3.1.3 Jenny's profile

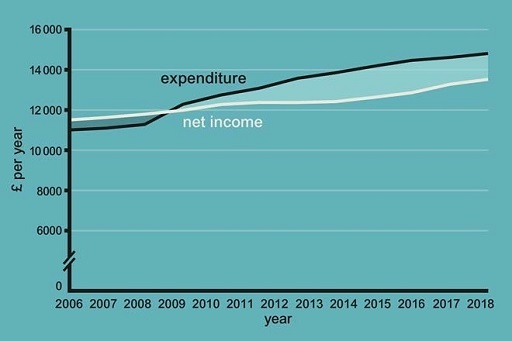

Figure 2 shows both Jenny’s net income and her expenditure but the thing to note is her net income as that is what matters most for budgeting purposes. In order to think about planning expenditure, an individual or household needs to know how much income they have available to spend, save, invest or to pay back borrowing.

Gross income does not provide this information because Income Tax and other deductions are not taken into consideration, whereas net income takes such deductions into account. For the same reason, the income side of the budget, in Week 2, showed net income.

You can see that since 2009 Jenny’s expenditure has been higher than her net income. From 2009 the gap between the two lines shows the amount that Jenny is spending over her income, and the shaded area from 2009 to 2018 between the two lines gives the total amount that she’s spent above her net income.

In such a situation, Jenny will have had to borrow to pay for this excess expenditure, unless she had savings to draw on. Between 2006 and 2009, when her net income was higher than expenditure, Jenny will have accumulated some savings, but these are not enough to prevent her having to borrow in the later period when she spends more than her income.

Assuming Jenny doesn’t want to accumulate larger debts, she needs either to increase her income or to reduce her expenditure, or both: effectively, she would like to move her income line up and/or her expenditure line down. If she manages to do this sufficiently (and budgeting is one way to achieve this aim), in the future she will be in a position where her expenditure no longer exceeds her income.

The graph shows Jenny’s total net income and total expenditure per year. This is useful because it gives Jenny a clear picture of what’s happening to her finances over time and provides an idea of why she might need to make changes in the future.

Budgeting can help you to plan such changes by looking at the details of your income and expenditure. This requires you to examine your income and expenditure flows over a shorter time horizon than a year, usually as often as income comes in (weekly or monthly), and then to project the flows forward to work on an annual level and beyond.

This example highlights the dual functions of a budget:

- first, it can be used to achieve the immediate goal of managing your money on a short-term, day-to-day basis

- second, it is vital for planning ahead to help ensure that your medium- and long-term goals – like coping with higher education fees and having sufficient money to retire – can be achieved.