3.2 The system of double-entry accounting

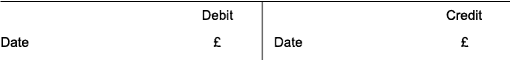

Rather than keep changing the accounting equation as in Activity 3, every transaction is recorded using an established double-entry system. This system uses pages ruled off in the form of a T, known as T-account, as illustrated below.

The following T-accounts that you will encounter in Weeks 3 and 4 of this course are available to download in a Word document: T-accounts [Tip: hold Ctrl and click a link to open it in a new tab. (Hide tip)] .

These T–accounts are more correctly known as ‘ledger accounts’ as they were originally recorded in a ledger, the old name for a book. Under this system every transaction has two separate and distinct aspects, so two separate T-accounts are involved in each transaction. Monetary values recorded in these T-accounts are recorded either on the left-hand side, known as the debit side, or on the right-hand side known as the credit side. The value of the debits should always equal the values of the credits, as shown in Figure 2 below.

Separate T-accounts are needed for each type of asset and liability and also for capital. At least two accounts are needed to record each transaction.

Box 1 The difference between debit and credit and debtors and creditors

The term debit has nothing to do with debtors, the amount owing to a business by its credit customers. A debit in a T-account simply means that it is recorded on the left side of such an account. The term credit has nothing to do with creditors, the amount owing to a business by its credit suppliers. A credit in a T-account simply means that it is recorded on the right side of such an account.