5.3 Understanding investments

In this section, you will examine how savings and investments differ, understand share investments and the returns they offer and discover why some shares are riskier investments than others.

In personal finance, the terms ‘savings’ and ‘investments’ have different meanings. Savings accounts refer to any form of deposit account that pays interest on top of the amount deposited. The amount deposited is not at risk unless the institution defaults. Investments also allow interest or dividends to be paid but, crucially, the investment itself can fall or rise in value. Financial investments are those products with the warning in the small print that the value of your investment can go down as well as up.

Financial investments, which for simplicity we will call ‘investments’, include shares and bonds and investment funds that hold these types of asset. The amount invested – the ‘principal’ or ‘capital’ – is usually at risk, as well as the rate of return on the investment.

This means that it is not income alone that is relevant (as the rate of interest is on savings products) but the total return, which may be made up partly of income and partly of the change in the value of the capital. If the price of the investment goes up, a capital gain will be made, but if the price goes down, a capital loss is made. Newspapers often print cases of investors who have lost money on investment schemes.

With increased regulation of financial intermediaries and other financial firms, including the actual providers of savings and investment products and their company salespeople, and the requirement to explain fully the characteristics of the financial products they sell, mis-selling of financial products should, in theory, be unlikely, but it still happens.

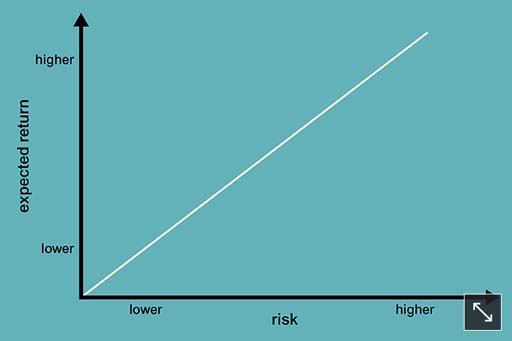

Not everyone reads the small print on documents, or understands all the choices and all the products’ details, but the saying ‘the safest way to double your money is to fold it in half ’ is perhaps a reminder that promises of high returns usually carry higher risks. This can be linked to a risk–return spectrum. Products with low risks tend to have lower returns, and those with higher risks have potentially higher returns, as you see in the graph.

For the rest of this section, you explore investment funds, which represent the usual way that personal investors invest in the stock markets. You may think that investments are not relevant to you, but if you have pension savings or save regularly through a life insurance policy, then whether you know it or not, you are an investor! To understand the nature of these funds, you take a quick look first at how shares and bonds work, since these are the fundamental building blocks of most funds and many other investments.

Before you move on, bear in mind that the definition of the difference between savings and investment being used in this course is not a universal one. In particular, some products that are advertised as being ‘long-term savings products’ may well involve shares or other forms of investment, and so their value can go down as well as up.