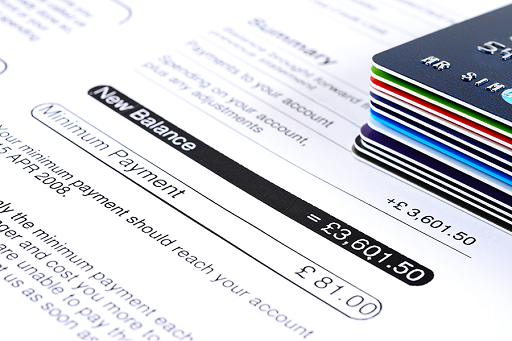

4 Shared bills and a household bank account

Some shared households set up a separate bank account for settling the bills.

This can be very useful: each utility service and other essentials (gas, electricity, water, internet) is normally set up in the name of just one of the tenants, so a household bank account helps make sure everyone contributes fairly when it comes to paying the bills for these services.

The account can be used to settle these essential bills using through direct debits or standing orders. It can be also used to settle general household costs, for example cleaning materials.

It’s probably best not to use the household bank account as a way to settle the rental payments. Each housemate should settle these direct from their own accounts, given that each has entered into their own agreement with the landlord.

To pay for these outgoings each person in the shared tenancy would be required to pay in a monthly amount to cover their share of the joint costs.

At the end of the tenancy any funds left in the account can be shared between the tenants. If there are any shortfalls on the shared costs, make sure that the individuals concerned are chased and the money secured before people leave at the end of the year.

Ideally the household account should have at least two joint signatories, who can access details. This means that the responsibility of looking after the account is shared and there’s at least a second pair of eyes monitoring movements on the account.

Once the tenancy has ended and all sums of money into and out of the account have been resolved properly the direct debits and standing orders can be cancelled and the account closed.

Activity 4 A joint account – pros and cons

You’ve read about the advantages of having a joint household account. Now unpack this idea by comparing the pros and cons. Draw up a set of benefits and downsides and see which list – the pros or the cons – is longer for you.

Feedback

A household bank account is a way of ensuring that all the shared costs arising during a tenancy are dealt with simply and fairly. It avoids the need to gather in money from each housemate on a bill-by-bill basis.

The potential downside is the bank account holder(s) will have to keep a check on the account and might, at times, have to chase housemates to ensure they pay into the household bank account.

Watch out for disputes too when it comes to shared costs. For example if a housemate is away from the property for a time (for example on a field trip related to their course) they might feel that they are due a reduction in shared costs for not being in the property for the same amount of time as others.

In some ways your views on this method of paying joint bills will depend on your own experience of personal finance so far.