as shown in the budget planner. What is the result? This should represent how much you’re saving or borrowing in a typical month. If it is positive, you should see your bank balance rise each month, and if negative it is likely to be falling. Is this the case? If not, revisit your income and spending as it’s easy to miss something.

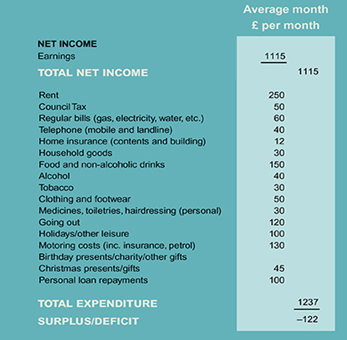

Have a look at Jenny’s budget to get the idea:

Stage 1. Assess: work out your income