3.2 Equity

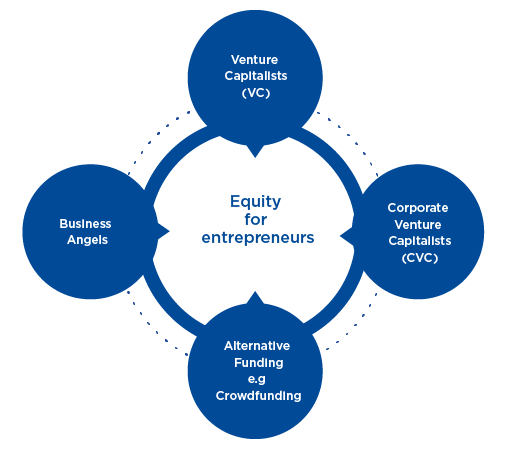

The modern entrepreneurial equity funding landscape generally comprises four sources: venture capitalists (VC); corporate venture capitalists (CVC); business angels and alternative sources of equity funding (Figure 2).

Venture capitalists

Although venture capitalists tend to fund only a small number of start-ups, in practice they represent the most recognised form of equity financing (especially for businesses with a high growth potential). Venture capitalists usually raise funds from a network of partners, such as university endowments or pension funds, and aim to provide a return to these investors through selective investments in young, innovative start-ups.

Venture capitalist firms often collaborate closely with the businesses in which they invest. Entrepreneurs benefit from the guidance and advice that VCs provide. The typical planning horizon of a VC is about ten years. Within this period of time investors expect a return from their investments. At the end of the funding period, VCs often exit via an acquisition or initial public offering (IPO) (Drover et al., 2017).

Corporate venture capitalists

Corporate venture capital means that an established corporation makes an equity investment in a start-up. This type of funding differs from traditional venture capital because the funding is provided by dedicated units of corporations. These units go beyond the primary purpose of their parent companies (Drover et al., 2017).

Business angels

Business angels are individual investors who invest their own money in promising early-stage start-ups. They are often former entrepreneurs, who aim to use their knowledge and experience in their area of expertise to help other entrepreneurs to start and grow a new business.

Recently, business angels have become more formalised by setting up networks of angel investors (Drover et al., 2017). A list of UK-based business angel networks can be found at syndicateroom.com [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)] .

While some angel networks invest globally (for example, Angel Investment Network), others focus on selected geographical areas (for example, London- and Cambridge-based Cambridge Angels and Minerva Business Angel Network focus on the East Midlands, Thames Valley, West Midlands and Yorkshire).

Alternative funding

Novel sources of funding are emerging. Among them, crowdfunding and accelerators (or incubators) have become most popular.

Crowdfunding or crowdsourcing is a relatively new form of business financing that allows individuals to support new ventures with small contributions and typically online. Globally by 2016, it was estimated that $34 billion was made available through crowdfunding sites.

Two crowdfunding platforms are, for example, crowdfunder.com and crowdcube.com.

Accelerators or incubators are cohort-based programmes, which provide a combination of mentorship, work space and funding to early-stage start-up entrepreneurs in exchange for equity. One business that used accelerator funding is:

AirBnB, the famous website for finding short-term accommodation. AirBnB was founded in 2008. The following year, the venture was admitted to the incubator program of Ycombinator. During the three months of incubation, important strategic changes were implemented, including the change of name from Airbedandbreakfast.com to AirBnB.com. In the years following the program, the venture raised a total of $2.39B from prominent angel investors such as movie star Ashton Kutcher, as well as VCs such as Sequoia, Andreessen Horowitz, and Greylock Partners.

Most accelerators are associated with universities. Entrepreneurs usually apply for an opportunity to develop a business idea on site during a fixed period of time (usually three to six months). At the end of this period, cohorts of start-up entrepreneurs benefit from a ‘demo day’, where they can present and pitch their business ideas to potential investors (Drover et al., 2017; Katz and Green, 2014).

3.1 Borrowing