2 Credit reference agencies and you

Your credit score, as calculated by the credit reference agencies, is a key factor in your ability to borrow money.

As soon as you open a bank account or take on a credit card from the age of 18 your credit history is recorded and a profile of you starts to build. The main UK credit reference agencies are:

- Equifax [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)]

- Experian

- TransUnion

These agencies will score your creditworthiness and keep a credit file on you.

Where do they get the information about you?

This is provided by your bank or credit card provider and other organisations that have extended credit to you. They include your phone provider if you have a contract with them.

The information covers the amount of credit granted to you, whether you make repayments on time and the proportion of your bill that you repay each month.

Your credit score will be accessed by financial and other institutions when you’re seeking to borrow money from them. A poor credit score may mean that you will be turned down when you apply to borrow money, for example a mortgage to buy a property. However, banks and other lenders normally take a broader look at your credit history when making lending decisions rather than focusing solely on your credit score – although they will be interested if your score has markedly changed recently.

Have you taken a look at your own credit files? It’s recommended that in future years, and particularly when you become active borrowers, you should keep an eye on your credit files at least once a year.

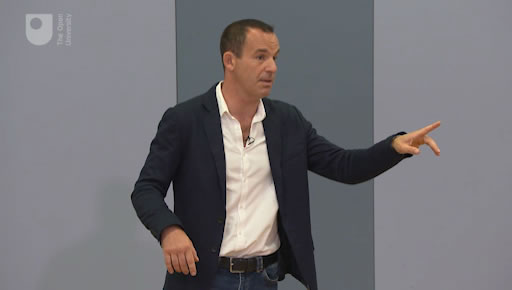

Watch this video where Martin Lewis uses a storyline based around exchanges in a non-alcoholic bar to illustrate the key principles that will affect a person’s credit score.