14 Vertical and Horizontal Mergers

Another strategy that firms use to restrict competition relies on merging with one of their competitors, suppliers or customers to increase their market power. Firms engaging in mergers argue that the merger will enable them to achieve an increase in production efficiency, for example by exploiting economies of scale, helping consumers find cheaper and better products. Nonetheless, mergers between large firms also increase concentration in the market, which also means less competition, more market power and potentially higher prices.

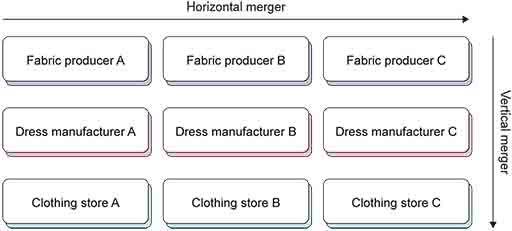

There are two main types of mergers: horizontal, where competing firms producing similar products decide to join, and vertical mergers, which occur when firms at different stages of the production process decide to integrate their operations. Figure 13 shows why they are named horizontal and vertical mergers, when we imagine a grid displaying the industry. A merger between Clothing Store A and B is called a horizontal merger, while a merger between Clothing Store A and Dress Manufacturer A is a vertical merger.

Competition authorities analyse proposed or potential mergers if it is believed they could lessen competition. Most competition authorities will investigate in three cases:

- if the merged entity can raise its prices, worsen its quality or reduce innovation as a consequence of the merger (increasing its market power)

- if coordination between suppliers is easier through the merger

- if the merger prevents rivals from accessing the market, mostly in the case of vertical mergers.

Box 1 The failed merger of ASDA and Sainsbury’s

In November 2018, supermarket chain Sainsbury’s PLC announced its intention to merge with ASDA to create a grocery store with 2,800 supermarkets, convenience stores and petrol stations (Wood, 2019). The merger would boost Sainsbury’s into the market leader with around 30% of the market shares. The intention of merging alerted the CMA to act and start an inquiry that led to it blocking the deal a year later.

The CMA (Competition and Markets Authority, 2019) investigation found that other than affecting customers, the merger would increase prices and reduce quality in both grocery stores and petrol stations To arrive at this decision the CMA convened a panel of independent experts who had information from both companies and the market to understand the effect on the lives of consumers and employers, which in this case agreed with the decision to block the merger as it could also affect their wages and employment.