3.2.2 Recording transactions using T-accounts

The following activity, which revisits the transactions in Activity 3, illustrates these double-entry rules for asset and liability accounts as well as the capital account. In this activity you will not enter the answer in a box but will instead have an opportunity to work out the answer mentally before you click on the ‘Reveal answer’ button.

Activity 4 Recording transactions in double entry

As per Activity 3, Edgar Edwards Enterprises carries out the following six transactions:

- The owner starts the business with £5,000 paid into a business bank account on 1 July 20X2.

- The business buys furniture for £400 on credit from Pearl Ltd on 2 July 20X2.

- The business buys a computer for £600 on 3 July 20X2 from the bank account.

- The business borrows £5,000 on loan from a bank on 4 July 20X2. The money is paid into the business bank account.

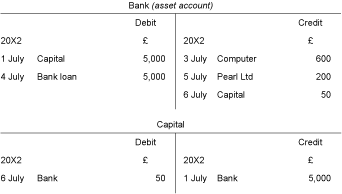

- The business pays Pearl Ltd £200 on 5 July 20X2.

- The owner takes £50 from the bank for personal spending on 6 July 20X2.

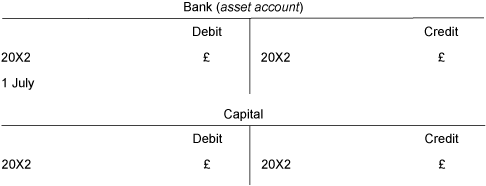

For each of the transactions above you will be given the two relevant ledger or T-accounts, and you will need to decide the date, corresponding account and the relevant amount in either the debit or credit side of the account. Go back over the rules of double-entry accounting and the layout of T-accounts if you have forgotten them.

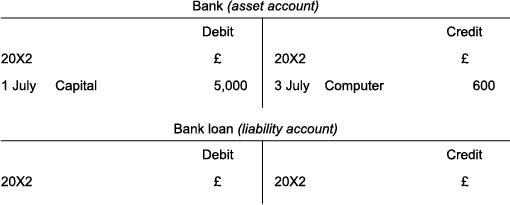

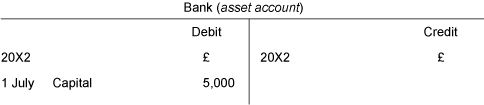

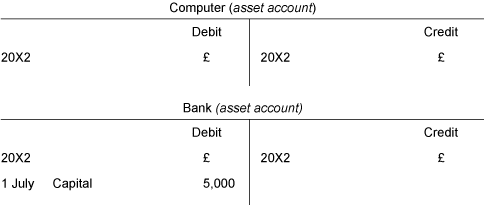

Transaction 1: The owner starts the business with £5,000 paid into a business bank account on 1 July 20X2

Answer

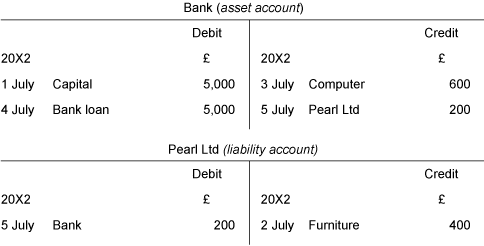

Receipt of money of £5,000 into the bank account is recorded on the debit side of the bank account as the asset of money into the bank has increased.

The capital account is recorded on the credit side to indicate that capital has increased.

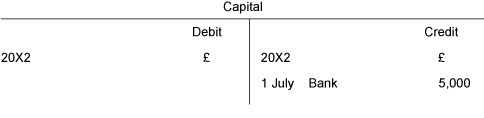

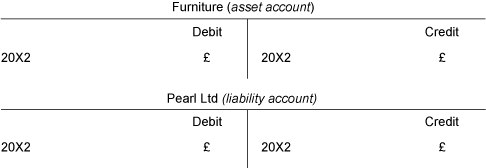

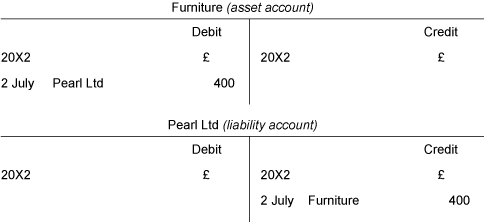

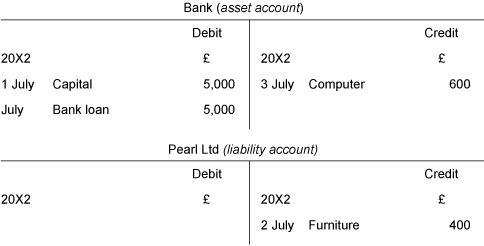

Transaction 2: The business buys furniture for £400 on credit from Pearl Ltd on 2 July 20X2.

Answer

According to the rules of double-entry accounting debit the asset account and credit the liability account.

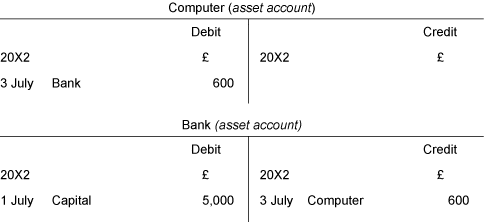

Transaction 3: The business buys a computer for £600 on 3 July 20X2.

Answer

According to the rules of double-entry accounting debit the first asset account ‘Computer’ to show an increase and credit the second asset account ‘Bank’ to show a decrease.

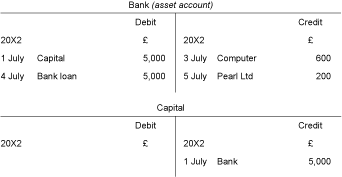

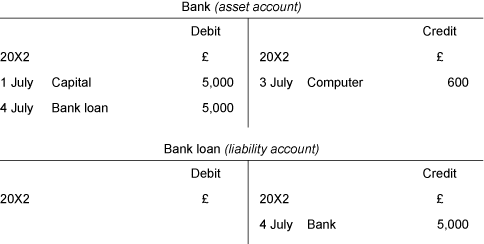

Transaction 4: The business borrows £5,000 on loan from a bank on 4 July 20X2. The money is paid into the business bank account.

Answer

According to the rules of double-entry accounting debit the asset account ‘Bank’ and credit the liability account ‘Bank loan’.

Transaction 5: The business pays Pearl Ltd £200 on 5 July 20X2.

Answer

According to the rules of double-entry accounting debit the liability account and credit the asset account.

In the next and final week you will learn how to work out the balance for each account in order to prepare the trial balance and the balance sheet. As you can see in the bank account above, there may be a number of changes in an account for a period and it is important to know the balance in such an account at the end of a period.