1.1 Rewarding risk

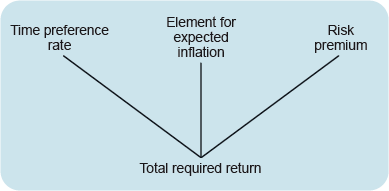

The return required by investors for making any form of investment is based on three key determinants:

- A time preference rate. This is the return required to persuade investors to give up the ability to use their cash for consumption today in favour of investing the cash to provide a return over a future time period.

- An element for expected inflation. This is required to ensure that the purchasing value of the money invested keeps pace with the expected rate of price inflation. Without this investors could find that the value of their investment after accounting for the impact of inflation is worth less than at the inception of the investment.

- A risk premium. This is required to reward investors for the risk that they may not receive back all or any of the money they invested – for example, if the company invested in becomes bankrupt and defaults on its financial obligations.

These factors that underpin the expected return on an investment are set out in Figure 1

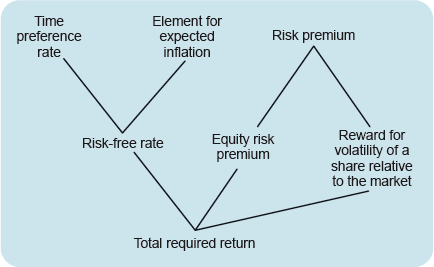

When it comes to investments in shares we need to develop these three elements that determine the expected return to investors.a

For shares the return is subdivided into three different elements:

- a risk-free rate

- an equity risk premium

- a reward adjustment for the volatility of the share relative to the share market as a whole.

This is shown in Figure 2.

The risk-free rate in Figure 2 includes two of the three elements set out in Figure 1: a time preference rate and a reward for expected inflation. The risk premium from Figure 1 is now subdivided into two elements: a risk premium for shares (or equities) generally and a reward adjustment for the relative volatility of a particular share compared with the share (or equity) market as a whole. Both Figures 1 and 2 show different constituent elements of the required return on equity by investors.

In this course we will look at the first two elements of the required rate of return on a share as shown in Figure 2: the risk-free rate and the equity risk premium.

The third element – the reward adjustment for the volatility of a share relative to the market – is an adjustment that investors make to accommodate the perceived riskiness in investing in the shares of a specific company relative to the average risk of investing in the equity market.