4.1 From T-accounts to the trial balance

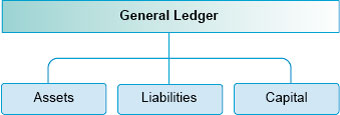

You have now learned how to record transactions in T-accounts. Capital, and each type of asset and liability, has its own T-account. These T-accounts are recorded in the general ledger (also known as the nominal ledger). Figure 1 below shows the general ledger and the three categories of T-accounts therein that we have discussed so far.

In order to prevent errors and to make sure that all transactions are properly recorded as debits and credits in the correct T-accounts, a checking procedure takes place at the end of each accounting period. This is known as preparing a trial balance. A trial balance is thus a list of all the debit and credit balances in the general ledger accounts. If all the individual double entries have been correctly carried out, the total of the debit balances should always equal the total of the credit balances in the trial balance. A further important purpose of the trial balance is that it forms the basis for the preparation of the balance sheet.

If the total of the debit balances do not equal the total of the credit balance then there is a mistake somewhere, which needs to be investigated and corrected.