Stage 3. Act: make small changes towards your goals

After having realised what you want, you know your goals and you want to get there. To achieve your goals you’ll likely need to reduce your spending in some areas. This isn’t easy and will require effort, but by working out what’s important to you and focusing on small changes to your habits you can often have a much bigger impact with less pain than you’d expect.

Always keep in mind the positive – the goals you’re working towards, why they matter to you, and how your life will be different when you reach them. You’re not cutting spending, you’re moving it from things you currently spend it on to what you’ve decided you really want.

Go to the “Assess & Act” table of your budget planner. With each step look at the current spending figures in your budget planner, consider how you want to change it, and write the new figure in the budget column.

Step 1: Explore ways you can save money without noticing it. For example are you paying for a gym or subscription you no longer use? Have you got extended warrantees or specific insurance to cover goods already covered by your home insurance? Could you get a better deal on your mobile phone, TV, mortgage, credit card, insurance, or energy bills? We’ve collated some tips on saving money for personal finance experts below, though these are far from exhaustive. Money Saving Expert [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)] has many more tips on saving money, and an active forum where you can ask questions.

Step 2: Rule out spending you cannot change. Look at the current spending table of your budget planner. Which items do you consider essential spending that you could not reduce at all? We all have lines we are not willing to cross but be strict with yourself when ruling out changes.

Step 3: Think about changes in your life you’d like to make that could also save you money. For example you may want to stop smoking, drink less alcohol, have a meat-free day, or cycle to work rather than driving. These are all difficult changes to make but the financial benefit could provide the additional motivation you need to make that change.

Step 4: Work out the one or two areas where spending money makes you happy and try to find cheaper alternatives for everything else. Most of us have one or two things we really care about and many others where we’d barely notice the difference. Personally I don’t mind buying cheaper clothes, taking tea bags to work rather than going to the coffee shop, having friends over instead of going to a bar, swapping the gym for a run, or driving a cheap-but-reliable car, but I love food and would struggle to cut my grocery bill. Focusing your spending in this way minimises the pain of cutting back, and you may even find you can afford to spend more on the area you particularly care about. Budgeting is not about going without but about deciding what you want and where you can afford to treat yourself.

Step 5: If you still need to reduce your spending further, consider what you could bear to go without and compare it to your goals. Often the small changes above are enough to meet your goals without feeling like you’re giving too much up, but sometimes you’re faced with difficult choices. Ask yourself if each goal is worth what you’d have to go without to reach it. Imagine your future with each trade-off and compare which future you prefer.

Does your new budget enable you to reach your goals? If not then repeat steps 1-5 above, or revisit your goals and decide if they’re realistic and whether you’re willing to make the changes necessary to achieve them.

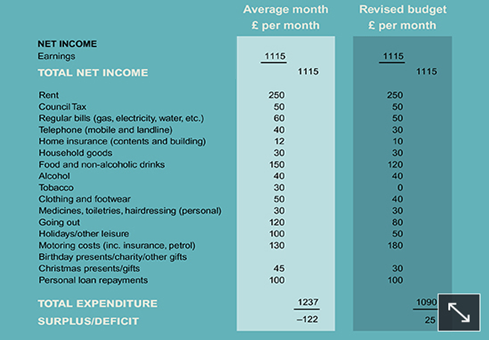

Here’s Jenny’s new budget as an example:

Once you have your budget, try to stick to it. This is easier said than done, but by simply writing down how much you want to spend on different areas it can help you follow it. Always keep in mind why you’re doing this – your goals – to help with motivation.

Tips on how to save money

There are so many ways to save money. Here are a few of the more common ideas from personal finance experts.

- Paying some bills by direct debit may save you money, for example utility bills. (But check this carefully as some bills such as household and car insurance may cost more if paid monthly by direct debit.)

- Think about remortgaging. Saving 1% on a £100,000 mortgage saves up to £83 a month.

- Shop around when it’s time to renew insurance. Premiums are often increased each year, relying on customers not bothering to switch to another company. Also check that you’re not paying for any ‘extras’ you didn’t ask for or want.

- If you’re paying high interest on your credit cards, look for 0% deals on balance transfers but check for transfer fees. If you have payday loans or other expensive debt talk to your back or credit union about taking out a cheaper loan.

- Switch suppliers of gas, electricity, telephone or internet connection. Consider a water meter. There are major savings to be had in these areas.

- Think about whether a branded item is really value for money.

- Cut down on the number of takeaway meals you have – cutting from two to one a week would typically save over £250 a year.

- Call your mobile phone supplier and ask them if there’s a better tariff to suit your needs.

- Buying in bulk for items such as contact lenses saves a lot of money.

- Buy fresh fruit and vegetables in season. Check whether a local market is cheaper than the supermarket.

- Turn off lights, don’t leave stand-by buttons on and turn down the thermostat to save large amounts on energy bills (and help the environment) each year.

- Make a shopping list and stick to it. Try to use money-off coupons from papers and magazines where possible.

- Think carefully about buying extended warranties – they are usually poor value for month and household goods are often covered on home insurance policies.

- If you have internet access, look for price comparison websites to find the best deals.

Revisit your budget if your goals or circumstances change or unexpected expenses arise. It can be useful to put it in a prominent place to remind you – I pin mine to the fridge.

Stage 2. Decide: what do you want?