3.1 Occupational schemes: moving to average salary pensions

Increasingly, and where they still open, defined benefit schemes are shifting from ‘final salary’ schemes to those linked in a different way to a scheme member’s earning. One common example is pensions based on a ‘career average revalued earnings’ (CARE) basis. This has particularly applied to public sector workers. This means the pension is based on average pay over all the years in the scheme, after adjusting each year’s pay for inflation between the time it was earned and the person retiring or leaving the scheme. This measure replaces the final salary in the computation of the pension payable.

Activity 4 CARE schemes and the cost to the government

How do you think a switch from final salary to CARE schemes for public sector workers could help to reduce the cost to the government of providing pensions?

Which employees might gain, and which might lose from such a switch? To help you identify winners and losers, take as an example a profession such as teaching.

Discussion

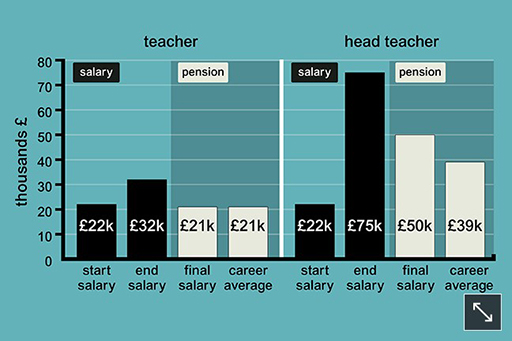

Using career salary averages to determine the annual pension payable will reduce the cost to the government as, even with inflation adjustments, a career average salary is normally less than the salary in the final year of employment.

Workers whose pay tends to peak in mid-career might gain from a switch, whereas workers whose pay tends to peak towards the end of their career would lose. So, in the example of teachers, a person who reached the position of head teacher would lose out in relative terms from this change.

Most employees are likely to lose out by the move to career average schemes – but, in relative terms, those who will lose out most will be those who see their salary rise the most during their career as a result of promotions and the climbing of the career ladder.