Case Study 1: ComparetheMarket and home insurers

ComparetheMarket is a famous service comparison website. It is known for comparing different services (including utilities, insurance, credit cards, and loans) and giving the consumer the best price for similar services. It offers comparison services for utilities, insurance, credit cards, and loans.

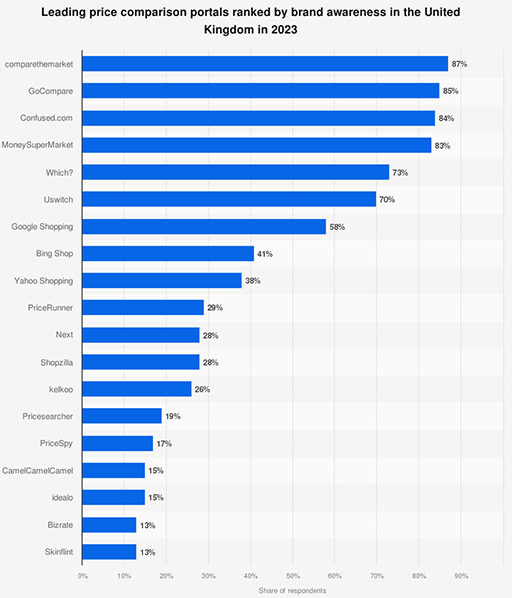

According to a survey of 1,247 respondents in the UK, the brand is well regarded as a comparison site. In 2016, the website offered the lowest home insurance prices, raising a few alarms to the Competition Market Authorities (CMA). The CMA (2022b) found that the comparison website, to ensure the lowest prices, had what it called a “most favoured nation” clause in their contracts with the insurance providers. This clause ensured that the lowest market price for home insurance was given to the portal customers.

Activity 6: Were the meerkats wrong?

a.

Yes

b.

No

The correct answer is a.

Discussion

If you answered yes, you are right! The clause could mean a market segmentation that is hurting the customers, although they are receiving a lower price. If you answered no, try again. Although the customer obtains a lower price for home insurance, it could be affected in other services by choosing ComparetheMarketevery time.

a.

Collusion

b.

Abuse of dominance

The correct answer is b.

Discussion

If you answered collusion, incorrect. Although there are two parties involved in the transaction, and it could be argued that the portal did not coerce the insurers to sign the contract, the reality is that its position in the market allowed it to set that clause.

If you answered abuse of dominance, correct! Comparethemarket used its market position to add advantageous clauses in the contracts with insurers, allowing the best price to stay in its platform but limiting its access to other consumers who do not want to engage with them.

ComparetheMarket was charged with Abuse of Dominance, most known as CA98 infringement, and was imposed a financial penalty of £17,910,062. CMA Chief Executive, Andrea Coscelli, said:

‘Over 20 million UK households have home insurance, and more than 60% of new policies are found on price comparison sites. Therefore, it’s crucial that these companies are able to offer customers their best possible deals.’

‘Our investigation has provisionally found that ComparetheMarket has broken the law by preventing home insurers from offering lower prices elsewhere. This could result in people paying higher premiums than they need to.’